- United States

- /

- Medical Equipment

- /

- NasdaqGS:IART

Why Integra LifeSciences Holdings (IART) Is Up 17.7% After Medicare Expands Reimbursement for Skin Substitutes

Reviewed by Sasha Jovanovic

- Earlier in November 2025, Integra LifeSciences commended the Centers for Medicare & Medicaid Services (CMS) for including its entire portfolio of skin substitute products and dermal regenerative templates in the 2026 Medicare Physician Fee Schedule and Outpatient Prospective Payment System rules.

- This uniform reimbursement change by CMS is expected to broaden patient access to Integra’s wound reconstruction products and enhance the commercial potential across multiple care settings.

- We’ll explore how the expanded Medicare reimbursement for Integra’s skin substitutes could influence the company’s future growth outlook and investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Integra LifeSciences Holdings Investment Narrative Recap

To be a shareholder in Integra LifeSciences, you need to believe in the company's ability to drive margin and revenue recovery as it resolves supply disruptions and capitalizes on favorable industry trends such as expanded reimbursement. The recent CMS inclusion of Integra’s entire skin substitute and dermal regenerative product line in the 2026 Medicare rules directly supports one of the major short-term catalysts, broader patient access and growth in wound care, though ongoing operational risks tied to product recalls and delayed relaunches remain a significant concern and could still pressure margins if not fully resolved.

Among the company’s recent announcements, completion of enrollment for the DuraSorb IDE clinical study is most relevant, as it aligns with Integra’s focus on expanding its advanced reconstruction portfolio, a key area that could benefit from increased reimbursement and patient access under the new CMS policy. The success of such clinical programs may influence Integra’s ability to regain lost ground in high-growth product segments and reinforce its position in the wound care market.

On the other hand, investors should also be aware that risks from ongoing remediation efforts and manufacturing challenges remain unresolved…

Read the full narrative on Integra LifeSciences Holdings (it's free!)

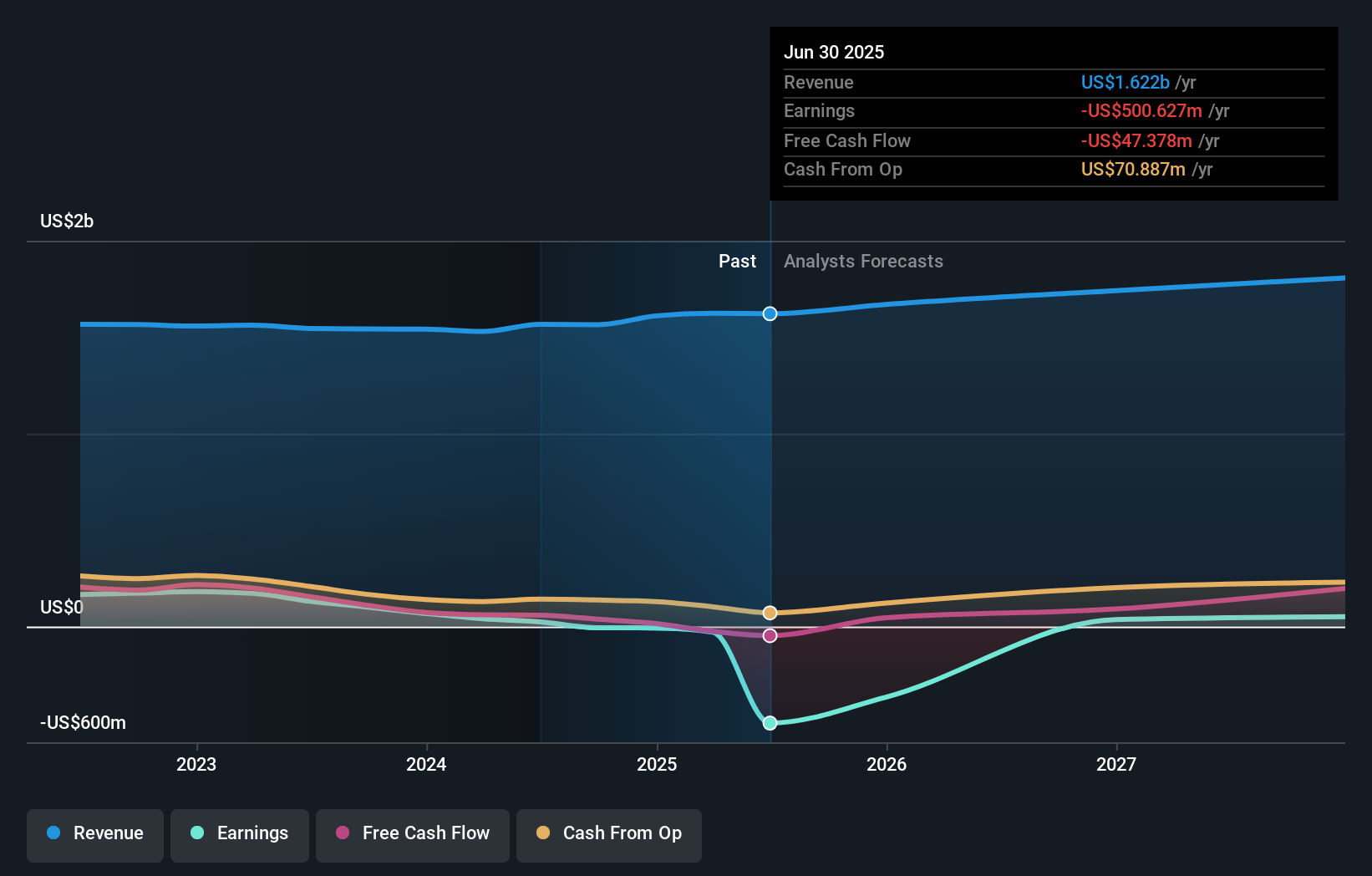

Integra LifeSciences Holdings is expected to reach $1.9 billion in revenue and $90.9 million in earnings by 2028. This outlook is based on annual revenue growth of 4.5% and an earnings increase of $591.5 million from current earnings of -$500.6 million.

Uncover how Integra LifeSciences Holdings' forecasts yield a $15.88 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Two Community fair value estimates for Integra LifeSciences range from US$14.98 to US$15.88, reflecting varied views on its potential. While recent Medicare changes could help commercial expansion, delays in product relaunches still carry sizable implications for performance, see how other Community members compare these risks.

Explore 2 other fair value estimates on Integra LifeSciences Holdings - why the stock might be worth as much as 21% more than the current price!

Build Your Own Integra LifeSciences Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Integra LifeSciences Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Integra LifeSciences Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Integra LifeSciences Holdings' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IART

Integra LifeSciences Holdings

Manufactures and sells surgical instrument, neurosurgical, ear, nose, throat, and wound care products for use in neurosurgery, neurocritical care, and otolaryngology.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026