- United States

- /

- Medical Equipment

- /

- NasdaqGS:IART

Integra LifeSciences Holdings Insiders Placed Bullish Bets Worth US$2.50m

Multiple insiders secured a larger position in Integra LifeSciences Holdings Corporation (NASDAQ:IART) shares over the last 12 months. This is reassuring as this suggests that insiders have increased optimism about the company's prospects.

While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

Check out our latest analysis for Integra LifeSciences Holdings

The Last 12 Months Of Insider Transactions At Integra LifeSciences Holdings

Over the last year, we can see that the biggest insider purchase was by Executive Chairman Stuart Essig for US$1.5m worth of shares, at about US$28.49 per share. That means that even when the share price was higher than US$24.63 (the recent price), an insider wanted to purchase shares. It's very possible they regret the purchase, but it's more likely they are bullish about the company. In our view, the price an insider pays for shares is very important. It is generally more encouraging if they paid above the current price, as it suggests they saw value, even at higher levels.

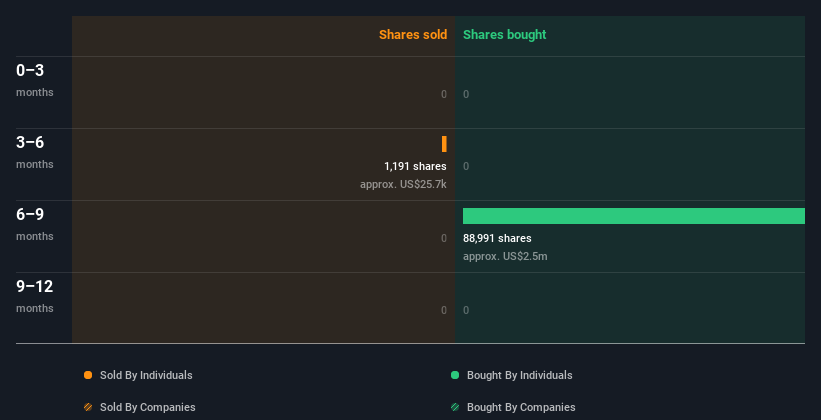

In the last twelve months insiders purchased 88.99k shares for US$2.5m. On the other hand they divested 2.89k shares, for US$67k. In total, Integra LifeSciences Holdings insiders bought more than they sold over the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

Integra LifeSciences Holdings is not the only stock that insiders are buying. For those who like to find small cap companies at attractive valuations, this free list of growing companies with recent insider purchasing, could be just the ticket.

Insiders At Integra LifeSciences Holdings Have Sold Stock Recently

We have seen a bit of insider selling at Integra LifeSciences Holdings, over the last three months. Executive VP & President of Codman Specialty Surgical Michael McBreen sold just US$41k worth of shares in that time. Neither the lack of buying nor the presence of selling is heartening. But the selling simply isn't sufficiently substantial to be of much use as a signal.

Insider Ownership Of Integra LifeSciences Holdings

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Insiders own 3.3% of Integra LifeSciences Holdings shares, worth about US$63m. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

What Might The Insider Transactions At Integra LifeSciences Holdings Tell Us?

We did not see any insider buying in the last three months, but we did see selling. However, the sales are not big enough to concern us at all. But insiders have shown more of an appetite for the stock, over the last year. Overall we don't see anything to make us think Integra LifeSciences Holdings insiders are doubting the company, and they do own shares. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Every company has risks, and we've spotted 1 warning sign for Integra LifeSciences Holdings you should know about.

But note: Integra LifeSciences Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:IART

Integra LifeSciences Holdings

Manufactures and sells surgical instruments, neurosurgical products, and wound care products for use in neurosurgery, neurocritical care, and otolaryngology.

Undervalued with moderate growth potential.