- United States

- /

- Medical Equipment

- /

- NasdaqGS:IART

Could Integra LifeSciences (IART) Leverage New Clinical Leadership to Advance Its Innovation Agenda?

Reviewed by Sasha Jovanovic

- In September 2025, Integra LifeSciences Holdings Corporation appointed Dr. Raymond Turner as its new chief medical officer, adding more than 20 years of global MedTech clinical and leadership experience to its senior team.

- Dr. Turner's dual expertise in neurosurgery and high-level clinical operations positions Integra to strengthen its medical affairs and clinical development at a critical time for innovation in patient care.

- We'll explore how Dr. Turner's arrival as chief medical officer could reinforce Integra's focus on clinical evidence and innovation in its investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Integra LifeSciences Holdings Investment Narrative Recap

For shareholders in Integra LifeSciences Holdings, the core investment thesis centers around the company’s ability to restore margin stability and recapture lost market share through operational improvements and new clinical evidence, particularly as it works to resolve ongoing product recalls and delayed relaunches. The appointment of Dr. Raymond Turner as chief medical officer underlines a commitment to innovation and clinical rigor, but does not materially shift the most pressing short-term catalyst, which remains the successful relaunch of SurgiMend and PriMatrix in 2026, or the primary risk of prolonged operational disruptions.

One relevant recent announcement is the enrollment of the first patient in the Acclarent AERA Pediatric Registry, which highlights Integra’s continued investment in clinical research amid supply and regulatory challenges. Collectively, both executive leadership changes and ongoing clinical studies signal a focus on strengthening the clinical underpinnings for future product relaunches, aligning with the company’s immediate needs around reliability and margin recovery.

Yet, despite progress on multiple fronts, investors should not overlook the persistent risk associated with extended product recalls and shipholds, as...

Read the full narrative on Integra LifeSciences Holdings (it's free!)

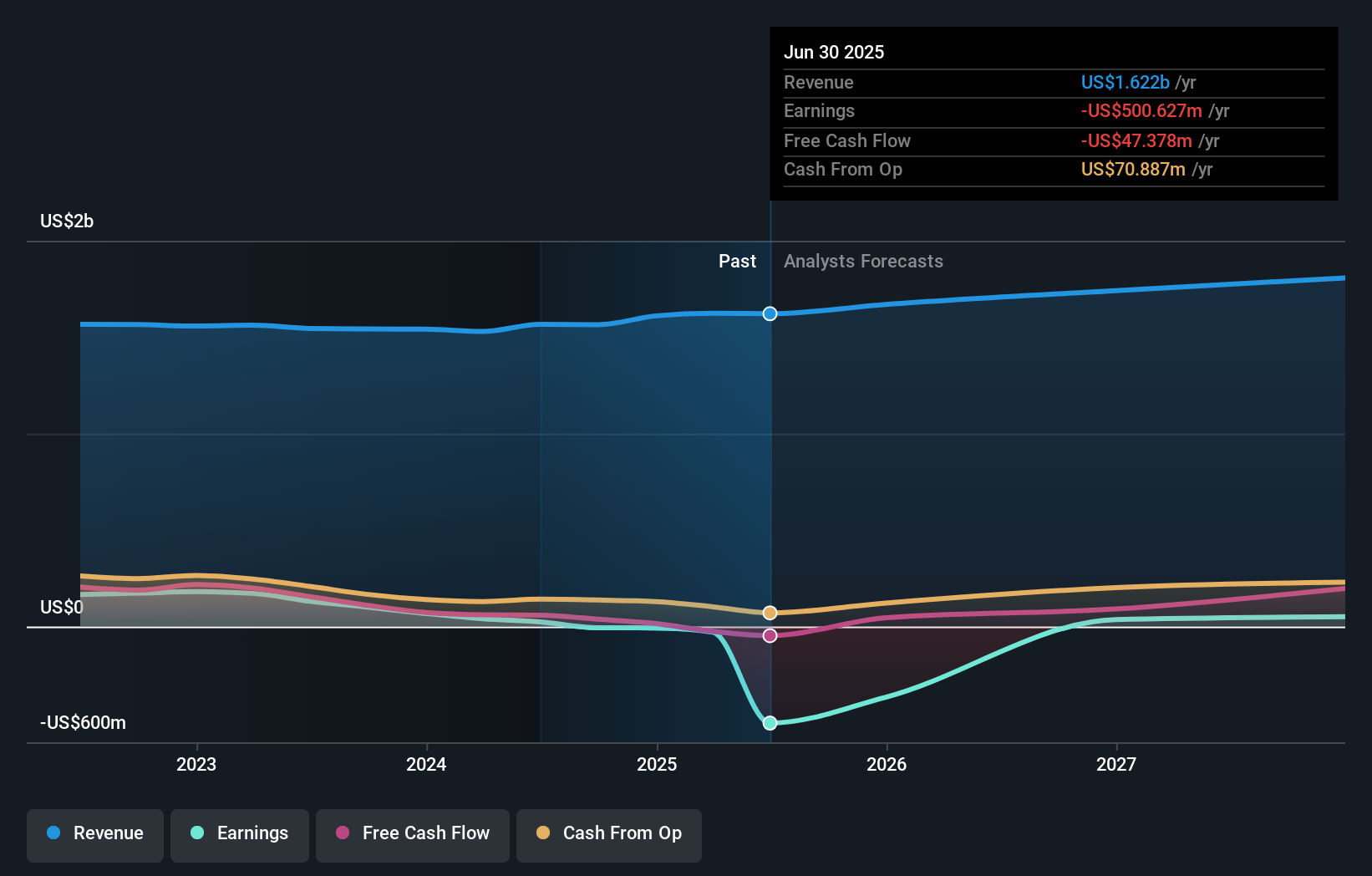

Integra LifeSciences Holdings is expected to achieve $1.9 billion in revenue and $90.9 million in earnings by 2028. This outlook is based on a 4.5% annual revenue growth rate and a $591.5 million increase in earnings from the current level of -$500.6 million.

Uncover how Integra LifeSciences Holdings' forecasts yield a $15.88 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community range from US$15.88 to US$80.98, showing sharply divided individual outlooks. While perspectives differ widely, many continue to focus on whether Integra can resolve recalls and resume high-margin product sales, an issue likely to influence longer-term performance.

Explore 2 other fair value estimates on Integra LifeSciences Holdings - why the stock might be worth over 5x more than the current price!

Build Your Own Integra LifeSciences Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Integra LifeSciences Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Integra LifeSciences Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Integra LifeSciences Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IART

Integra LifeSciences Holdings

Manufactures and sells surgical instrument, neurosurgical, ear, nose, throat, and wound care products for use in neurosurgery, neurocritical care, and otolaryngology.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives