- United States

- /

- Healthcare Services

- /

- NasdaqGS:HSIC

Will Biomerica Deal Help Henry Schein (HSIC) Advance Its Diagnostic Distribution Ambitions?

Reviewed by Sasha Jovanovic

- Earlier this week, Biomerica announced a marketing services agreement with Henry Schein to distribute the inFoods IBS test nationwide in the US (excluding New York State), leveraging Henry Schein’s network of over 400 sales representatives to reach primary care and gastroenterology practices.

- This collaboration highlights Henry Schein’s expanding involvement in distributing innovative, clinically validated diagnostic solutions and supporting broader healthcare technology integration.

- We'll examine how Henry Schein’s expanded diagnostic distribution capabilities may influence its long-term outlook and margin improvement strategy.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Henry Schein Investment Narrative Recap

For investors to remain confident in Henry Schein, they need to see continued proof that its expanding network and technology partnerships can power durable earnings growth, even as core dental markets face volume and pricing challenges. The Biomerica inFoods IBS test agreement adds a promising new clinical diagnostic to Schein's distribution portfolio, but its near-term impact is unlikely to significantly shift the company’s most pressing short-term catalyst: margin improvement in highly competitive categories, nor does it materially reduce the risk from persistent pricing pressure in gloves and core supplies.

The recent Aspen Dental partnership, with Henry Schein supporting a nationwide rollout of advanced digital imaging, is especially relevant given the emphasis on innovation and technology integration. This offering complements the diagnostic expansion theme and ties directly to the company’s ongoing push to grow higher-margin, technology-driven business segments, which remain a central catalyst for structural margin enhancement.

In contrast, persistent competitive pricing pressures in Henry Schein’s biggest distribution lines remain a key risk investors should be aware of...

Read the full narrative on Henry Schein (it's free!)

Henry Schein's outlook calls for $14.4 billion in revenue and $614.4 million in earnings by 2028. This implies a 4.0% annual revenue growth rate and a $225.4 million increase in earnings from $389.0 million today.

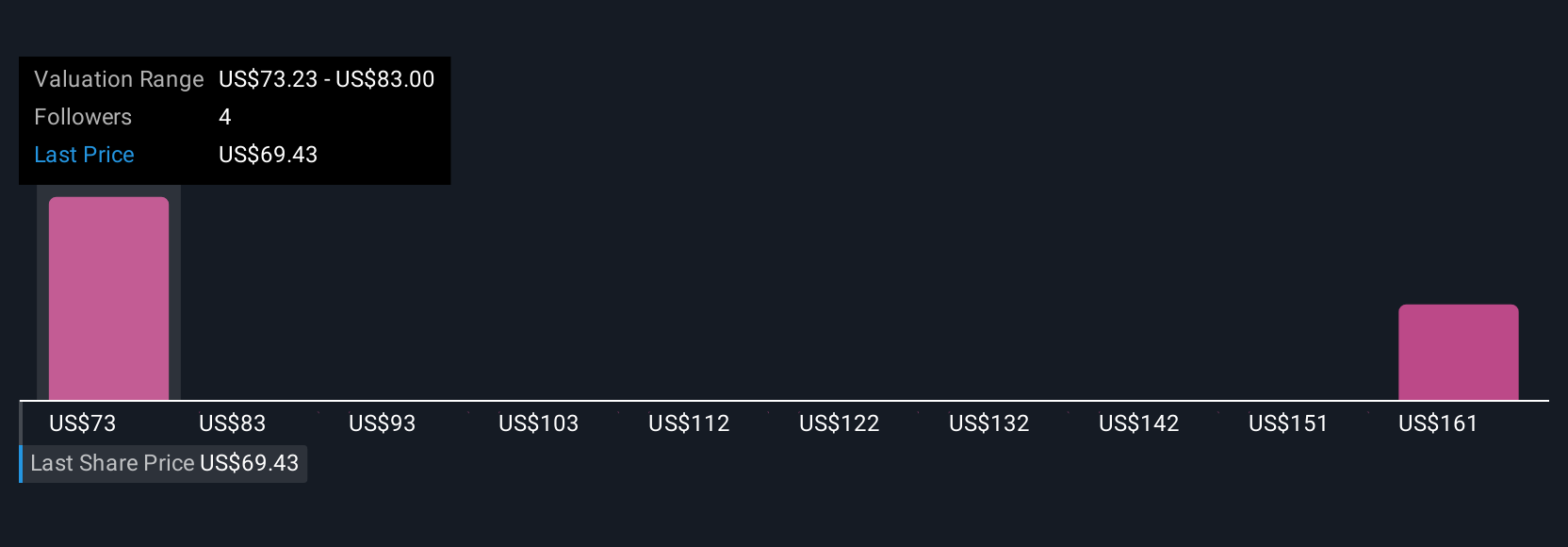

Uncover how Henry Schein's forecasts yield a $73.23 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have shared two fair value estimates for Henry Schein, ranging widely from US$73 to US$171 per share. While some see strong upside linked to technology and high-margin businesses, others point out ongoing competitive risks that could weigh on future returns, showing just how much opinions can differ, consider reviewing several viewpoints before making up your mind.

Explore 2 other fair value estimates on Henry Schein - why the stock might be worth over 2x more than the current price!

Build Your Own Henry Schein Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Henry Schein research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Henry Schein research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Henry Schein's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henry Schein might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HSIC

Henry Schein

Provides health care products and services to office-based dental and medical practitioners, and alternate sites of care worldwide.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives