- United States

- /

- Healthcare Services

- /

- NasdaqGS:HSIC

What Recent Pressure Means for Henry Schein Shares in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with Henry Schein stock? You are not alone. Whether you already hold shares or have them on your watchlist, recent market moves and shifting investor sentiment have made now a crucial time to understand what you really own. Over the last year, Henry Schein’s share price has seen a noticeable slide, down 10.4%, while longer-term returns show only a modest 1.3% gain over five years. These numbers reflect not only company-specific dynamics, but also broader changes across the healthcare supply landscape. For example, the rough patch in the past month, with the stock off 6.3%, has coincided with shifting risk perceptions around medical distributors and talks of tighter margins industrywide. It is easy to wonder: is the market being too pessimistic?

When it comes to value, numbers do not lie. A quick look at Henry Schein’s value score tells an interesting story. Out of six key valuation criteria, the company comes out as undervalued in five, earning it a robust score of 5. This kind of valuation strength is a sign that the stock could be offering a compelling opportunity for more patient investors, despite recent declines. Of course, the real question is which valuation approaches matter most, and how you can make sense of them in a fast-changing market. Let’s dig into each of the classic value checks, and finish with a potentially smarter way to look at Henry Schein’s true worth.

Approach 1: Henry Schein Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those values back to today to account for risk and the time value of money. This approach helps investors determine what the business is fundamentally worth, regardless of current market sentiment.

For Henry Schein, the most recent twelve months' Free Cash Flow stands at $327.4 million. Based on a combination of analyst estimates and forward projections, cash flow is expected to grow significantly over the next decade, reaching approximately $1.0 billion by 2035. Analysts have provided direct forecasts for the next five years, while longer-term figures are extrapolated by Simply Wall St. The model used is a 2 Stage Free Cash Flow to Equity approach, which captures both near-term growth and a transition to a more stable, mature growth rate in the future.

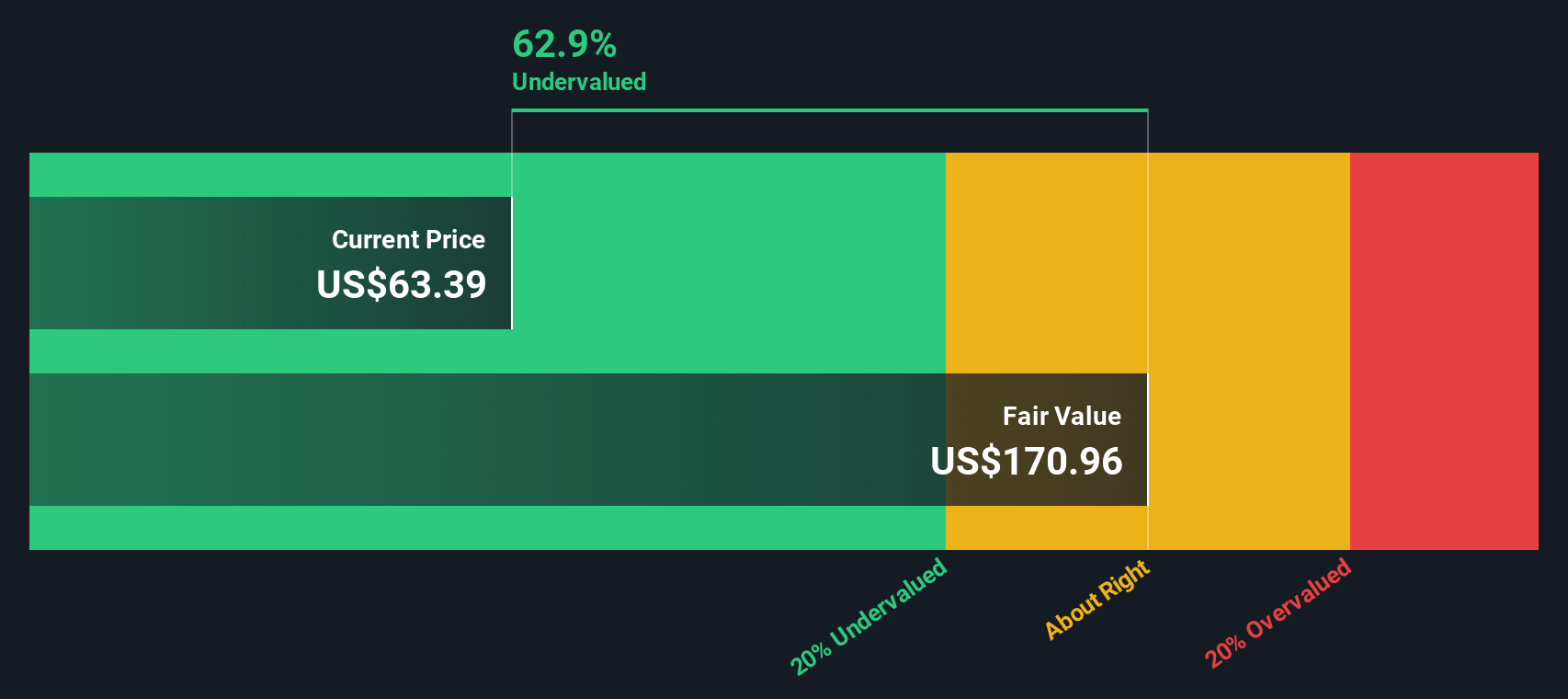

According to the DCF analysis, the intrinsic value of Henry Schein shares is estimated at $170.96 per share. With the current share price trading at a 63.1% discount to this fair value, the model suggests the stock is meaningfully undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Henry Schein is undervalued by 63.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Henry Schein Price vs Earnings

The Price-to-Earnings (PE) ratio is widely regarded as a reliable valuation measure for established, profitable companies like Henry Schein. This metric directly compares a company’s share price to its earnings, offering a straightforward gauge of how much investors are willing to pay for each dollar of profit.

What constitutes a “normal” or “fair” PE ratio depends on several factors, such as the company’s expected earnings growth, its historical stability, and the risks it faces within its industry. For example, higher-growth firms often command a premium. Those in more stable or slower-growth niches may trade at a lower multiple.

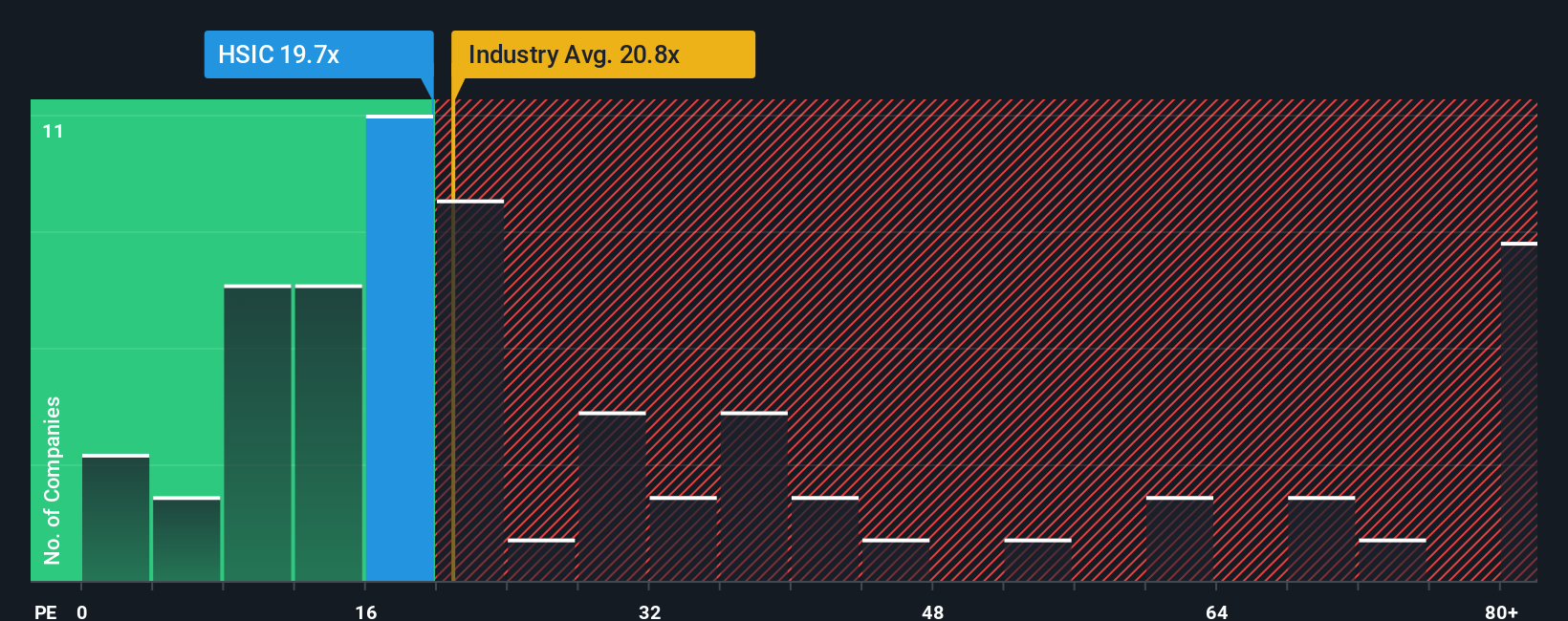

Currently, Henry Schein’s PE ratio stands at 19.7x. This is below the healthcare industry average of 21.4x and trails the peer group average of 25.5x. On the surface, this suggests Henry Schein is trading at a discount compared to its direct industry rivals.

However, a more nuanced view comes from the Simply Wall St “Fair Ratio.” This proprietary metric calculates what a reasonable PE would be for Henry Schein, factoring in earnings growth, industry trends, profitability, company size, and business risks. Unlike simple peer or industry comparisons, the Fair Ratio provides a more tailored, accurate sense of whether Henry Schein’s valuation matches its specific strengths and circumstances.

Currently, Henry Schein’s Fair PE Ratio is 22.8x. Since this is only modestly above the company’s current PE, it suggests the stock is very close to fair value, with valuations well-aligned to fundamentals rather than showing a clear discount or premium.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Henry Schein Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a concise story that captures your perspective on Henry Schein by combining your views about its future revenue, profit margins, risks, and what the stock is really worth. Unlike just looking at metrics or ratios, Narratives help investors see the company as a dynamic business, connecting its growth ambitions or challenges directly to a clear financial forecast and, ultimately, a fair value.

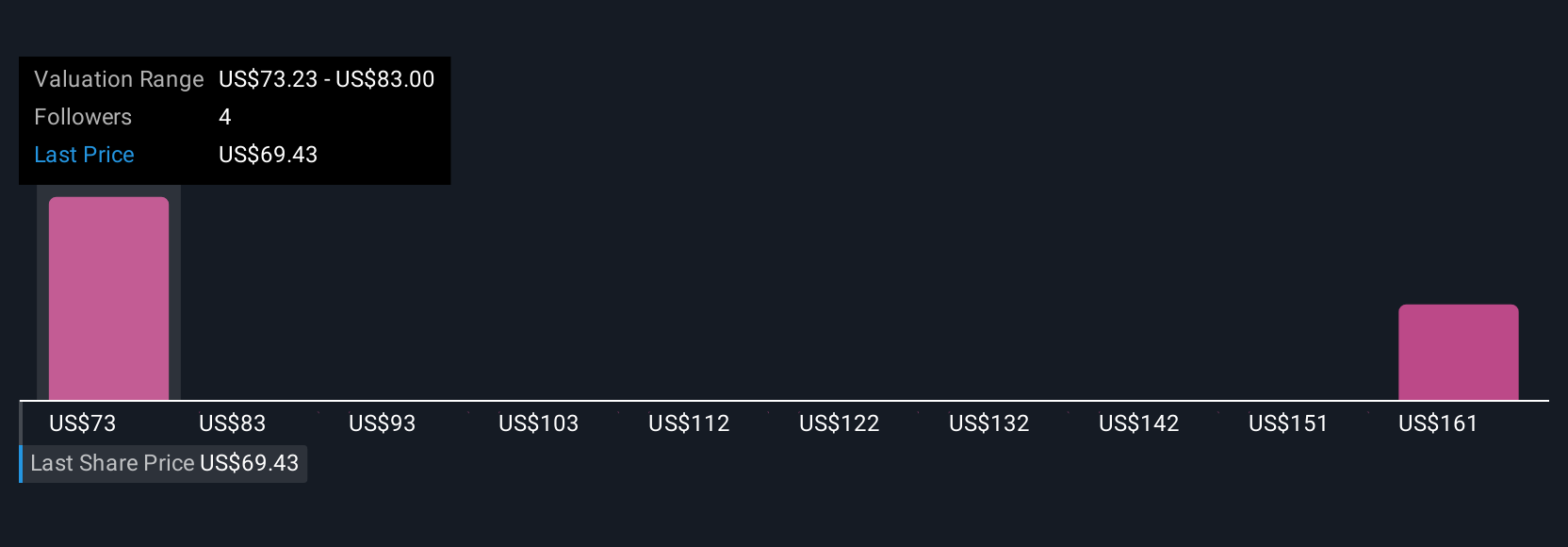

Narratives are easy to create and use, available for any investor on Simply Wall St’s Community page, and are updated immediately as news, earnings, or market conditions change. This means your investment thesis is always relevant. They empower you to make smart, timely decisions by showing whether the current stock price is above or below your own Fair Value calculation, helping you decide whether to buy, hold, or sell.

For example, right now some investors believe Henry Schein’s digital health push and margin improvements justify a fair value of $83.00 per share, while others are more cautious given industry risks, estimating fair value down at $55.00. These are two very different stories reflected in real numbers. Both perspectives are valid, and with Narratives, you can build and follow the one that best matches your belief about Henry Schein’s future.

Do you think there's more to the story for Henry Schein? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henry Schein might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HSIC

Henry Schein

Provides health care products and services to office-based dental and medical practitioners, and alternate sites of care worldwide.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives