- United States

- /

- Healthcare Services

- /

- NasdaqGS:HQY

Will HealthEquity's (HQY) New GLP-1 Telehealth Platform Redefine Its Growth Narrative?

Reviewed by Sasha Jovanovic

- HealthEquity, Inc. recently announced the launch of two consumer-focused platforms: a GLP-1 telehealth offering giving HSA members streamlined access to weight management medications, and a direct HSA enrollment solution available through its app and website.

- These initiatives align with recent regulatory changes and make HealthEquity services accessible to millions of newly eligible Americans, addressing the financial barriers many families face in affording healthcare.

- We'll explore how HealthEquity's new GLP-1 telehealth platform could expand its addressable market and reshape its investment narrative.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

HealthEquity Investment Narrative Recap

To be a HealthEquity shareholder, you need to believe in the continued expansion of the HSA market, fueled by regulatory changes and rising healthcare costs that drive demand for tax-advantaged savings solutions. The recent launch of consumer-focused platforms comes as the largest-ever eligibility expansion approaches, which could be an important short-term catalyst for new account growth, but risks tied to interest rate trends and consumer contributions remain key to monitor.

Of the recent announcements, the new direct HSA enrollment platform is particularly relevant, as it targets over 7 million Americans expected to gain HSA eligibility under regulatory changes by 2026. This digital expansion could accelerate customer acquisition at a critical time, supporting the business’s growth catalysts while testing the resilience of its technology investments and margin potential if onboarding or engagement falls short.

However, with rising operating costs and intense competition, the real test investors need to watch is whether new user growth keeps pace with...

Read the full narrative on HealthEquity (it's free!)

HealthEquity's narrative projects $1.6 billion in revenue and $325.3 million in earnings by 2028. This requires 7.9% yearly revenue growth and a $179.5 million earnings increase from current earnings of $145.8 million.

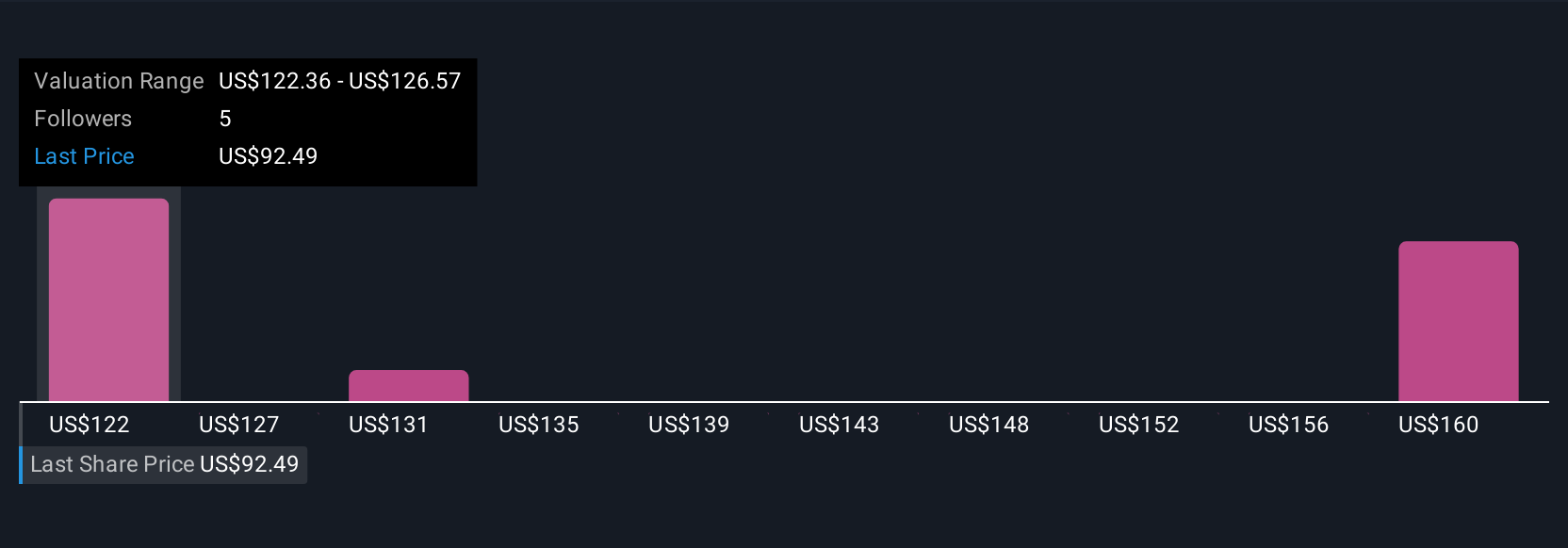

Uncover how HealthEquity's forecasts yield a $122.36 fair value, a 32% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community placed HealthEquity’s fair value between US$97.01 and US$168.06. While direct enrollment could drive new growth, consumer funding and interest rate trends remain central for future performance outlooks. Explore how your perspective compares as investor views can differ widely.

Explore 4 other fair value estimates on HealthEquity - why the stock might be worth as much as 82% more than the current price!

Build Your Own HealthEquity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HealthEquity research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free HealthEquity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HealthEquity's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HealthEquity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HQY

HealthEquity

Provides technology-enabled services platforms to consumers and employers in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives