- United States

- /

- Healthcare Services

- /

- NasdaqGS:HQY

HealthEquity (HQY): Assessing Valuation as New HSA Platforms Target Market Expansion and Cost Savings

Reviewed by Kshitija Bhandaru

HealthEquity (HQY) is rolling out two new consumer-focused platforms: one connecting HSA members to affordable healthcare solutions like GLP-1 medications, and another enabling direct HSA enrollment. This move aligns with rapid HSA growth and shifting regulations.

See our latest analysis for HealthEquity.

HealthEquity’s share price has seen pockets of momentum lately, posting a healthy 6.2% weekly gain after it unveiled its new healthcare platforms. However, it is still down 3.7% year-to-date. Notably, its 12-month total shareholder return stands at a robust 9.7%, highlighting steady long-term growth for investors despite recent ups and downs.

If these moves in the healthcare sector have you curious, it could be the perfect time to discover more standout names in the space. See See the full list for free..

With a strong year-long gain and analyst targets pointing to significant upside, the question now becomes whether HealthEquity is trading at a discount that presents a real buying opportunity or if the market is already pricing in further growth.

Most Popular Narrative: 23.8% Undervalued

The narrative consensus points to a fair value of $122.36, well above the last close at $93.23. This sizable gap has caught investors’ attention and raises the question of what fundamental catalysts are driving such an optimistic outlook.

The recent regulatory expansion, allowing direct primary care, pre-deductible telehealth, and millions of new ACA bronze/catastrophic plan members to qualify for HSAs, creates the largest addressable market increase in two decades. This is poised to accelerate new account openings and AUM growth, which could meaningfully boost future revenue.

What exactly supports this valuation leap? It is not just broad market trends. The real intrigue lies in bold, quantifiable assumptions about market expansion and future profitability built into this narrative. Curious which financial levers analysts believe could drive the stock that much higher? The details are just a click away.

Result: Fair Value of $122.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sluggish labor markets or a decline in interest rates could quickly challenge analyst optimism and undermine HealthEquity’s projected growth trajectory.

Find out about the key risks to this HealthEquity narrative.

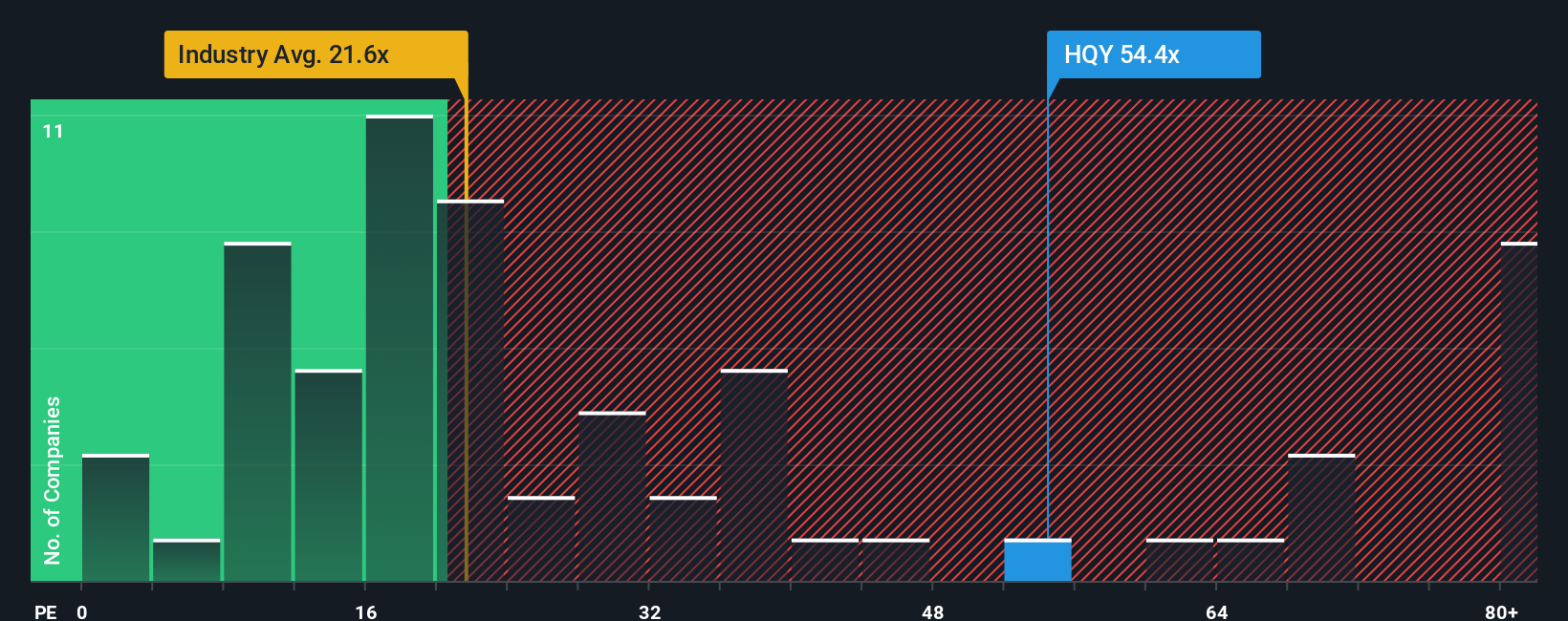

Another View: High Price Tag by Earnings Benchmarks

While some see HealthEquity as undervalued based on future cash flows, a look at its earnings-based valuation tells a different story. Its current price-to-earnings ratio stands at 55.1x, which is much higher than both the healthcare industry average of 21.4x and its peer group average of 17.9x. The fair ratio, calculated from company fundamentals, is 32.6x. This wide gap suggests the market is pricing in a lot of optimism, which could mean greater risk if growth expectations are missed. Is the premium justified, or does it set a high bar for the future?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HealthEquity Narrative

If the consensus view does not reflect your perspective, or you want to dig into the numbers yourself, you can build your own HealthEquity narrative in just a few minutes and shape your personalized outlook. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding HealthEquity.

Looking for More Investment Ideas?

Make your next smart move and get ahead of the market by tapping into unique stock themes that others are missing. Here’s where to start:

- Unlock big yield potential when you check out these 18 dividend stocks with yields > 3% which offer attractive payouts paired with solid performance records.

- Jump on powerful trends by exploring these 25 AI penny stocks that are driving the future of automation, smart data, and next-generation business models.

- Spot value before the crowd does with these 891 undervalued stocks based on cash flows highlighting standout low-priced opportunities ready to reward forward-thinking investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HealthEquity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HQY

HealthEquity

Provides technology-enabled services platforms to consumers and employers in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives