- United States

- /

- Healthcare Services

- /

- NasdaqGS:HQY

3 Stocks That May Be Undervalued By As Much As 41.6%

Reviewed by Simply Wall St

The United States market has experienced a steady rise of 13% over the past year, despite remaining flat in the last week, with earnings projected to grow by 14% annually. In this context, identifying stocks that are potentially undervalued can be a strategic move for investors seeking opportunities that may offer growth potential relative to their current valuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Berkshire Hills Bancorp (NYSE:BHLB) | $25.03 | $49.21 | 49.1% |

| Mid Penn Bancorp (NasdaqGM:MPB) | $26.67 | $52.26 | 49% |

| Brookline Bancorp (NasdaqGS:BRKL) | $10.45 | $20.70 | 49.5% |

| Valley National Bancorp (NasdaqGS:VLY) | $8.76 | $17.31 | 49.4% |

| Central Pacific Financial (NYSE:CPF) | $26.56 | $51.99 | 48.9% |

| e.l.f. Beauty (NYSE:ELF) | $114.78 | $225.86 | 49.2% |

| TXO Partners (NYSE:TXO) | $15.05 | $29.99 | 49.8% |

| Lyft (NasdaqGS:LYFT) | $15.35 | $30.52 | 49.7% |

| Verra Mobility (NasdaqCM:VRRM) | $24.12 | $47.84 | 49.6% |

| Expand Energy (NasdaqGS:EXE) | $118.22 | $234.19 | 49.5% |

Let's explore several standout options from the results in the screener.

Global-E Online (NasdaqGS:GLBE)

Overview: Global-E Online Ltd. operates a direct-to-consumer cross-border e-commerce platform across multiple countries including Israel, the United Kingdom, and the United States, with a market cap of approximately $5.47 billion.

Operations: The company generates revenue of $796.77 million from its internet information provider segment, focusing on facilitating cross-border e-commerce.

Estimated Discount To Fair Value: 27.2%

Global-E Online is trading at US$32.91, significantly below its estimated fair value of US$45.19, suggesting it may be undervalued based on cash flows. Recent earnings showed improved performance with sales rising to US$189.88 million and a reduced net loss of US$17.86 million year-over-year. The strategic partnership renewal with Shopify enhances its market position, potentially driving future revenue growth beyond the forecasted 20% annually, outpacing the broader U.S. market growth rate.

- According our earnings growth report, there's an indication that Global-E Online might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Global-E Online.

HealthEquity (NasdaqGS:HQY)

Overview: HealthEquity, Inc. operates technology-enabled services platforms for consumers and employers in the United States, with a market cap of approximately $8.91 billion.

Operations: The company's revenue is primarily derived from its Pharmacy Services segment, which generated approximately $1.20 billion.

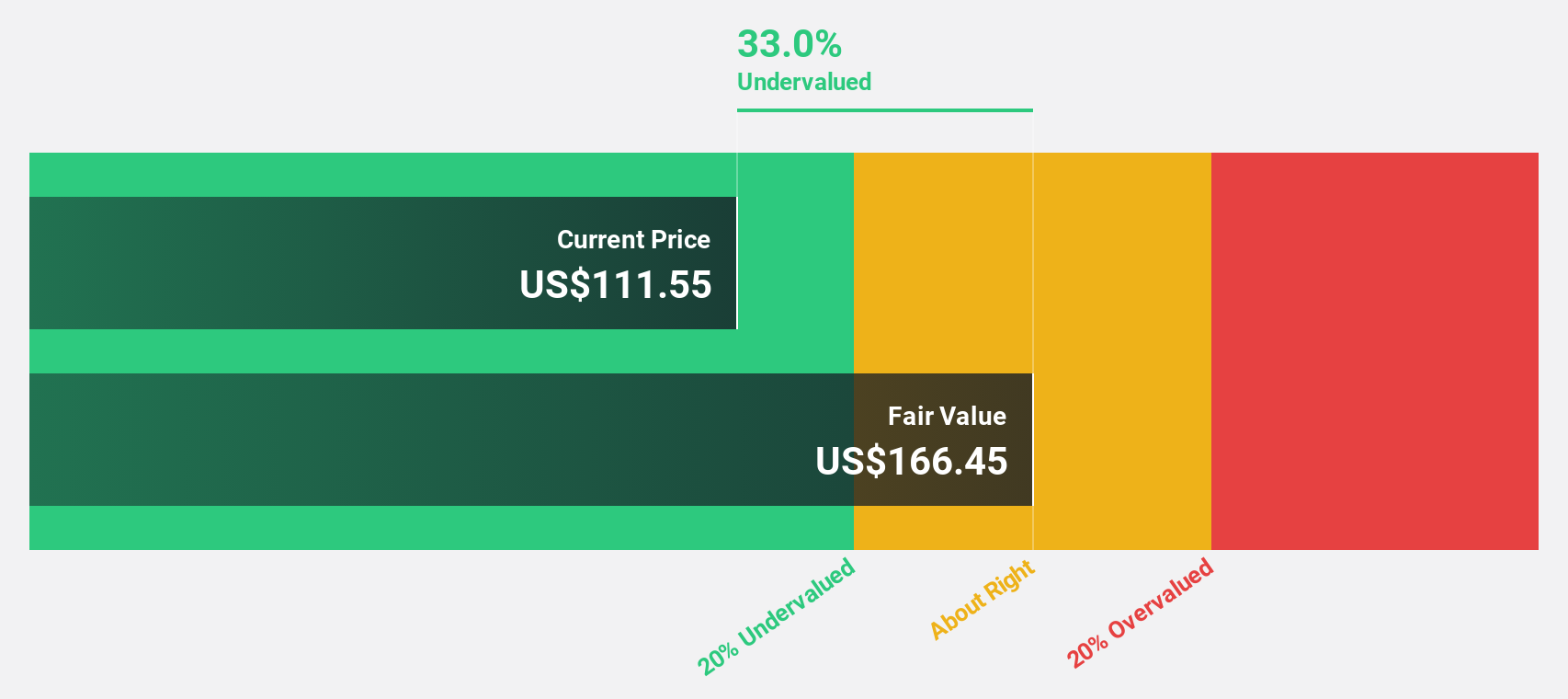

Estimated Discount To Fair Value: 41.6%

HealthEquity is trading at US$103.76, well below its estimated fair value of US$177.58, highlighting potential undervaluation based on cash flows. Recent earnings reveal a robust increase in revenue to US$330.84 million and net income to US$53.92 million for Q1 2025, compared to the previous year. The company has raised its fiscal year guidance, with projected revenues up to $1.305 billion and net income reaching $188 million, supporting strong future growth expectations.

- Our expertly prepared growth report on HealthEquity implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of HealthEquity with our detailed financial health report.

Citizens Financial Group (NYSE:CFG)

Overview: Citizens Financial Group, Inc. is a bank holding company offering a range of retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions in the United States with a market cap of $17.37 billion.

Operations: Citizens Financial Group generates revenue primarily from its Consumer Banking segment, which accounts for $5.50 billion, and its Commercial Banking segment, contributing $2.42 billion.

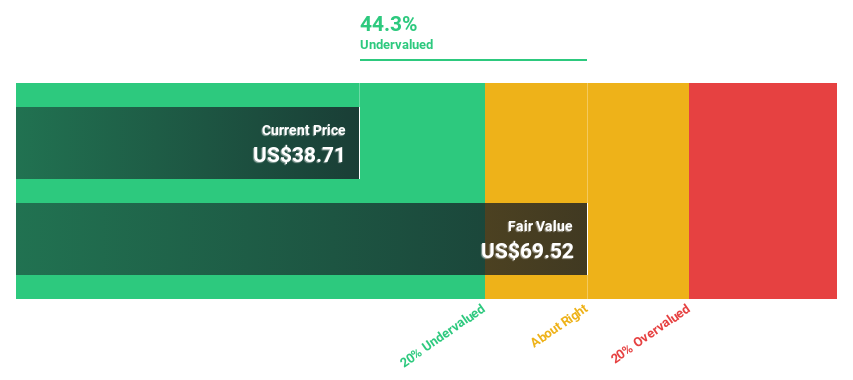

Estimated Discount To Fair Value: 36.8%

Citizens Financial Group is trading at US$40.83, significantly below its estimated fair value of US$64.58, indicating potential undervaluation based on cash flows. The company reported Q1 2025 net income of US$373 million, an increase from the previous year. Despite a slight decline in net interest income to US$1.39 billion, earnings per share rose to $0.78 from $0.66, supporting expectations for significant future profit growth above market averages.

- Upon reviewing our latest growth report, Citizens Financial Group's projected financial performance appears quite optimistic.

- Take a closer look at Citizens Financial Group's balance sheet health here in our report.

Key Takeaways

- Navigate through the entire inventory of 169 Undervalued US Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HealthEquity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HQY

HealthEquity

Provides technology-enabled services platforms to consumers and employers in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives