- United States

- /

- Medical Equipment

- /

- NasdaqGS:HOLX

Hologic's (NASDAQ:HOLX) investors will be pleased with their favorable 66% return over the last five years

The main point of investing for the long term is to make money. Better yet, you'd like to see the share price move up more than the market average. Unfortunately for shareholders, while the Hologic, Inc. (NASDAQ:HOLX) share price is up 66% in the last five years, that's less than the market return. Zooming in, the stock is up a respectable 16% in the last year.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Hologic

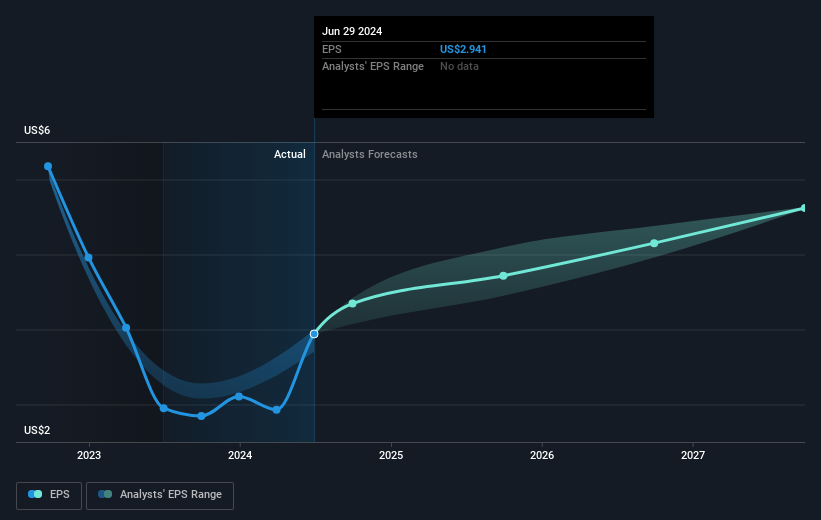

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last half decade, Hologic became profitable. That would generally be considered a positive, so we'd hope to see the share price to rise.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Hologic has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

Hologic shareholders gained a total return of 16% during the year. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 11% over half a decade It is possible that returns will improve along with the business fundamentals. If you would like to research Hologic in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hologic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HOLX

Hologic

Develops, manufactures, and supplies diagnostics products, medical imaging systems, and surgical products for women's health through early detection and treatment.

Flawless balance sheet and undervalued.