- United States

- /

- Medical Equipment

- /

- NasdaqGS:HOLX

Hologic (HOLX): Revisiting Valuation After a 13% Three-Month Share Price Climb

Reviewed by Simply Wall St

Hologic (HOLX) has been quietly grinding higher, with the stock up around 13% over the past 3 months as investors warm to its steady diagnostics and women’s health business.

See our latest analysis for Hologic.

That recent 12.7% 3 month share price return has started to reverse last year’s weakness, even though the 1 year total shareholder return is still slightly negative. This suggests momentum is rebuilding as earnings growth looks more durable.

If Hologic’s steady climb has you rethinking the healthcare space, it could be worth exploring other healthcare stocks that are starting to show similar signs of improving momentum.

With earnings growing faster than revenue, a modest discount to fair value, and shares hovering just below analyst targets, is Hologic still an underappreciated women’s health compounder, or has the market already priced in its next leg of growth?

Most Popular Narrative: 1.8% Undervalued

Compared to Hologic’s last close around $74.82, the most followed narrative points to a slightly higher fair value anchored in steady, compounding fundamentals.

The global rise in preventive women's health and the aging population, combined with growing healthcare expenditure (especially in emerging markets), are positioning Hologic's core businesses for long-term growth. This underlies sustained demand for diagnostic and screening products and should drive higher utilization and recurring revenue.

Curious how measured growth, rising margins and a lower future earnings multiple can still support a higher fair value than today’s price? The narrative’s detailed revenue, earnings and profitability roadmap may surprise you.

Result: Fair Value of $76.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent China weakness and ongoing tariff pressures could cap international growth and margins, challenging the idea that Hologic’s earnings trajectory is fully de risked.

Find out about the key risks to this Hologic narrative.

Another Lens On Value

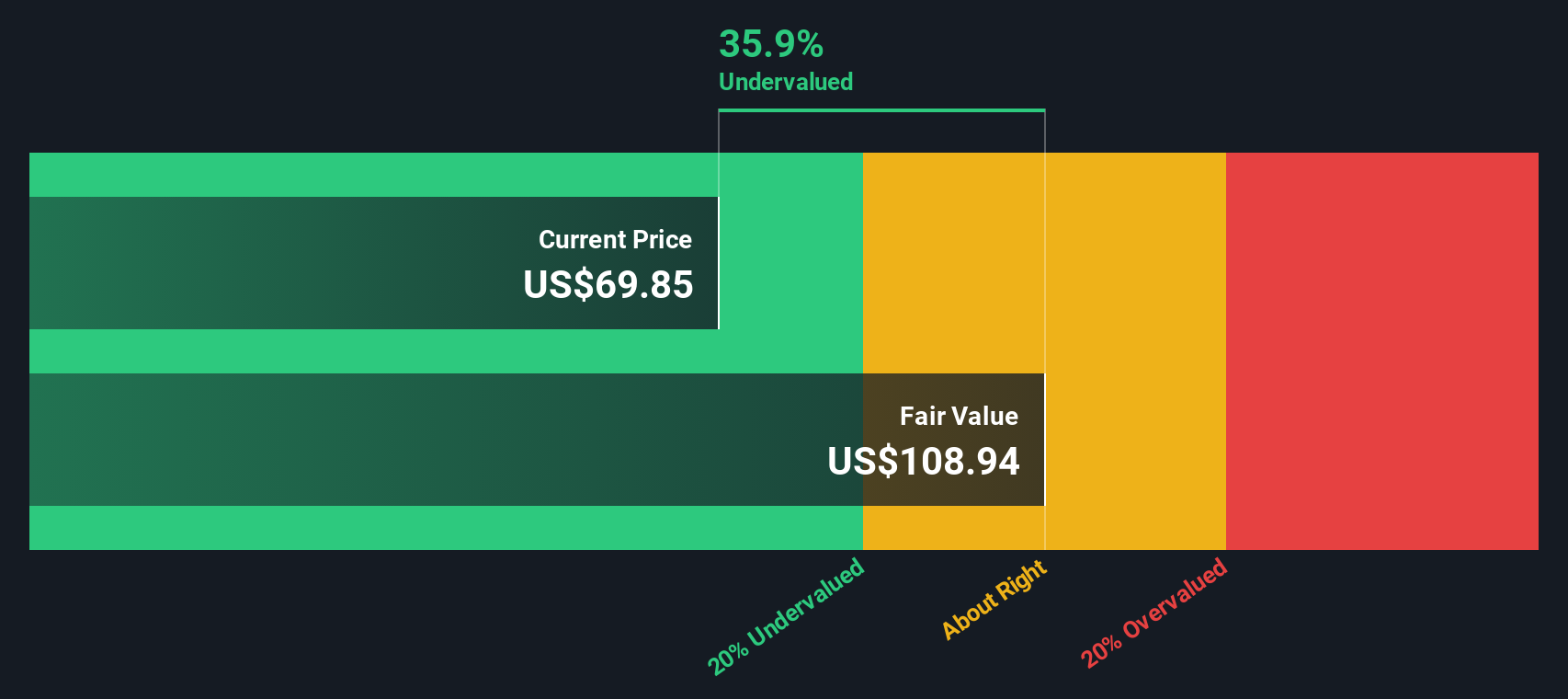

While the popular narrative sees Hologic as just 1.8% undervalued, the SWS DCF model presents a different perspective, putting fair value closer to $104.89, roughly 29% above the current $74.82 share price. If cash flows indicate significantly more potential upside, what is the market missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hologic Narrative

If you see the story differently or want to stress test your own assumptions using the same data, you can build a custom view in minutes: Do it your way.

A great starting point for your Hologic research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more actionable ideas?

Before you move on, give yourself an edge by using the Simply Wall Street Screener to uncover fresh opportunities that most investors are still overlooking.

- Secure growing income streams by targeting these 14 dividend stocks with yields > 3% that can potentially strengthen your portfolio through every market cycle.

- Catch tomorrow’s innovation leaders early by scanning these 24 AI penny stocks shaping the next wave of intelligent technology.

- Capitalize on mispriced potential with these 925 undervalued stocks based on cash flows that may offer strong upside if the market closes the valuation gap.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hologic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOLX

Hologic

Engages in the development, manufacture, and supply of diagnostics products, medical imaging systems, and surgical products for women's health through early detection and treatment worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026