- United States

- /

- Healthcare Services

- /

- NasdaqGS:GH

Guardant Health (GH): Evaluating Valuation After FDA Approval Expands Guardant360 CDx Utility in Breast Cancer Care

Reviewed by Kshitija Bhandaru

Guardant Health (GH) caught investor attention after the FDA approved its Guardant360 CDx test as a companion diagnostic for breast cancer patients with certain ESR1 mutations who may benefit from Eli Lilly’s Inluriyo.

See our latest analysis for Guardant Health.

Guardant Health’s FDA win marked a major milestone and fueled fresh optimism. This was reflected in a sharp 17% jump in the 30-day share price return and a remarkable 102% gain year-to-date. The momentum has reignited interest among investors, especially as the one-year total shareholder return topped 200%. This signals renewed confidence after years of challenging performance and underscores the company’s status as a resurgent force in precision oncology.

If this surge in cancer diagnostics has you exploring the sector’s future stars, take the next step and discover See the full list for free.

With the stock’s sharp gains and optimism running high, the crucial question now is whether Guardant Health still offers compelling value for new investors, or if the recent rally has already priced in much of the anticipated future growth.

Most Popular Narrative: 5.9% Undervalued

With the latest fair value pegged at $68.23 per share and Guardant Health’s last close at $64.22, the narrative implies a modest upside from current levels. This highlights renewed momentum and potential for investors seeking exposure to precision oncology’s growth story.

Rapid integration of AI-powered clinical analytics and multi-omic profiling into Guardant's "Smart Liquid Biopsy" platform is creating new clinical applications. This is enhancing product utility and differentiation versus peers, which is leading to higher average selling prices (ASPs), rising margins, and increased potential for broader payer reimbursement and improved net margins.

Curious what powers this premium valuation? The narrative hinges on aggressive revenue targets, bold profit margin bets, and ambitious adoption curves. Ready to see the projections that insiders believe will change everything?

Result: Fair Value of $68.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, steep ongoing R&D costs and delays in broader insurer adoption could quickly dampen Guardant Health's growth story if these issues are not carefully managed.

Find out about the key risks to this Guardant Health narrative.

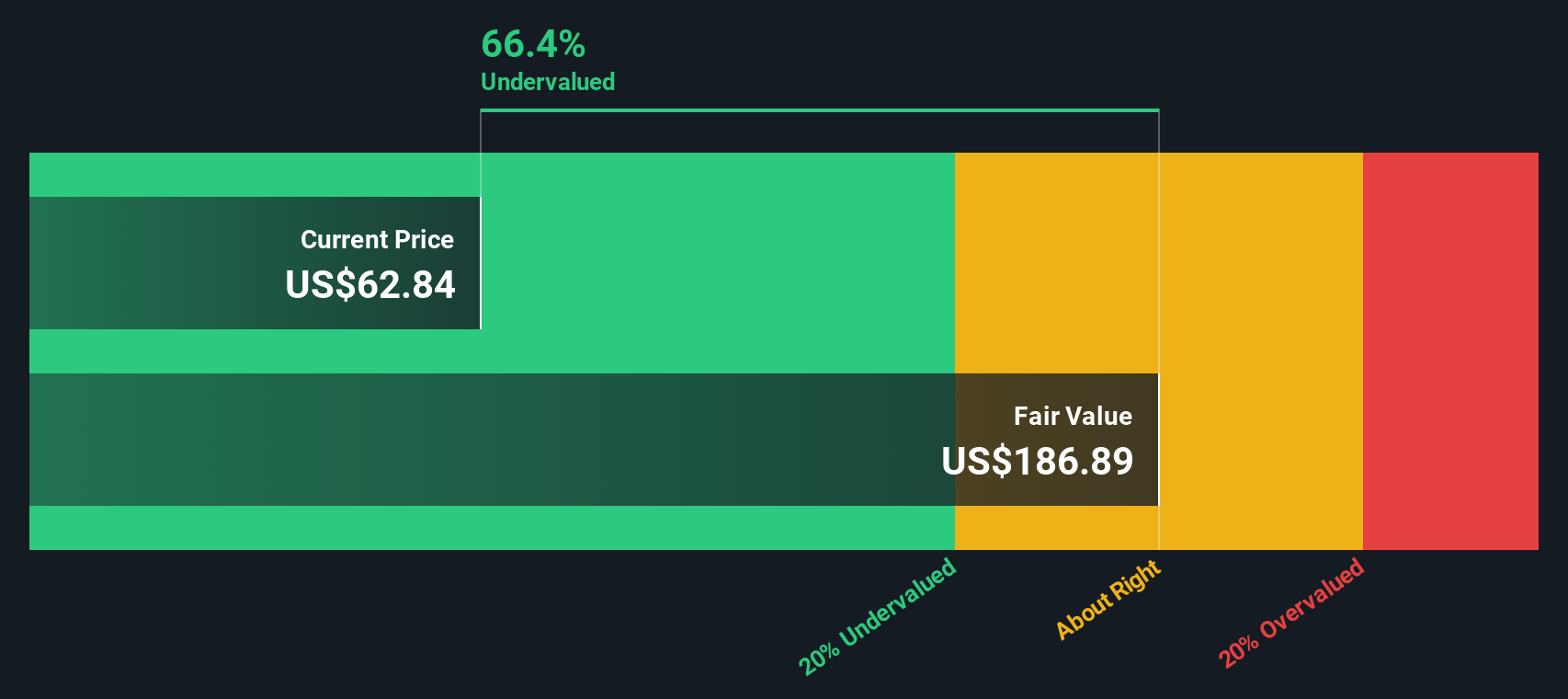

Another View: Discounted Cash Flow Signals Undervaluation

While many analysts focus on revenue multiples, the SWS DCF model suggests a different story for Guardant Health. According to our DCF estimate, the shares are trading close to 67% below fair value at $195.52 per share. This indicates significant upside potential if long-term forecasts play out. Can the fundamentals justify such optimism, or will reality prove more conservative?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Guardant Health Narrative

If you want to dig deeper or have your own viewpoint on Guardant Health, you can easily build your personal narrative in just a few minutes. Do it your way

A great starting point for your Guardant Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't miss out on tomorrow's breakthroughs. Expand your portfolio by tapping into trends that are shaking up markets, fueling returns, and transforming entire industries.

- Unlock potential growth by following these 3587 penny stocks with strong financials that combine strong financials with the agility to seize emerging opportunities in untapped markets.

- Benefit from powerful recurring income. Target these 19 dividend stocks with yields > 3% offering yields above 3% and a track record of rewarding shareholders.

- Position yourself for the AI revolution by reviewing these 24 AI penny stocks designed to capture companies driving advances in automation and machine learning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GH

Guardant Health

A precision oncology company, provides blood and tissue tests, and data sets in the United States and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives