- United States

- /

- Hospitality

- /

- NasdaqCM:AGAE

Spotlight On 3 Promising Penny Stocks With Market Caps Over $60M

Reviewed by Simply Wall St

As the U.S. stock market navigates mixed signals with the S&P 500 and Dow Jones aiming to extend their winning streaks, investors are keenly observing how broader economic factors like interest rates and tariffs might impact future growth. For those willing to explore beyond established giants, penny stocks—often representing smaller or newer companies—continue to hold relevance despite their somewhat outdated moniker. These stocks can offer surprising value when backed by strong financials, presenting a blend of potential value and growth that larger firms may overlook.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.45 | $361.71M | ✅ 4 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.39 | $1.44B | ✅ 3 ⚠️ 3 View Analysis > |

| Perfect (NYSE:PERF) | $1.86 | $189.44M | ✅ 3 ⚠️ 1 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $1.05 | $18.66M | ✅ 4 ⚠️ 4 View Analysis > |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.315 | $9.95M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.65 | $46.16M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.56 | $77.65M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.8294 | $6.02M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.594 | $80.24M | ✅ 3 ⚠️ 2 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.7957 | $71.73M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 748 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Allied Gaming & Entertainment (NasdaqCM:AGAE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Allied Gaming & Entertainment Inc., along with its subsidiaries, operates globally as a public esports and entertainment company with a market cap of $64.39 million.

Operations: Allied Gaming & Entertainment Inc. does not report specific revenue segments.

Market Cap: $64.39M

Allied Gaming & Entertainment Inc., with a market cap of US$64.39 million, operates in the esports and entertainment sector but remains pre-revenue. The company has more cash than debt and a sufficient cash runway for over three years based on current free cash flow trends. However, it faces challenges with compliance as it received a Nasdaq deficiency letter due to delayed SEC filings, which could impact its listing status if not resolved by June 2025. Despite these hurdles, management's experience and efforts to regain compliance may provide some stability amidst its unprofitable status and increased debt-to-equity ratio over recent years.

- Jump into the full analysis health report here for a deeper understanding of Allied Gaming & Entertainment.

- Examine Allied Gaming & Entertainment's past performance report to understand how it has performed in prior years.

Beauty Health (NasdaqCM:SKIN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: The Beauty Health Company, along with its subsidiaries, engages in the design, development, manufacturing, marketing, and sale of aesthetic technologies and products across the Americas, Asia-Pacific, Europe, the Middle East, and Africa with a market cap of $143.63 million.

Operations: The company's revenue is primarily generated from its Personal Products segment, totaling $334.29 million.

Market Cap: $143.63M

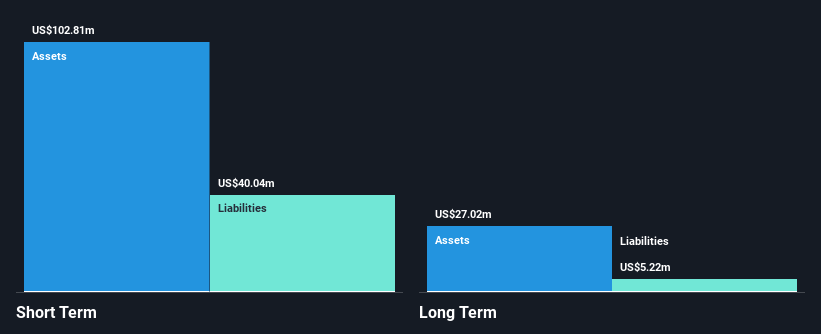

Beauty Health, with a market cap of US$143.63 million, has shown improvement by reducing its net loss from US$100.1 million to US$29.1 million over the past year, despite remaining unprofitable. The company’s revenue for 2024 was US$334.29 million, down from the previous year, and it forecasts further declines in sales for 2025 to between US$270 million and US$300 million. Although its short-term assets cover liabilities comfortably, long-term liabilities remain uncovered by current assets. Leadership changes include Mr. Ronald Menezes becoming an executive officer as part of efforts to stabilize operations amidst ongoing volatility and high debt levels.

- Click to explore a detailed breakdown of our findings in Beauty Health's financial health report.

- Examine Beauty Health's earnings growth report to understand how analysts expect it to perform.

GoodRx Holdings (NasdaqGS:GDRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GoodRx Holdings, Inc. operates by providing consumers in the United States with information and tools to compare prices and save on prescription drug purchases, with a market cap of approximately $1.80 billion.

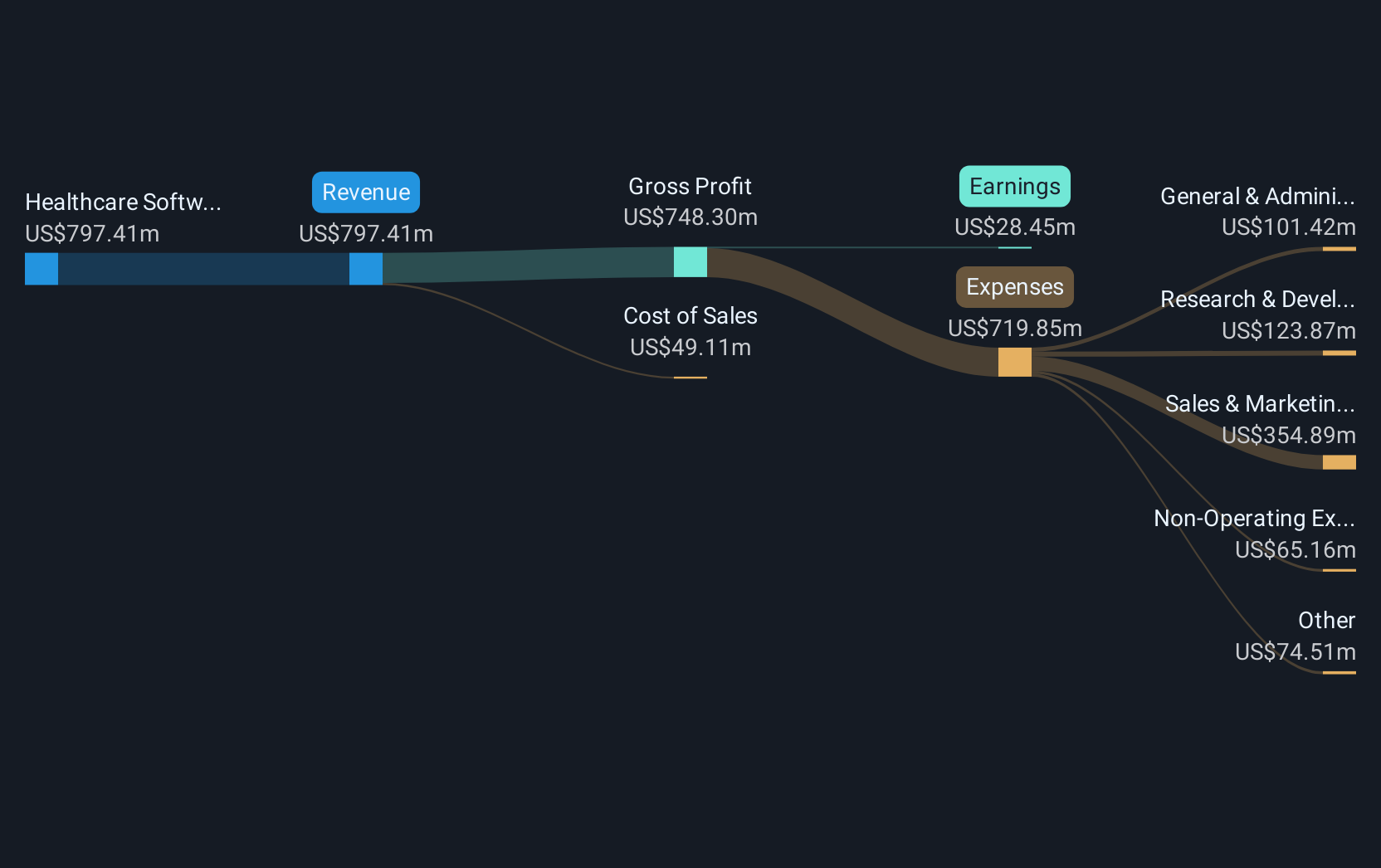

Operations: The company's revenue is primarily derived from its Healthcare Software segment, which generated $792.32 million.

Market Cap: $1.8B

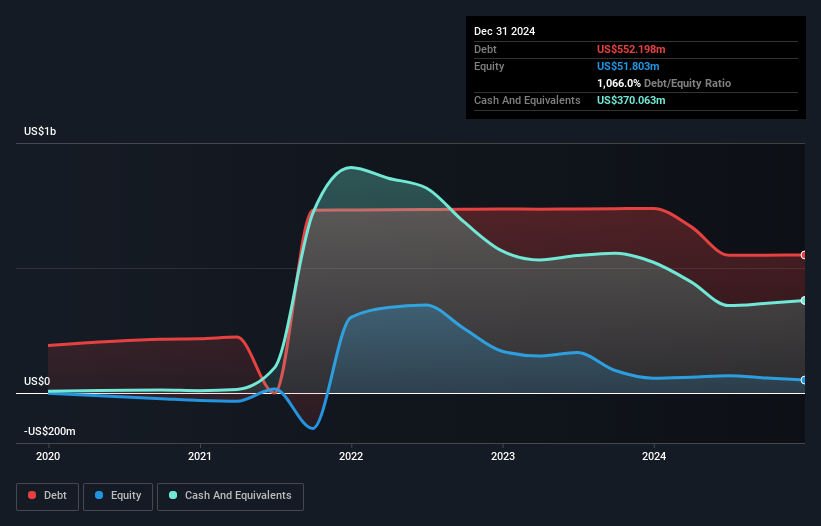

GoodRx Holdings, with a market cap of US$1.80 billion, is actively leveraging digital innovation to enhance its prescription purchasing process. The recent launch of an e-commerce experience with Hy-Vee aims to streamline medication access and improve pharmacy efficiency. Financially, GoodRx reported 2024 revenue of US$792.32 million and transitioned to profitability with a net income of US$16.39 million from a previous loss. While short-term assets exceed liabilities significantly, interest coverage remains slightly below optimal levels at 2.9x EBIT coverage, despite satisfactory debt management and experienced leadership poised for strategic growth initiatives in the healthcare sector.

- Take a closer look at GoodRx Holdings' potential here in our financial health report.

- Learn about GoodRx Holdings' future growth trajectory here.

Where To Now?

- Dive into all 748 of the US Penny Stocks we have identified here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AGAE

Allied Gaming & Entertainment

Operates as a public esports and entertainment company worldwide.

Excellent balance sheet minimal.

Similar Companies

Market Insights

Community Narratives