- United States

- /

- Healthtech

- /

- NasdaqGS:GDRX

Exploring High Growth Tech Stocks in the US This July 2025

Reviewed by Simply Wall St

In the last week, the United States market has been flat, but over the past 12 months, it has risen by 18%, with earnings expected to grow by 15% per annum in the coming years. In this context of steady growth and positive outlooks, identifying high-growth tech stocks involves focusing on companies that demonstrate strong innovation potential and adaptability within this dynamic sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.17% | 38.20% | ★★★★★★ |

| Circle Internet Group | 30.81% | 60.66% | ★★★★★★ |

| Ardelyx | 20.96% | 62.26% | ★★★★★★ |

| TG Therapeutics | 26.14% | 39.04% | ★★★★★★ |

| Alkami Technology | 20.57% | 76.67% | ★★★★★★ |

| AVITA Medical | 27.39% | 61.05% | ★★★★★★ |

| Alnylam Pharmaceuticals | 24.07% | 59.30% | ★★★★★★ |

| Ascendis Pharma | 34.90% | 59.91% | ★★★★★★ |

| Caris Life Sciences | 24.80% | 72.64% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 106.24% | ★★★★★★ |

Click here to see the full list of 222 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Day One Biopharmaceuticals (DAWN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Day One Biopharmaceuticals, Inc. is a commercial-stage company dedicated to developing advanced medicines for both childhood and adult diseases in the United States, with a market cap of $703.46 million.

Operations: Day One Biopharmaceuticals focuses on developing innovative medicines for childhood and adult diseases in the United States. The company operates as a commercial-stage entity with a market cap of approximately $703.46 million.

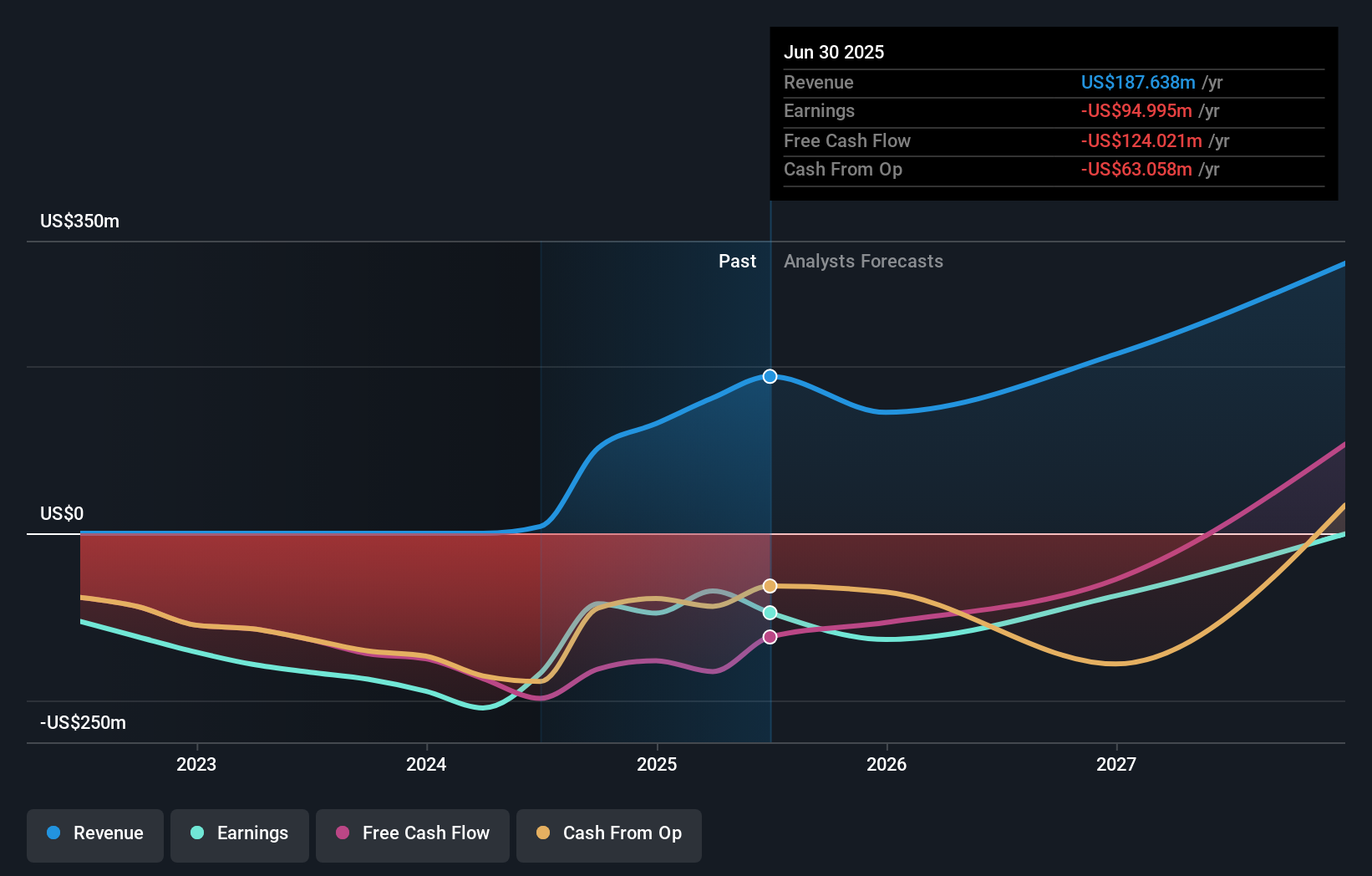

Day One Biopharmaceuticals has shown robust dynamics, with a notable 29% annual revenue growth and an anticipated earnings increase of 60.24% per year. The recent appointment of Michael Vasconcelles as Head of R&D is pivotal, given his extensive background in oncology and biotech leadership, promising to invigorate Day One's research endeavors significantly. Despite current unprofitability, the company's aggressive R&D focus (evident from recent executive changes) aligns with its strategy to transition into profitability within three years, underscoring a commitment to innovation and market expansion in high-stakes biopharmaceuticals.

- Take a closer look at Day One Biopharmaceuticals' potential here in our health report.

Gain insights into Day One Biopharmaceuticals' past trends and performance with our Past report.

GoodRx Holdings (GDRX)

Simply Wall St Growth Rating: ★★★★☆☆

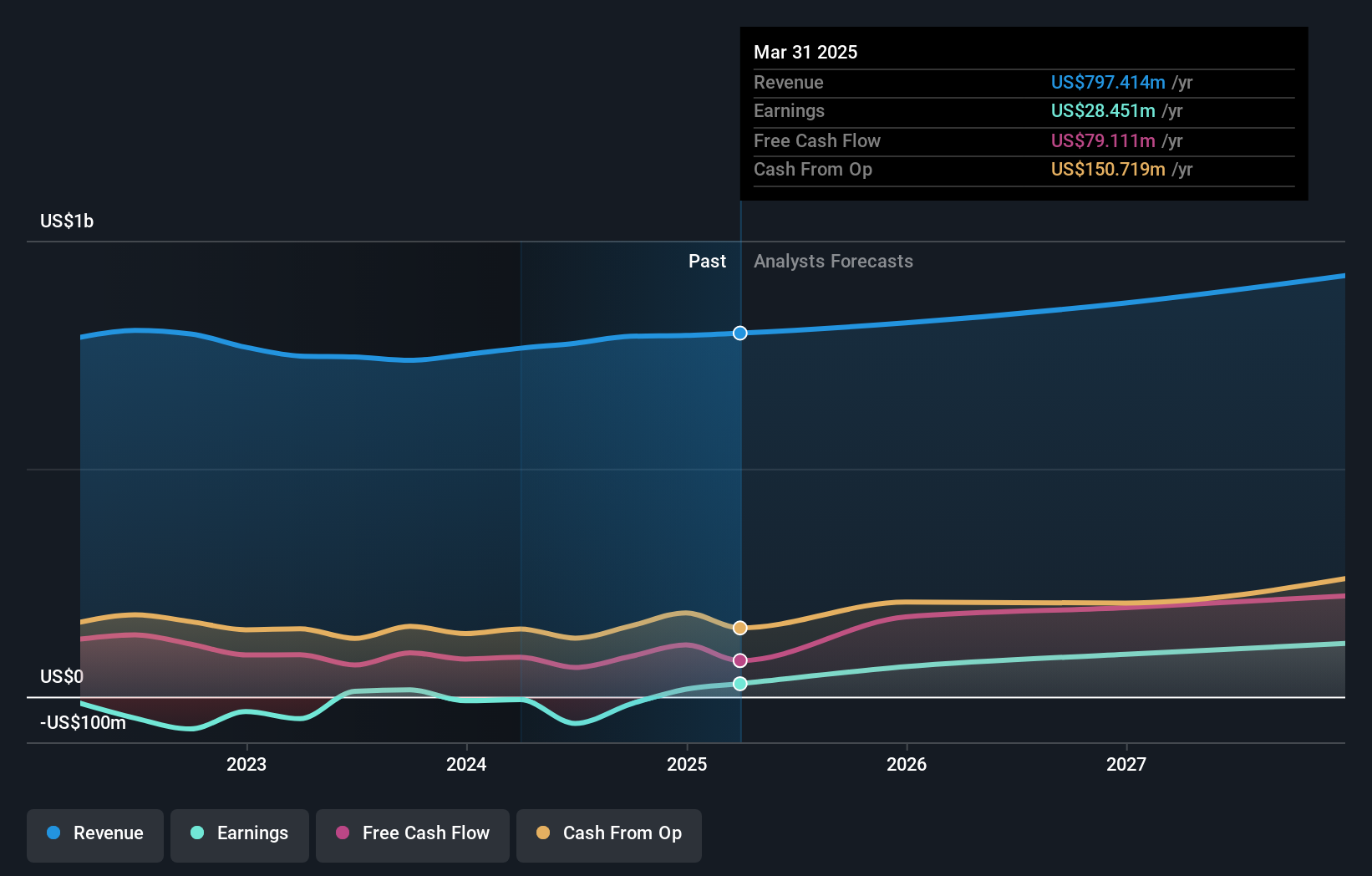

Overview: GoodRx Holdings, Inc. provides consumers in the United States with tools to compare and save on prescription drug prices, with a market cap of approximately $1.91 billion.

Operations: GoodRx Holdings, Inc. generates revenue primarily through its healthcare software segment, which accounted for $797.41 million. The company focuses on providing tools that help consumers in the U.S. compare and save on prescription drug prices.

GoodRx Holdings has recently pivoted toward enhancing consumer access to healthcare with innovative solutions like its new subscription service for erectile dysfunction, priced from just $18/month. This move not only addresses a significant care gap—nearly one-third of U.S. men report issues with erectile function—but also circumvents insurance barriers and social stigma by offering discreet, direct-to-door services. The company's strategic focus on transparent, affordable healthcare is further exemplified by its Community Link initiative, which supports independent pharmacies with favorable pricing models free from Pharmacy Benefit Manager (PBM) involvement. Moreover, GoodRx's commitment to technological innovation is evident in its decision to open-source Lifecycle, a tool that improves software development efficiency—a reflection of its broader strategy to foster an open collaborative tech environment. These initiatives are part of why GoodRx reported a notable turnaround in profitability this year, with first-quarter net income reaching $11.05 million compared to a net loss the previous year and ongoing share repurchases underscoring confidence in their financial strategy.

- Dive into the specifics of GoodRx Holdings here with our thorough health report.

Understand GoodRx Holdings' track record by examining our Past report.

Phreesia (PHR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Phreesia, Inc. offers an integrated SaaS-based software and payment platform tailored for the healthcare industry in the United States and Canada, with a market capitalization of approximately $1.65 billion.

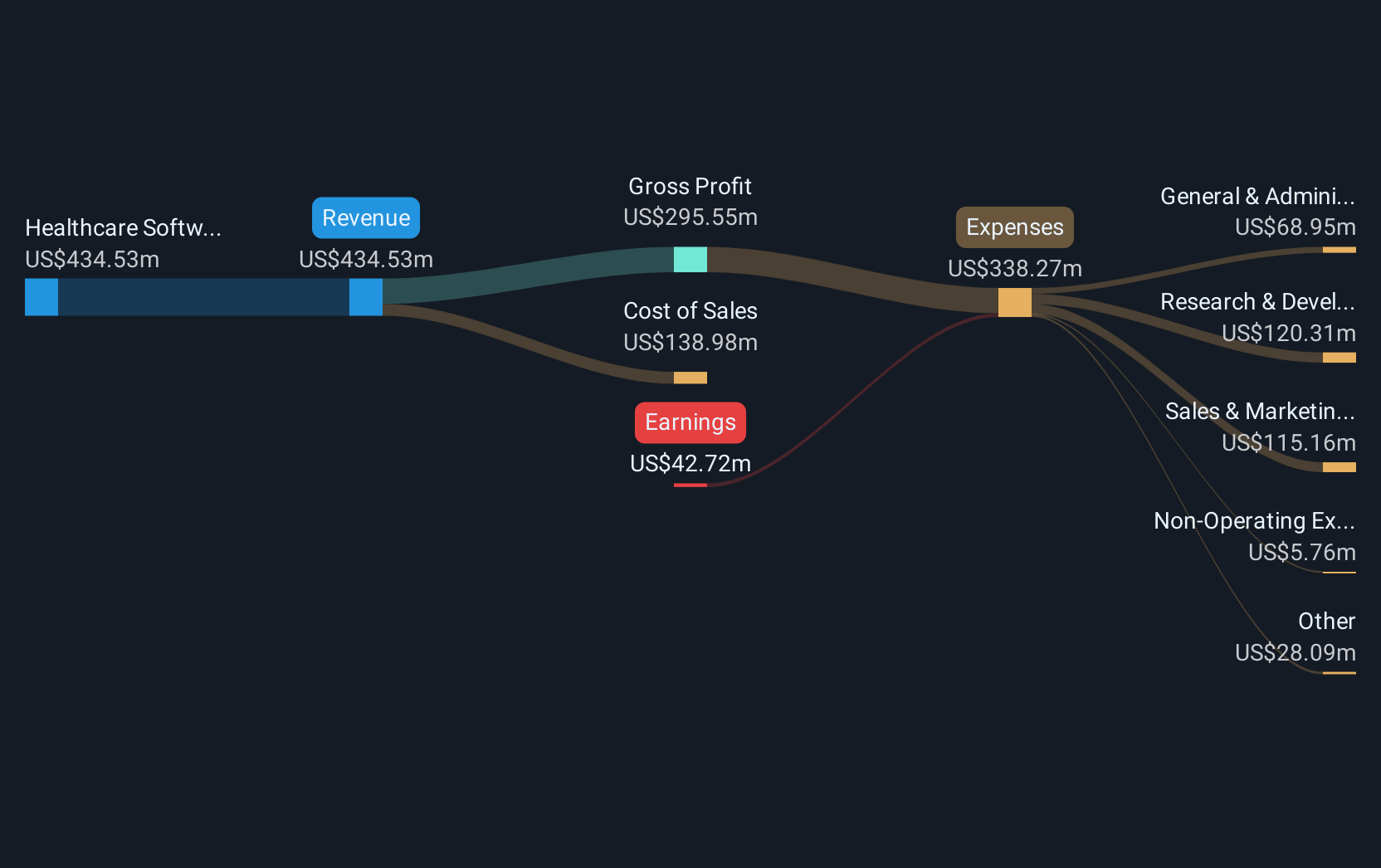

Operations: The company generates revenue primarily from its healthcare software segment, which reported $434.53 million.

Phreesia, a player in the healthcare technology sector, is navigating a transformative phase with expectations set for significant revenue and earnings growth. The company has maintained its revenue outlook for fiscal 2026 between $472 million to $482 million, reflecting confidence in its operational strategy and market position. Notably, Phreesia's annual revenue growth rate at 10.5% surpasses the US market average of 9%, signaling robust business dynamics despite current unprofitability. Moreover, earnings are projected to surge by an impressive 71% annually. This financial trajectory is underpinned by strategic initiatives such as enhancing service offerings per Automated Health Service Center (AHSC), expected to reach approximately 4,500 units by fiscal 2026. These developments suggest Phreesia is not only expanding its footprint but also optimizing revenue per service unit in a scalable manner.

- Click here to discover the nuances of Phreesia with our detailed analytical health report.

Examine Phreesia's past performance report to understand how it has performed in the past.

Make It Happen

- Dive into all 222 of the US High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GDRX

GoodRx Holdings

Offers information and tools that enable consumers to compare prices and save on their prescription drug purchases in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives