- United States

- /

- Specialty Stores

- /

- NasdaqGS:SPWH

Allakos And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As the U.S. stock market experiences volatility amid tariff announcements, investors are increasingly cautious about their next moves. Penny stocks, often associated with smaller or less-established companies, remain a relevant area for those seeking potential growth opportunities despite their vintage label. By focusing on penny stocks with strong financial foundations and clear growth trajectories, investors can uncover valuable prospects in today's uncertain market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.74 | $393.17M | ✅ 3 ⚠️ 3 View Analysis > |

| Taitron Components (NasdaqCM:TAIT) | $2.36 | $14.87M | ✅ 1 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $3.07 | $1.77B | ✅ 3 ⚠️ 3 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $0.761 | $13.77M | ✅ 4 ⚠️ 4 View Analysis > |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $2.81 | $8.79M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.87 | $64.25M | ✅ 2 ⚠️ 3 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $3.46 | $444.84M | ✅ 5 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.44 | $74.25M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.79 | $5.92M | ✅ 2 ⚠️ 3 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.7602 | $68.35M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 747 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Allakos (NasdaqGS:ALLK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Allakos Inc. is a clinical-stage biotechnology company focused on developing therapeutics targeting immunomodulatory receptors on immune effector cells for allergy, inflammatory, and proliferative diseases in the United States, with a market cap of $19.39 million.

Operations: Allakos Inc. does not currently report any revenue segments as it is a clinical-stage biotechnology company focused on developing therapeutics in the United States.

Market Cap: $19.39M

Allakos Inc., a pre-revenue clinical-stage biotech company, is set to be acquired by Concentra Biosciences for US$31 million. Despite its seasoned management and board, the company faces challenges with high volatility and a limited cash runway of less than a year. The recent Nasdaq delisting notice adds pressure as it struggles to maintain compliance with listing requirements. Allakos reported a net loss of US$115.82 million for 2024 but showed improvement from the previous year’s losses. The acquisition offers potential stability amid ongoing financial difficulties and strategic restructuring plans, including significant workforce reductions.

- Click here to discover the nuances of Allakos with our detailed analytical financial health report.

- Assess Allakos' future earnings estimates with our detailed growth reports.

GoodRx Holdings (NasdaqGS:GDRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GoodRx Holdings, Inc. operates a platform that provides consumers in the United States with tools to compare prices and save on prescription drug purchases, with a market cap of approximately $1.70 billion.

Operations: The company's revenue is primarily derived from its Healthcare Software segment, which generated $792.32 million.

Market Cap: $1.7B

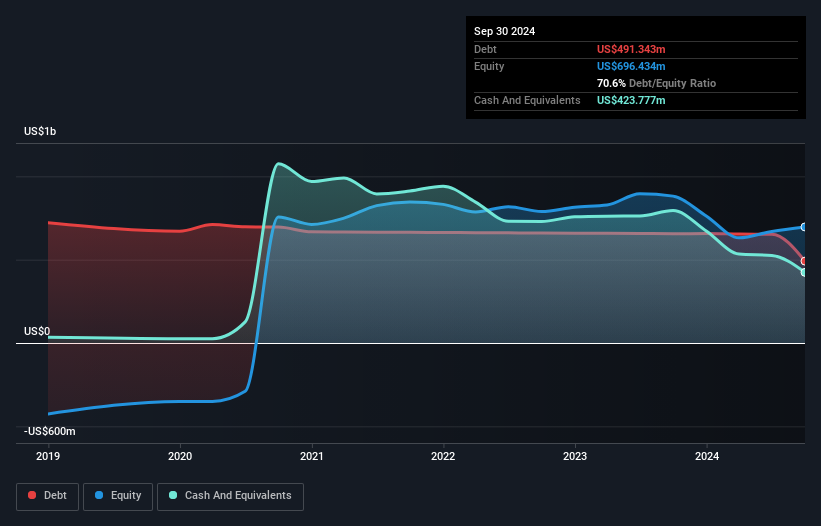

GoodRx Holdings, with a market cap of US$1.70 billion, showcases potential in the penny stock domain through its consistent revenue growth and recent profitability. The company reported US$792.32 million in revenue for 2024 and a net income of US$16.39 million, marking a turnaround from previous losses. Recent executive appointments aim to enhance strategic direction and operational efficiency, particularly within its Rx Marketplace segment. Despite positive cash flow coverage of debt and satisfactory short-term asset management, challenges remain with low return on equity and interest coverage by EBIT slightly below optimal levels at 2.9x.

- Navigate through the intricacies of GoodRx Holdings with our comprehensive balance sheet health report here.

- Learn about GoodRx Holdings' future growth trajectory here.

Sportsman's Warehouse Holdings (NasdaqGS:SPWH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sportsman's Warehouse Holdings, Inc. operates as an outdoor sporting goods retailer in the United States with a market cap of $36.77 million.

Operations: Sportsman's Warehouse Holdings does not report specific revenue segments.

Market Cap: $36.77M

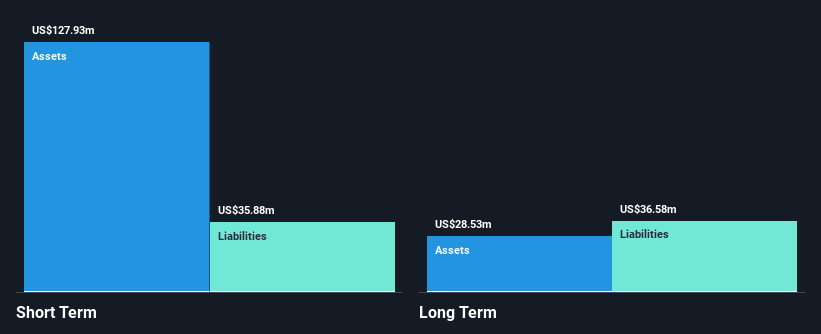

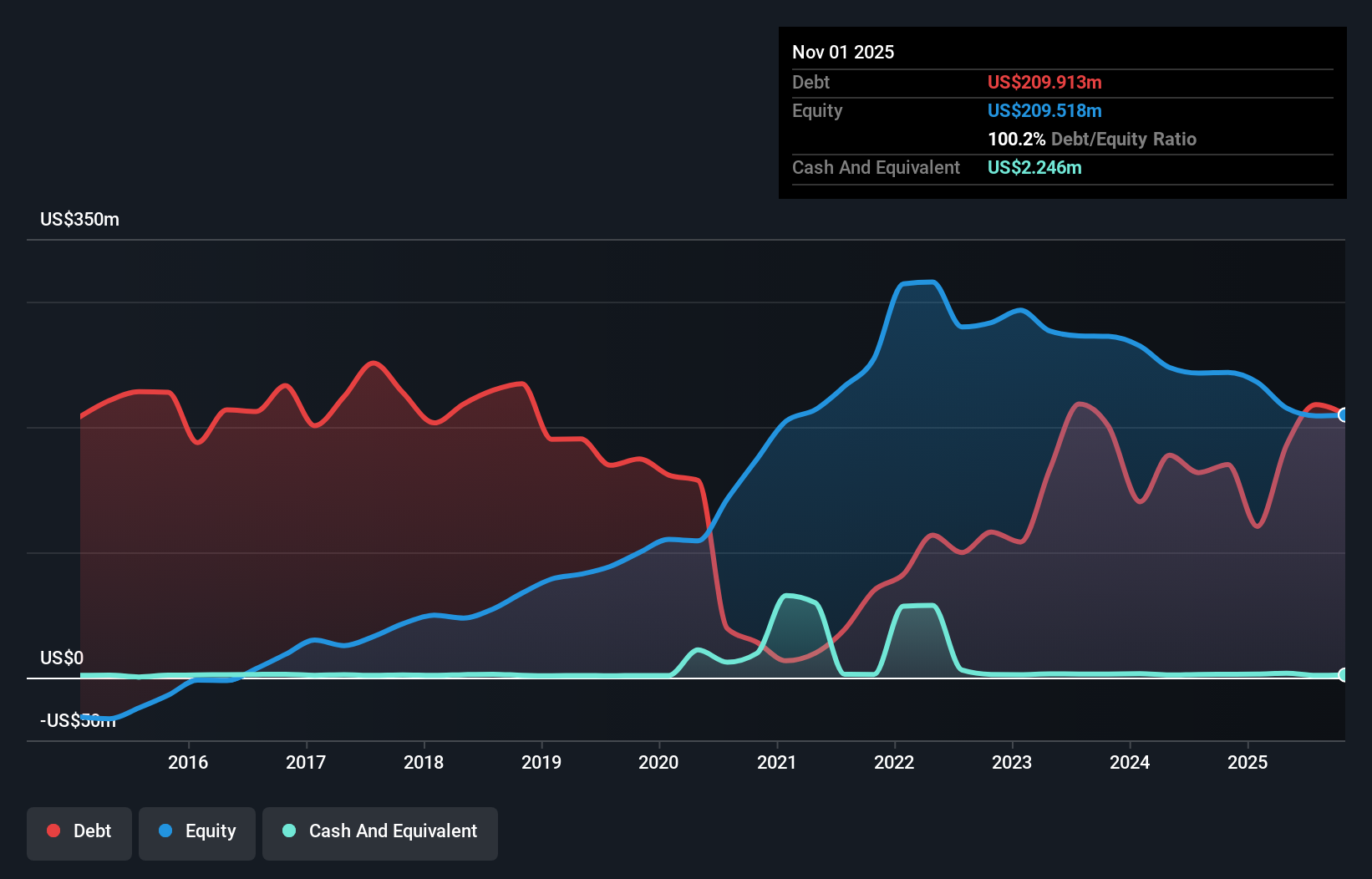

Sportsman's Warehouse Holdings, with a market cap of US$36.77 million, faces challenges typical of penny stocks, including high volatility and recent financial losses. The company reported a net loss of US$33.06 million for the full year 2025 despite generating sales of US$1.20 billion. While short-term assets exceed liabilities, the company's debt level remains high with a net debt to equity ratio at 40.7%. Recent strategic moves include expanding its retail footprint and partnering with Byrna Technologies and Silencer Central to enhance product offerings and customer experience, which may support future growth amidst current financial struggles.

- Get an in-depth perspective on Sportsman's Warehouse Holdings' performance by reading our balance sheet health report here.

- Examine Sportsman's Warehouse Holdings' earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Click through to start exploring the rest of the 744 US Penny Stocks now.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SPWH

Sportsman's Warehouse Holdings

Operates as an outdoor sporting goods retailer in the United States.

Very undervalued with adequate balance sheet.

Market Insights

Community Narratives