- United States

- /

- Medical Equipment

- /

- NasdaqGM:EDAP

Despite currently being unprofitable, EDAP TMS (NASDAQ:EDAP) has delivered a 52% return to shareholders over 5 years

It's been a soft week for EDAP TMS S.A. (NASDAQ:EDAP) shares, which are down 10%. But at least the stock is up over the last five years. In that time, it is up 52%, which isn't bad, but is below the market return of 82%. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 31% decline over the last twelve months.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

See our latest analysis for EDAP TMS

Given that EDAP TMS didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

For the last half decade, EDAP TMS can boast revenue growth at a rate of 8.0% per year. That's a fairly respectable growth rate. The annual gain of 9% over five years is better than nothing, but falls short of the market. Arguably, that means, the market (previously) expected stronger growth from the company.

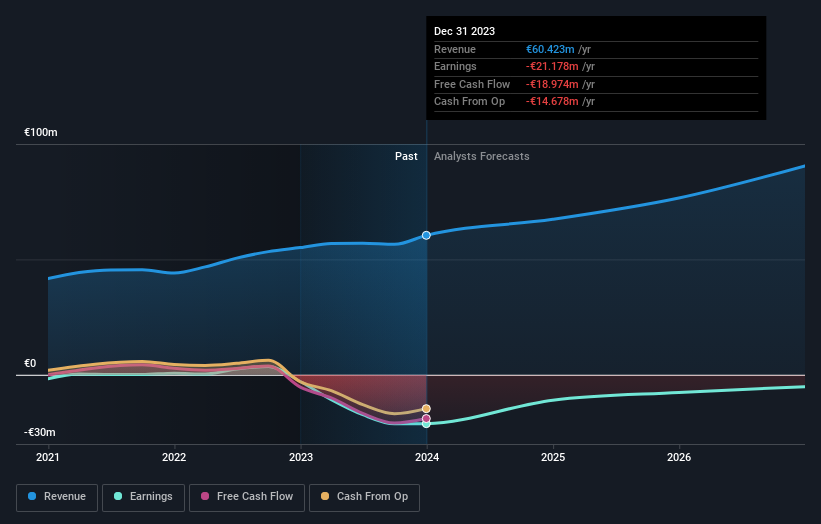

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on EDAP TMS' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

EDAP TMS shareholders are down 31% for the year, but the market itself is up 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 9%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for EDAP TMS that you should be aware of.

Of course EDAP TMS may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if EDAP TMS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:EDAP

EDAP TMS

Develops, produces, markets, distributes, and maintains a portfolio of minimally invasive medical devices for the treatment of urological diseases in Asia, France, the United States, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives