- United States

- /

- Medical Equipment

- /

- NasdaqGS:DXCM

Should You Reconsider DexCom After Shares Fall 14% in April 2025?

Reviewed by Bailey Pemberton

Trying to decide whether DexCom belongs in your portfolio right now? You are definitely not alone. The company is a household name in continuous glucose monitoring, but the ride for DexCom’s stock has been anything but steady. Over the last year, DexCom shares have trended down by 5.9%. If you zoom out to 3 or even 5 years, the declines are steeper, dropping 33.1% and 35.7% respectively. Even just this past month, the stock is down 14.3%. Whether that signals a hidden opportunity or greater risk is the question everyone’s asking.

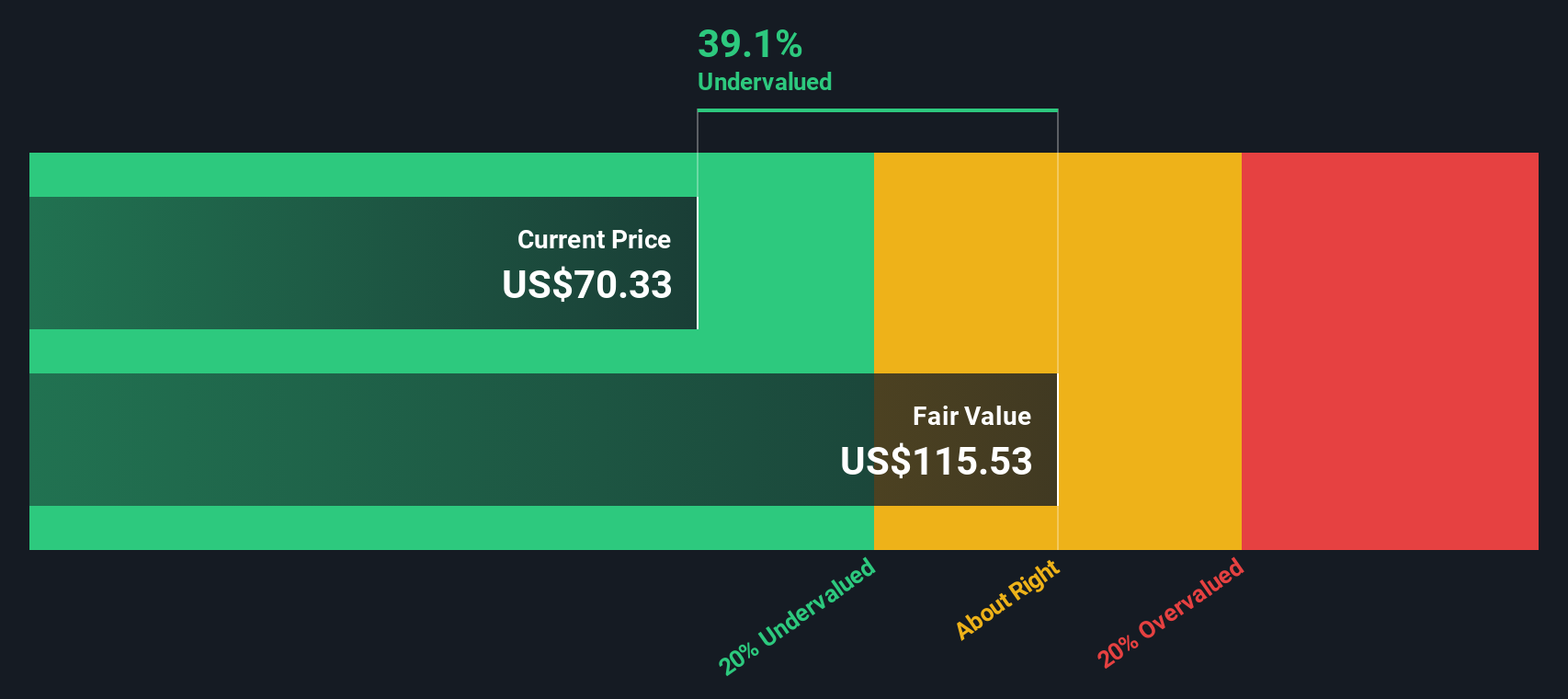

Some of these moves are part of a larger story. Changing healthcare market dynamics and evolving competition in diabetes tech have kept investors guessing. At the same time, periods of volatility often spark renewed debate about what DexCom is really worth. For those hunting value, DexCom’s current valuation score is 4 out of 6, meaning it appears undervalued by a variety of methods but not all. That is already piquing interest among bargain-seekers.

So, what do the numbers and valuation models really say? Next, we will break down DexCom’s standing across different classic approaches. Stay tuned, as later in the article we will explore an even more insightful way to judge whether the stock is truly trading for less than it is worth.

Why DexCom is lagging behind its peers

Approach 1: DexCom Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what DexCom could be worth today by projecting all of its future free cash flows and then discounting them back to present value. In essence, it calculates the intrinsic value of the stock based on the money the business is expected to generate over time.

For DexCom, the current Free Cash Flow (FCF) stands at $631 million. Analyst estimates extend over the next five years, with forecasts indicating robust growth. For example, FCF is projected to reach $1.26 billion by 2027. Beyond that, Simply Wall St extrapolates further. By 2029, the forecasted FCF rises to $1.90 billion.

Based on the 2 Stage Free Cash Flow to Equity model, the resulting estimated intrinsic value per share comes out to $117.33. This implies that DexCom is currently trading at a 44.5% discount to its fair value, making the stock look significantly undervalued using this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DexCom is undervalued by 44.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: DexCom Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is often a go-to valuation tool for profitable companies like DexCom because it directly reflects what investors are willing to pay for each dollar of current earnings. It is especially useful for mature businesses with a track record of steady profits, offering a snapshot of how the market values the company's actual earning power.

However, not all PE ratios are created equal. A higher PE can be justified if investors expect faster future growth, stronger margins, or lower risk; a lower PE might point to slower growth or higher uncertainty. So, it is important to set context by comparing DexCom's PE to relevant benchmarks.

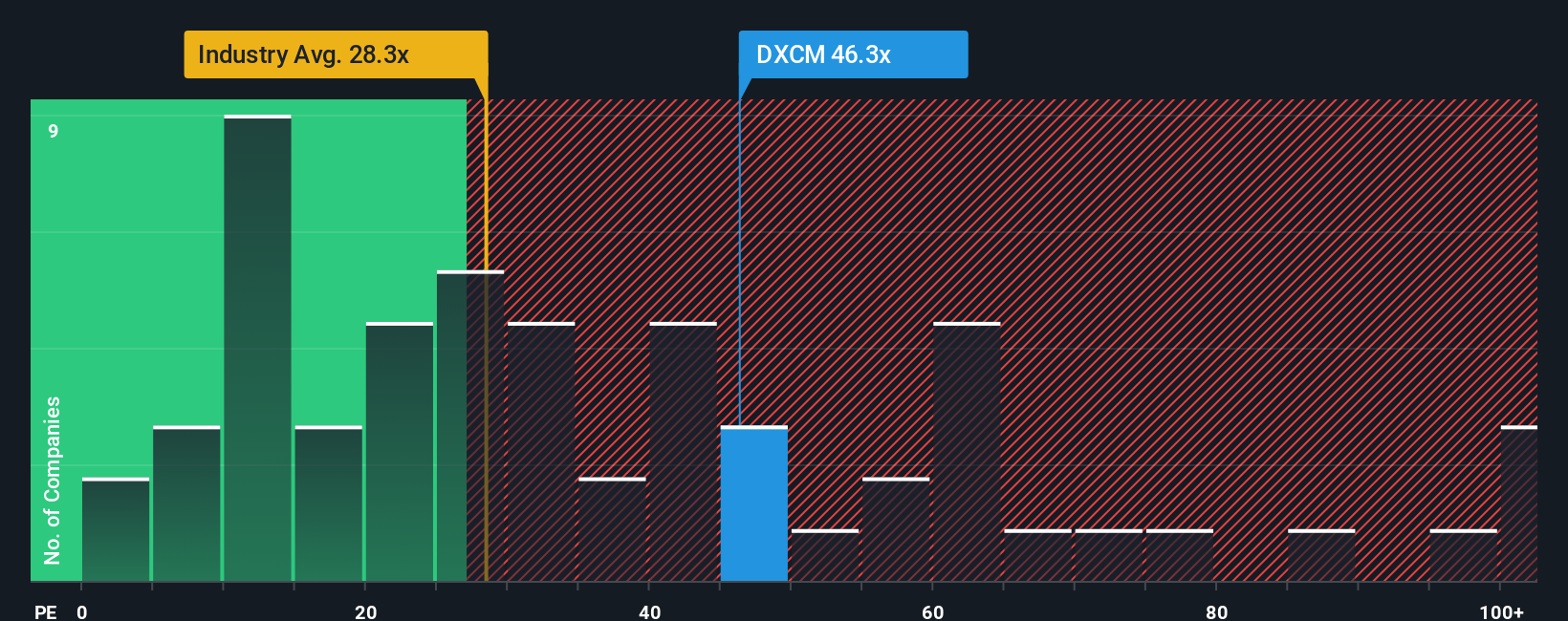

DexCom currently trades at a PE of 44.7x, which is nearly in line with the peer average of 45.2x, but well above the broader medical equipment industry average of 29.5x. This suggests that investors are pricing in above-average growth or quality compared to the sector overall.

To sharpen this analysis, Simply Wall St uses its proprietary "Fair Ratio." This Fair Ratio is calculated based on DexCom’s earnings growth, profit margins, risk profile, industry, and market cap, and comes out to 37.9x. Unlike plain industry or peer comparisons, the Fair Ratio aims to reflect what a business like DexCom truly deserves based on its unique fundamentals. That makes it a more tailored and meaningful benchmark for valuation.

Because DexCom's actual PE (44.7x) is notably above its Fair Ratio (37.9x), the shares look slightly expensive by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DexCom Narrative

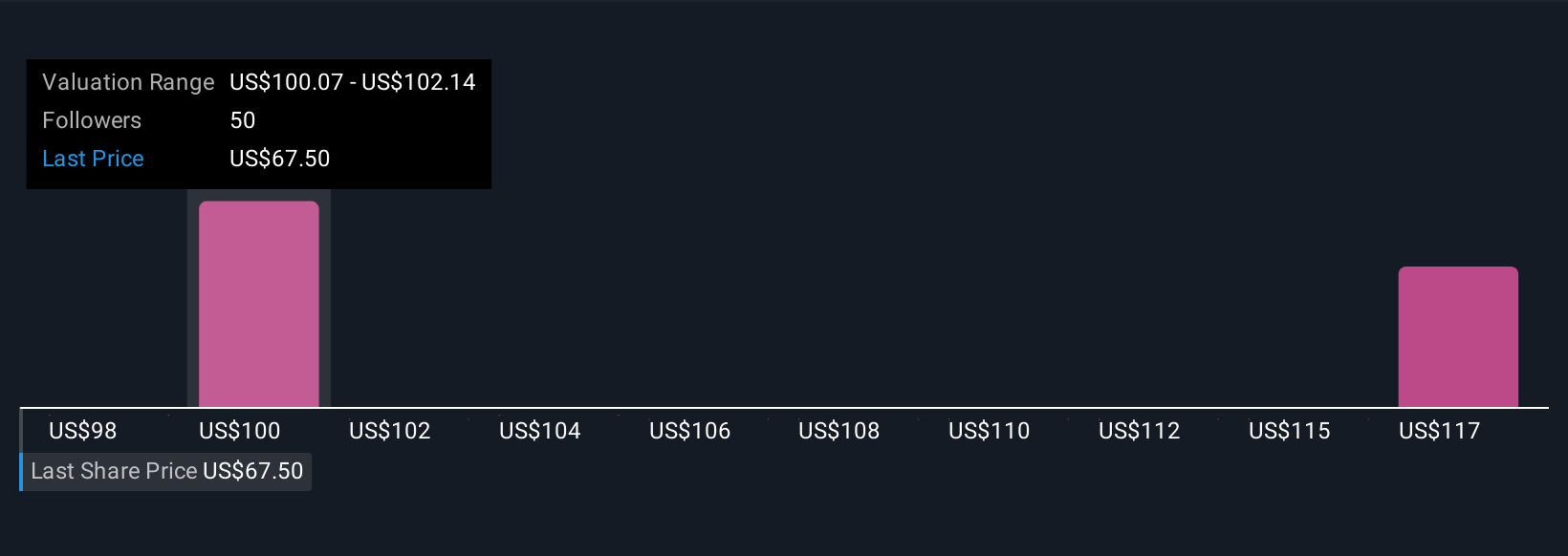

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story you believe about a company’s future, backed up by your own assumptions about revenue, margins, growth, and risks. This story leads to the resulting fair value you calculate. Narratives connect what is happening in DexCom’s world to a financial forecast, making it easy to see and understand your investment thesis and how it translates to a fair value versus today’s price.

Narratives are available in the Community page on Simply Wall St’s platform, used by millions of investors. They allow you to quickly test what you think is likely to happen next for a company and to compare whether the current share price is above or below your fair value. As news, earnings, or new information is released, Narratives automatically update so your analysis always stays relevant.

For example, some investors see global expansion and insurance reimbursement unlocking new growth, supporting a fair value as high as $115 per share. Others focus on risks like leadership transitions or market competition, which could result in fair values as low as $83. Narratives let you easily see and compare all these perspectives, empowering smarter, more dynamic decisions.

Do you think there's more to the story for DexCom? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DXCM

DexCom

A medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives