- United States

- /

- Medical Equipment

- /

- NasdaqGS:DXCM

DexCom (DXCM): Valuation Insights Following Trade Tensions and Supply Chain Concerns

Reviewed by Kshitija Bhandaru

DexCom (DXCM) shares slipped after renewed tensions between the US and China brought fresh worries about supply chain stability. President Trump’s critical remarks and China’s export controls on rare earth minerals have increased industry-wide concerns.

See our latest analysis for DexCom.

DexCom’s share price has been under pressure recently, dropping 4.4% in a single day and down over 14% in the past month as investors factor in supply chain headwinds and trade tension risks. While the total shareholder return for the past year is just under -6%, longer-term investors are still sitting on losses, with five-year total returns at -36%. This reflects fading momentum even though the company has experienced steady revenue and profit growth.

If recent volatility has you thinking more broadly about healthcare stocks, it might be the perfect moment to discover See the full list for free.

With DexCom now trading at a significant discount to analyst price targets and posting strong underlying growth, investors may wonder if this is a genuine bargain or if markets are correctly factoring in future headwinds.

Most Popular Narrative: 35.2% Undervalued

DexCom closed at $65.12, while the narrative’s fair value estimate lands substantially higher. This sets the stage for a potential recovery if its optimistic projections hold true. The sizeable gap frames the debate around DexCom’s longer-term prospects and how its developing business model could impact valuation.

The recent expansion of insurance reimbursement for type 2 non-insulin diabetes patients, now covering nearly 6 million lives across the three largest U.S. PBMs, opens a large, previously untapped segment of DexCom's addressable market, driving new patient growth and supporting robust multi-year revenue expansion. Growing global recognition of CGM efficacy, with recent clinical trial evidence and expanded coverage in international markets (for example, France, Japan, and Ontario, Canada), positions DexCom to penetrate underpenetrated regions and diversify revenue streams, creating sustainable top-line growth.

Want the full numbers behind this bullish outlook? The fair value relies on ambitious growth in new patient segments, global market penetration, and a revenue leap that could reset expectations. Get the exclusive projections that drive the optimism, but only in the complete narrative.

Result: Fair Value of $100.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still material risks, such as tighter reimbursement policies or intensified competition. These factors could challenge DexCom’s sustained growth trajectory and investor optimism.

Find out about the key risks to this DexCom narrative.

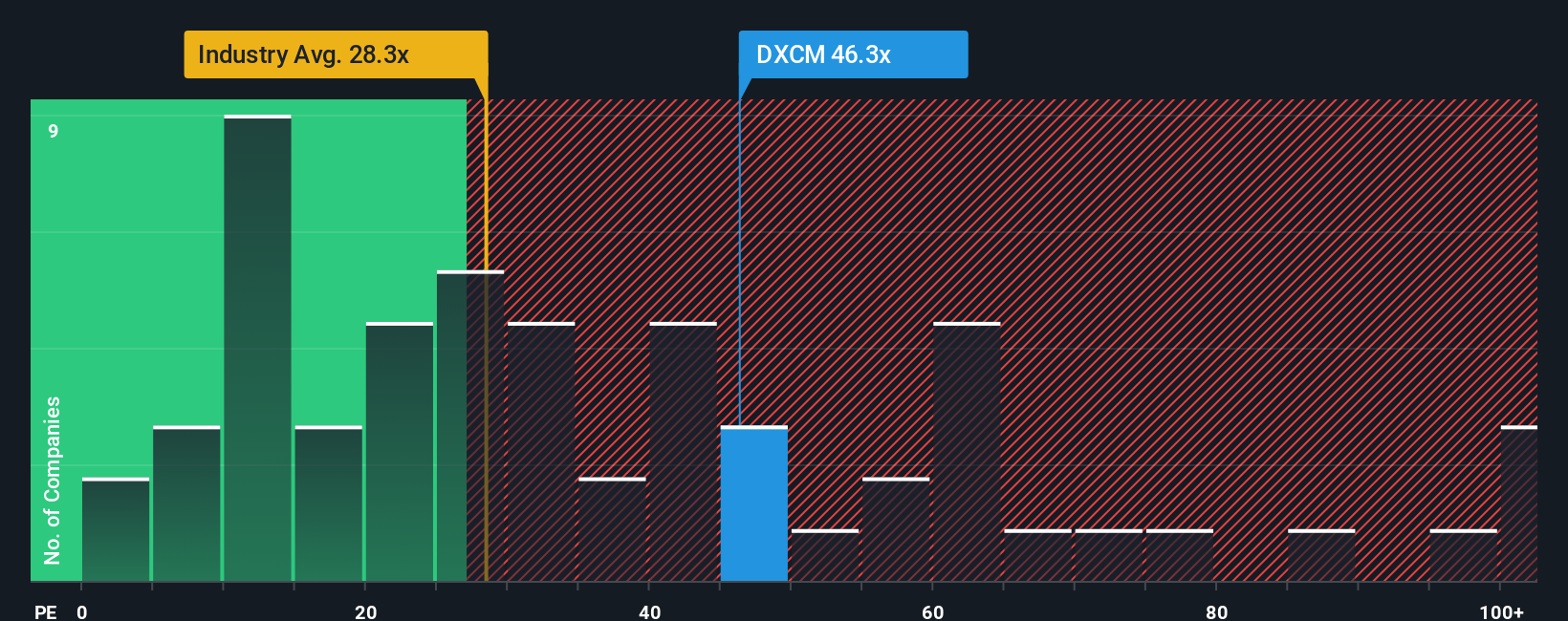

Another View: Market Multiples Tell a Different Story

Looking at valuation through traditional price-to-earnings ratios, DexCom appears expensive. Its current ratio of 44.7x is markedly higher than both the US Medical Equipment industry average of 29.5x and its peer average of 43.1x. The fair ratio sits at 37.6x, suggesting the market could move lower. Does this premium reflect a real growth opportunity, or could it mean more risk ahead if expectations falter?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DexCom Narrative

If you’d rather form your own perspective or challenge the consensus, you can dive into the numbers and create your own in just minutes, Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding DexCom.

Looking for More Smart Investment Ideas?

Don’t miss your chance to level up your portfolio. Fresh opportunities are waiting. These screens could reveal gems you’ll wish you found sooner.

- Unlock potential high-yield opportunities by checking out these 19 dividend stocks with yields > 3%. This is ideal for investors seeking income and stability in today’s ever-changing market.

- Target the future of medicine and technology when you browse these 33 healthcare AI stocks, featuring top companies transforming healthcare with artificial intelligence.

- Catch the latest wave in digital assets by exploring these 79 cryptocurrency and blockchain stocks. Discover innovative companies riding the cryptocurrency and blockchain revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DXCM

DexCom

A medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives