- United States

- /

- Medical Equipment

- /

- NasdaqGS:DXCM

DexCom (DXCM): Evaluating Valuation After Latest Workforce Restructuring and Manufacturing Shift

Reviewed by Simply Wall St

DexCom (DXCM) is making headlines again, this time with an announcement to cut about 305 jobs, primarily in its San Diego base, as it advances a plan to move more manufacturing to Arizona. This move comes just a year after a previous round of layoffs. The company describes this decision as a strategic restructuring designed to strengthen its position in the health technology sector. Management reports that these changes will free up resources for reinvestment, aiming for future growth rather than just short-term savings.

The market’s response has been measured. Over the last year, DexCom shares are up 14%, but the past three months have seen a dip of 6%. The stock is essentially flat for the year to date, suggesting investors are still weighing the risks and growth prospects tied to the company’s ongoing transition. With annual revenue growth at 13% and net income climbing 23%, there is momentum at the business level even as the share price has lost ground since its highs. Still, some may wonder whether this round of layoffs and the shift in operations signals a strengthening or a warning flag.

After these moves and the recent share price drift, is DexCom now a bargain with upside, or is the market already factoring future gains into today’s price?

Most Popular Narrative: 23.6% Undervalued

According to the most widely followed analyst consensus, DexCom is currently trading well below its estimated fair value, pointing to meaningful potential upside if growth plays out as expected.

The recent expansion of insurance reimbursement for type 2 non-insulin diabetes patients, now covering nearly 6 million lives across the three largest U.S. PBMs, opens a large, previously untapped segment of DexCom's addressable market. This drives new patient growth and supports robust multi-year revenue expansion. Growing global recognition of CGM efficacy, with recent clinical trial evidence and expanded coverage in international markets (such as France, Japan, and Ontario, Canada), positions DexCom to reach underpenetrated regions and diversify revenue streams. These factors create sustainable top-line growth.

Curious what’s driving this bullish fair value? The foundation is a powerful story of surging growth, expanding addressable markets, and ambitious profitability targets. Which specific expectations must DexCom hit to justify this premium? Are analysts too optimistic, or is the next wave of growth just ramping up? Explore the full narrative to discover the bold forecasts that power this valuation call.

Result: Fair Value of $102.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, competitive pricing pressure and delays in crucial product innovation could challenge DexCom’s growth and potentially limit the expected upside.

Find out about the key risks to this DexCom narrative.Another View: What Do Valuation Ratios Say?

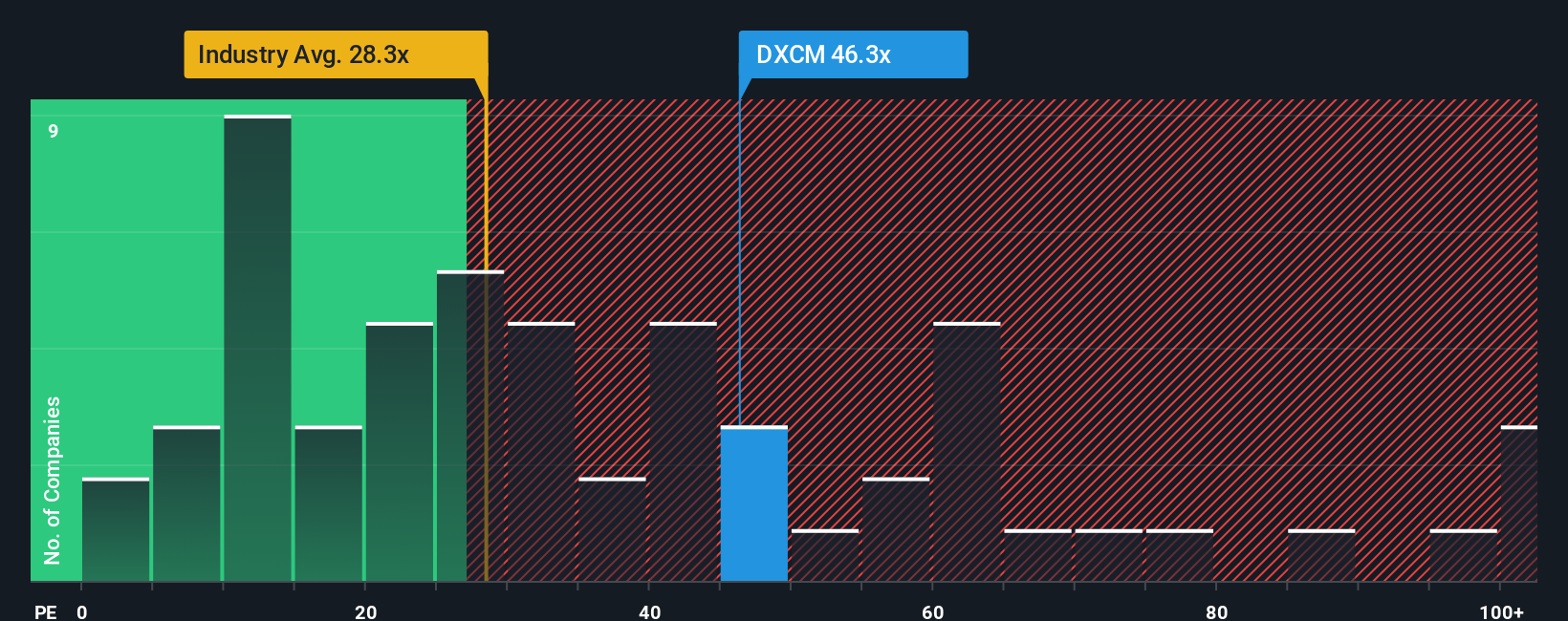

Looking from a different angle, DexCom's valuation appears less attractive when using a common earnings-based ratio compared to the industry benchmark. Is the growth story strong enough to justify this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding DexCom to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own DexCom Narrative

If you see things differently or want to dig into the numbers yourself, it takes just a few minutes to craft your own narrative. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding DexCom.

Ready for More Investment Ideas?

Don’t let opportunity pass you by. Turbocharge your search for standout stocks using the Simply Wall Street Screener. Spot trends and strategies others are missing and stay one step ahead in your investment journey.

- Uncover tomorrow’s tech leaders and power your portfolio growth by starting with AI penny stocks making waves in artificial intelligence.

- Grab potential high-flyers with strong balance sheets using our gateway to penny stocks with strong financials that punch above their weight financially.

- Hunt for value gems trading below their cash flow potential through an inside look at undervalued stocks based on cash flows, perfect for bargain seekers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:DXCM

DexCom

A medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)