- United States

- /

- Medical Equipment

- /

- NasdaqGS:DXCM

3 Top Value Stocks Estimated To Be Up To 46.8% Below Intrinsic Value

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has risen by 5.7% over the past year with earnings forecasted to grow by 13% annually. In this environment, identifying undervalued stocks that are trading below their intrinsic value can be a strategic approach for investors seeking opportunities in a stable yet growing market.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | $39.76 | $78.07 | 49.1% |

| First National (NasdaqCM:FXNC) | $18.60 | $36.91 | 49.6% |

| First Bancorp (NasdaqGS:FBNC) | $37.12 | $72.67 | 48.9% |

| Ready Capital (NYSE:RC) | $4.39 | $8.65 | 49.2% |

| Datadog (NasdaqGS:DDOG) | $91.18 | $178.41 | 48.9% |

| Curbline Properties (NYSE:CURB) | $23.18 | $46.14 | 49.8% |

| Viking Holdings (NYSE:VIK) | $39.80 | $77.55 | 48.7% |

| Sotera Health (NasdaqGS:SHC) | $10.48 | $20.96 | 50% |

| MYT Netherlands Parent B.V (NYSE:MYTE) | $7.70 | $15.30 | 49.7% |

| CNX Resources (NYSE:CNX) | $30.82 | $60.72 | 49.2% |

Here we highlight a subset of our preferred stocks from the screener.

DexCom (NasdaqGS:DXCM)

Overview: DexCom, Inc. is a medical device company specializing in the design, development, and commercialization of continuous glucose monitoring systems globally, with a market cap of approximately $26.89 billion.

Operations: DexCom generates its revenue primarily from the sale of patient monitoring equipment, totaling $4.03 billion.

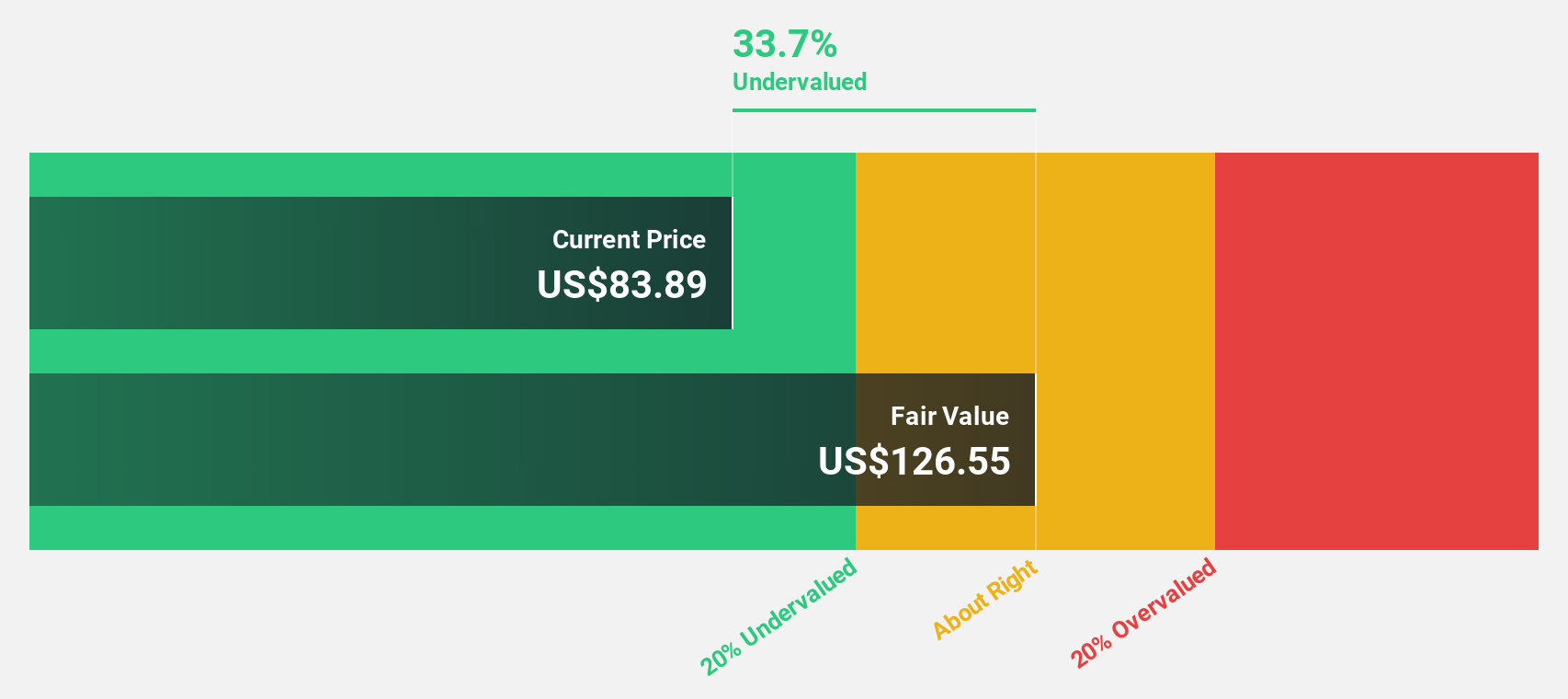

Estimated Discount To Fair Value: 37.5%

DexCom is trading at US$68.57, significantly below its estimated fair value of US$109.74, indicating potential undervaluation based on discounted cash flow analysis. Despite slower revenue growth forecasts of 12.6% annually compared to some peers, it outpaces the broader US market's 8.2%. Recent FDA clearance for its G7 system enhances product offerings but a recent FDA warning letter highlights operational challenges that may impact investor sentiment despite no immediate production or distribution restrictions.

- In light of our recent growth report, it seems possible that DexCom's financial performance will exceed current levels.

- Dive into the specifics of DexCom here with our thorough financial health report.

Atlassian (NasdaqGS:TEAM)

Overview: Atlassian Corporation, with a market cap of $53.79 billion, designs, develops, licenses, and maintains various software products worldwide through its subsidiaries.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated $4.79 billion.

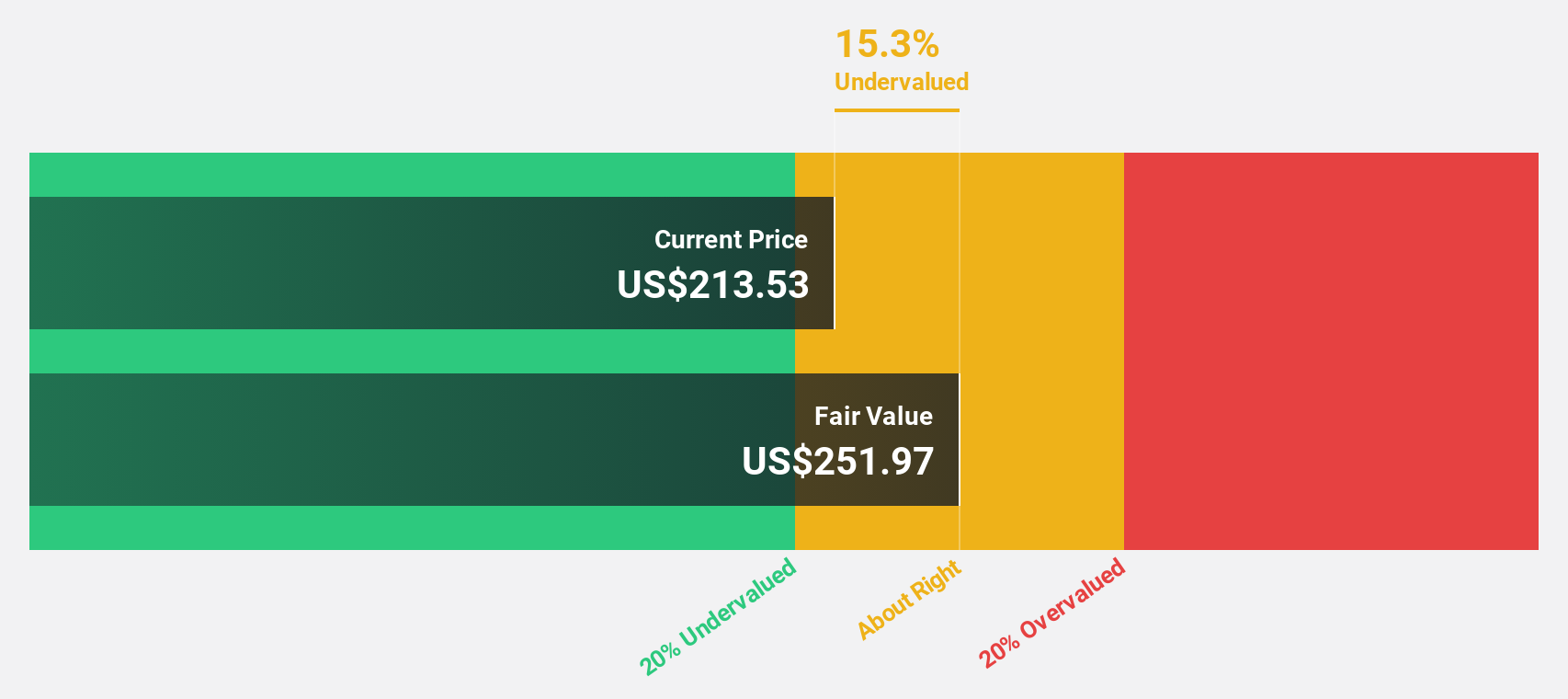

Estimated Discount To Fair Value: 46.8%

Atlassian, trading at US$202.75, is significantly undervalued compared to its estimated fair value of US$381.06, presenting a potential opportunity based on discounted cash flow analysis. The company is expected to become profitable within three years with earnings growth forecasted at 48.88% annually. However, recent insider selling could raise concerns among investors despite the positive outlook and recent board changes with Karen Dykstra's appointment potentially strengthening financial oversight.

- Insights from our recent growth report point to a promising forecast for Atlassian's business outlook.

- Click here to discover the nuances of Atlassian with our detailed financial health report.

Targa Resources (NYSE:TRGP)

Overview: Targa Resources Corp., along with its subsidiary Targa Resources Partners LP, owns and operates a portfolio of domestic infrastructure assets in North America, with a market cap of approximately $37.57 billion.

Operations: The company's revenue segments include Gathering and Processing, which generated $6.81 billion, and Logistics and Transportation, which brought in $14.03 billion.

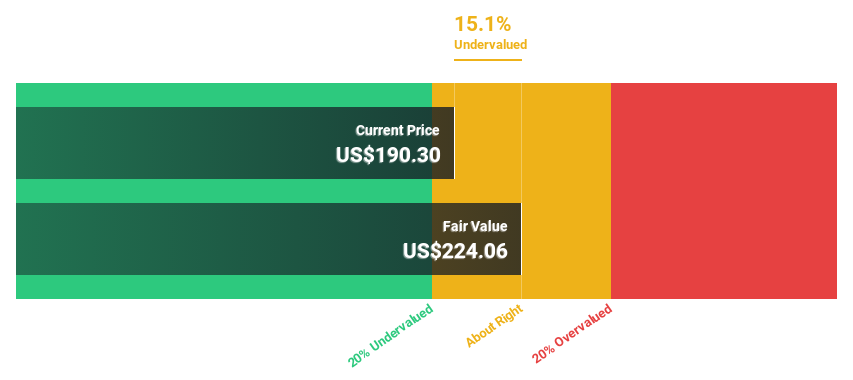

Estimated Discount To Fair Value: 32.6%

Targa Resources, trading at US$174.57, is undervalued by over 32% compared to its fair value of US$259.04 based on discounted cash flow analysis. Despite high debt levels and significant insider selling recently, earnings are projected to grow faster than the market at 16.5% annually. The company has expanded liquidity with a new US$3.5 billion revolving facility and is involved in the Traverse Pipeline project, enhancing future revenue potential through strategic partnerships.

- The analysis detailed in our Targa Resources growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Targa Resources stock in this financial health report.

Make It Happen

- Gain an insight into the universe of 172 Undervalued US Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DXCM

DexCom

A medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives