- United States

- /

- Healthtech

- /

- NasdaqCM:DRIO

A Piece Of The Puzzle Missing From DarioHealth Corp.'s (NASDAQ:DRIO) 27% Share Price Climb

Those holding DarioHealth Corp. (NASDAQ:DRIO) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 69% share price decline over the last year.

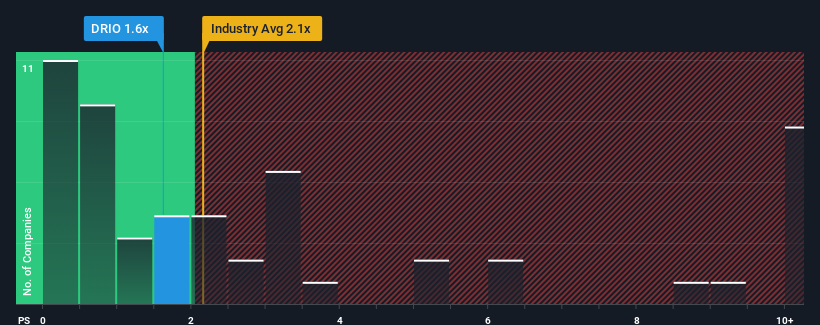

Although its price has surged higher, DarioHealth may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.6x, considering almost half of all companies in the Healthcare Services industry in the United States have P/S ratios greater than 2.1x and even P/S higher than 6x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for DarioHealth

How DarioHealth Has Been Performing

While the industry has experienced revenue growth lately, DarioHealth's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think DarioHealth's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For DarioHealth?

The only time you'd be truly comfortable seeing a P/S as low as DarioHealth's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 28%. Even so, admirably revenue has lifted 48% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 44% per annum as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 11% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that DarioHealth's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does DarioHealth's P/S Mean For Investors?

The latest share price surge wasn't enough to lift DarioHealth's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at DarioHealth's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with DarioHealth, and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:DRIO

DarioHealth

Operates as a digital health company in the United States, Canada, the European Union, Australia, and New Zealand.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives