- United States

- /

- Healthtech

- /

- NasdaqGS:DH

Spotlight On Definitive Healthcare And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

The U.S. stock market continues to break new ground, with the S&P 500 reaching record highs as investors anticipate major earnings reports and keep a close watch on Federal Reserve developments. In this context, penny stocks—often associated with smaller or newer companies—remain a relevant investment area despite their somewhat outdated label. When these stocks are backed by strong financials, they can offer significant growth opportunities at lower price points.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.14 | $469.33M | ✅ 5 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.77 | $658.23M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.37 | $257.21M | ✅ 4 ⚠️ 2 View Analysis > |

| WM Technology (MAPS) | $1.17 | $201.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.90 | $23.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $98.62M | ✅ 3 ⚠️ 2 View Analysis > |

| Table Trac (TBTC) | $4.85 | $22.5M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.9101 | $6.83M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.99 | $88.36M | ✅ 3 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $4.51 | $598.43M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 377 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Definitive Healthcare (DH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Definitive Healthcare Corp. offers a software as a service healthcare commercial intelligence platform both in the United States and internationally, with a market cap of $575.82 million.

Operations: The company generates revenue primarily from its Internet Information Providers segment, totaling $244.93 million.

Market Cap: $575.82M

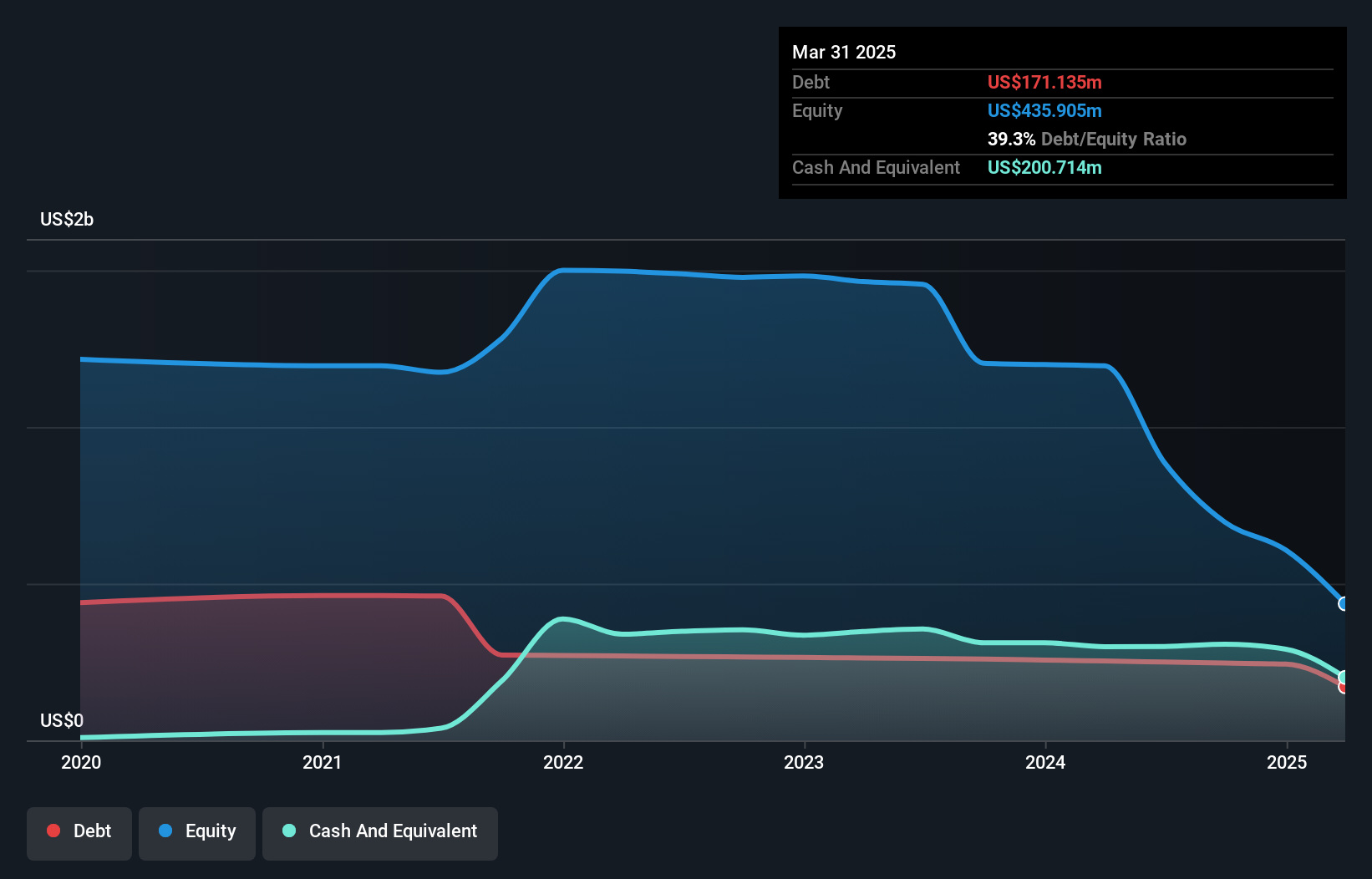

Definitive Healthcare Corp., with a market cap of US$575.82 million, operates in the healthcare commercial intelligence sector and reported second-quarter sales of US$60.75 million, down from last year. Despite being unprofitable, the company has improved its net loss significantly and raised its full-year revenue guidance to US$237–240 million. The board is experienced with an average tenure of 4.6 years; however, the management team is relatively new with a tenure of 0.6 years. The company's short-term assets exceed liabilities, providing a cash runway for over three years despite ongoing losses and negative return on equity.

- Click here to discover the nuances of Definitive Healthcare with our detailed analytical financial health report.

- Gain insights into Definitive Healthcare's future direction by reviewing our growth report.

Savara (SVRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Savara Inc. is a clinical-stage biopharmaceutical company specializing in rare respiratory diseases, with a market cap of $693.17 million.

Operations: Savara Inc. has not reported any revenue segments, as it is focused on developing treatments for rare respiratory diseases.

Market Cap: $693.17M

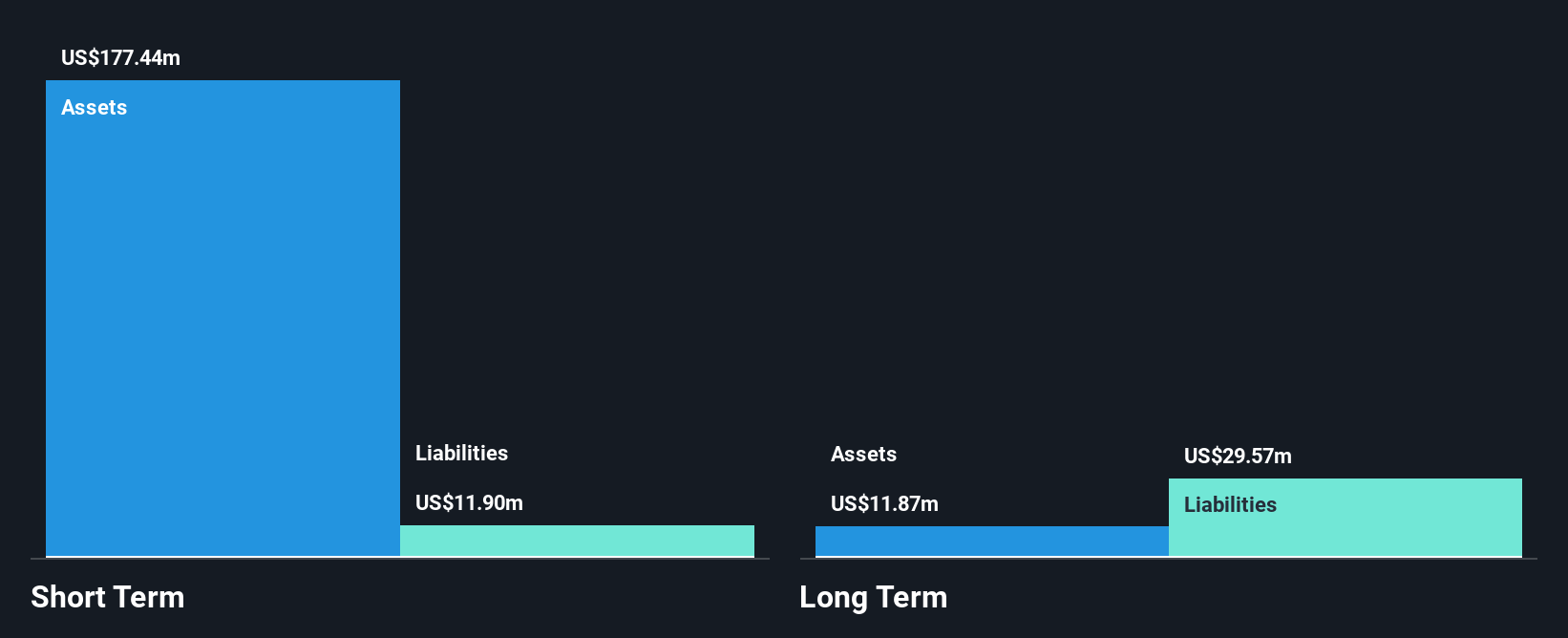

Savara Inc., a clinical-stage biopharmaceutical firm, is pre-revenue with a market cap of US$693.17 million, focusing on rare respiratory diseases. The company recently announced the acceptance of three abstracts for presentation at the European Respiratory Society Congress 2025. Despite being unprofitable and experiencing increased losses over the past five years, Savara maintains more cash than debt and has a cash runway exceeding one year. Its short-term assets significantly surpass both short- and long-term liabilities. However, it was recently dropped from several Russell indices, indicating potential challenges in market perception or valuation stability.

- Click to explore a detailed breakdown of our findings in Savara's financial health report.

- Gain insights into Savara's outlook and expected performance with our report on the company's earnings estimates.

Perfect (PERF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perfect Corp. is an artificial intelligence software as a service company offering AI and AR-powered solutions for the beauty, fashion, and skincare industries globally, with a market cap of $215.92 million.

Operations: The company generates revenue of $64.37 million from its Internet Software & Services segment.

Market Cap: $215.92M

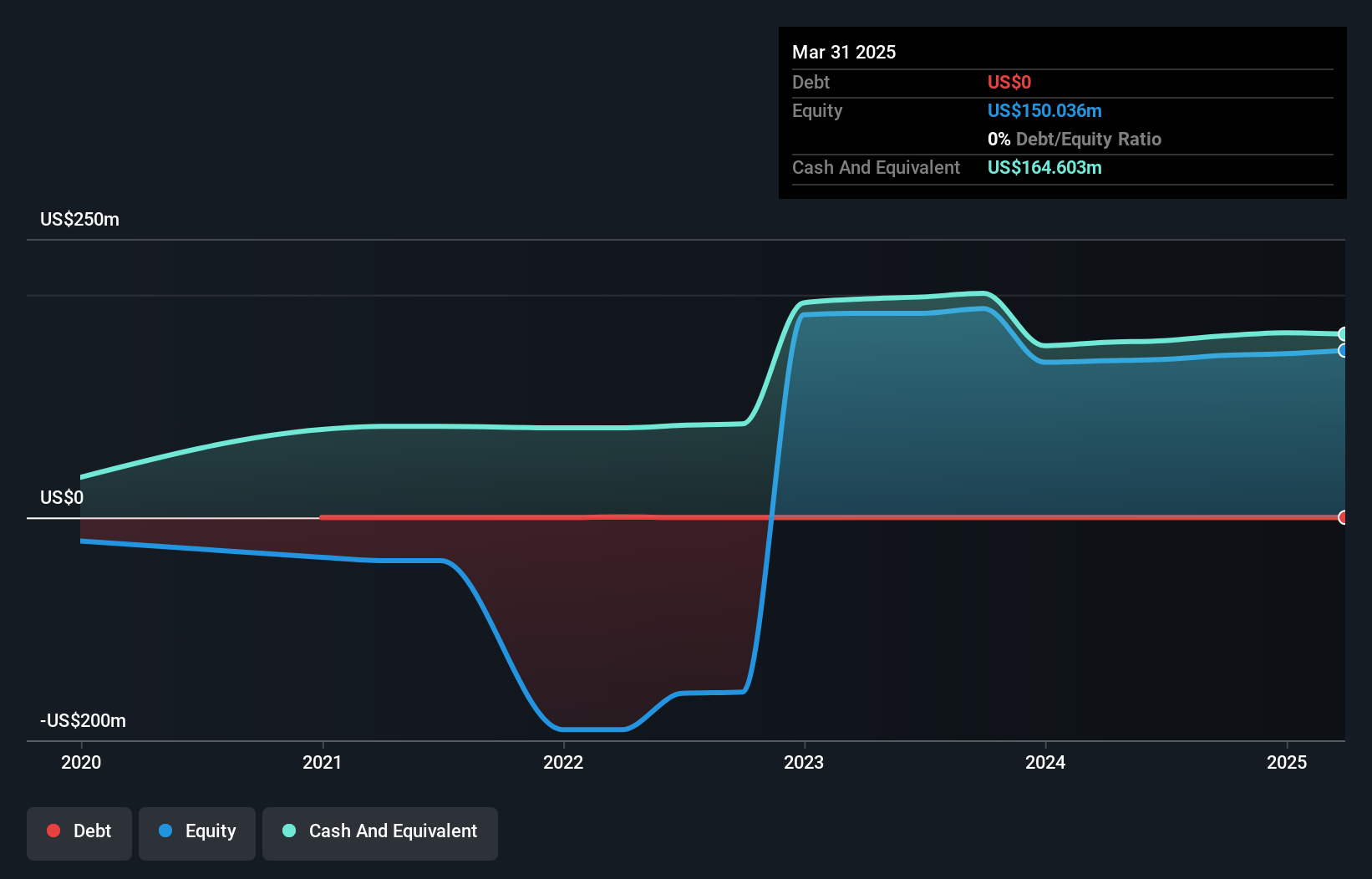

Perfect Corp., with a market cap of US$215.92 million, is leveraging AI and AR technologies to enhance consumer experiences in beauty and fashion, recently integrating NVIDIA technology for improved realism and speed. Despite negative earnings growth over the past year, it remains profitable with net income of US$2.5 million for the first half of 2025, though margins have declined slightly. The company is debt-free with strong asset coverage over liabilities and forecasts robust earnings growth at 32.26% annually. Trading below estimated fair value suggests potential upside, but recent volatility may concern some investors seeking stability in penny stocks.

- Get an in-depth perspective on Perfect's performance by reading our balance sheet health report here.

- Learn about Perfect's future growth trajectory here.

Make It Happen

- Unlock our comprehensive list of 377 US Penny Stocks by clicking here.

- Seeking Other Investments? Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DH

Definitive Healthcare

Provides software as a service (SaaS) healthcare commercial intelligence platform in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion