- United States

- /

- Medical Equipment

- /

- NasdaqGS:COO

Cooper Companies (NasdaqGS:COO) Stock Drops 15% Despite US$965M Q1 Sales Growth

Reviewed by Simply Wall St

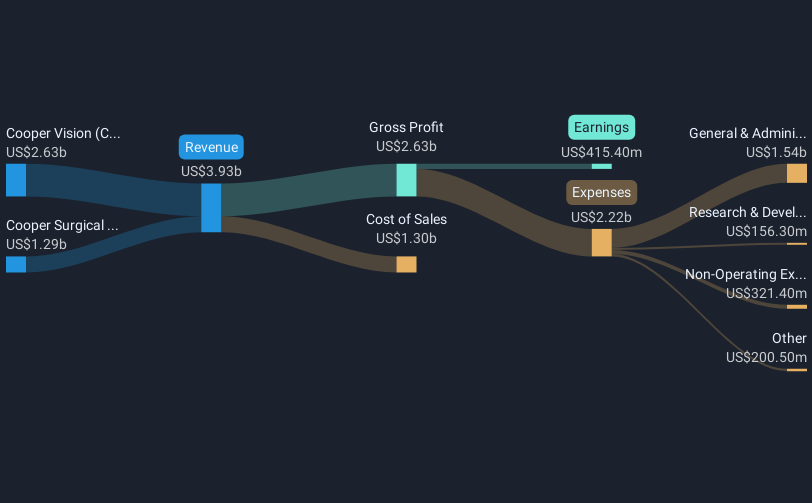

The Cooper Companies (NasdaqGS: COO) experienced a 14.56% decline in its share price last week following its recent earnings announcement. Notably, the company reported solid growth, with first-quarter sales increasing to $964.7 million and net income rising to $104.3 million. While positive from an operational standpoint, the updated earnings guidance did not seem to bolster investor confidence, possibly contributing to the share price fall. The broader market trends over the same week showed a 4.1% decline as the S&P 500 and Nasdaq posted their fourth consecutive week of losses amid economic concerns and tariff-related uncertainties, despite a tech sector rally led by companies like Nvidia. The negative investor sentiment that dominated equity markets likely exacerbated Cooper Companies’ stock decline despite its sound financial results, as the company was not immune to the wider market forces that influenced other equities.

The Cooper Companies (NasdaqGS: COO) achieved a total return of 13.89% over the past five years, reflecting a moderate gain when considering both share price appreciation and dividends. Despite this, COO underperformed compared to the broader US Market, which posted a higher return over the past year. A key event for the company was its growth in earnings, which accelerated significantly over the last year at 42.8%, surpassing industry growth of 22.8%. However, its longer-term average earnings declined annually, impacting investor sentiment. Furthermore, frequent executive and board changes, including retirements and resignations, may have contributed to market uncertainties.

The period also saw legal challenges, such as the lawsuit against CooperSurgical over defective embryo culture media. Despite these challenges, the company maintained consistent dividend payouts, supporting long-term shareholder return but potentially leading to a cautious stance among new investors. These factors combined highlight a complex but steady journey for Cooper Companies over the assessed period.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COO

Cooper Companies

Develops, manufactures, and markets contact lens wearers.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives