- United States

- /

- Medical Equipment

- /

- NasdaqCM:CLPT

Shareholders have faith in loss-making ClearPoint Neuro (NASDAQ:CLPT) as stock climbs 17% in past week, taking five-year gain to 280%

It hasn't been the best quarter for ClearPoint Neuro, Inc. (NASDAQ:CLPT) shareholders, since the share price has fallen 20% in that time. But that scarcely detracts from the really solid long term returns generated by the company over five years. In fact, the share price is 280% higher today. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Of course, that doesn't necessarily mean it's cheap now.

Since it's been a strong week for ClearPoint Neuro shareholders, let's have a look at trend of the longer term fundamentals.

We've discovered 2 warning signs about ClearPoint Neuro. View them for free.Given that ClearPoint Neuro didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years ClearPoint Neuro saw its revenue grow at 21% per year. That's well above most pre-profit companies. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 31% per year, compound, during the period. This suggests the market has well and truly recognized the progress the business has made. To our minds that makes ClearPoint Neuro worth investigating - it may have its best days ahead.

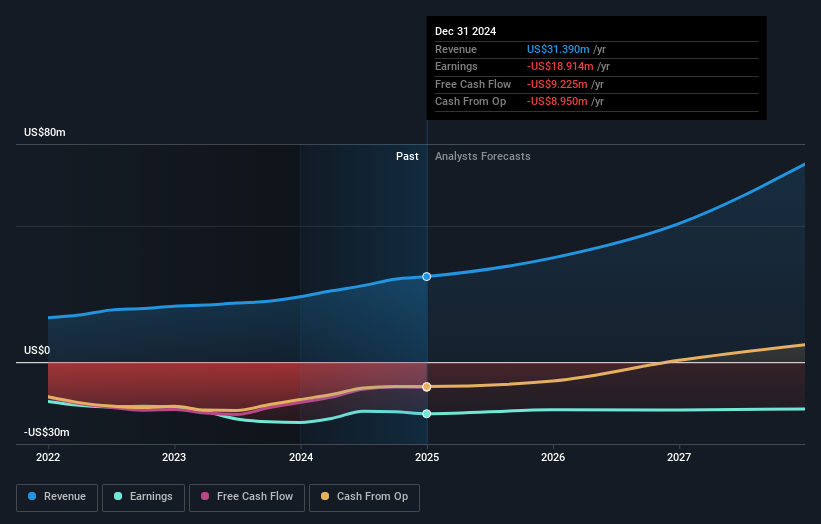

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on ClearPoint Neuro's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that ClearPoint Neuro has rewarded shareholders with a total shareholder return of 169% in the last twelve months. That gain is better than the annual TSR over five years, which is 31%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with ClearPoint Neuro , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CLPT

ClearPoint Neuro

Operates as a medical device company primarily in the United States.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives