- United States

- /

- Healthcare Services

- /

- NasdaqGS:CLOV

Clover Health Investments, Corp. (NASDAQ:CLOV) is Expected to Grow 14% in 2021, while also Expanding the Potential Service Terrain

Clover Health Investments, Corp. ( NASDAQ:CLOV ) is a volatile company, reaching a high of US$22.15 per share in June 2021 and then dropping to US$9.72 in the last trading session. This is not to say that it is a bad company, just that investors should be prepared for a possibly stressful ride going forward.

With that being said, it always helps to know the money making capacity of a company based on past fundamentals, as well as future estimates.

We will look at the last earnings update, released for Q1 on the 17th May 2021 and build from there.

The results don't look great, especially considering that statutory losses grew 30% to US$0.13 per share. Revenues of US$200m did beat expectations by 4.0%, but it looks like a bit of a cold comfort. Clover also released a guidance of around US$820m for 2021. The next earnings call is expected to be early August, and Clover will need to keep the interest of investors until then.

Interestingly, Clover had some good news surrounding it lately.

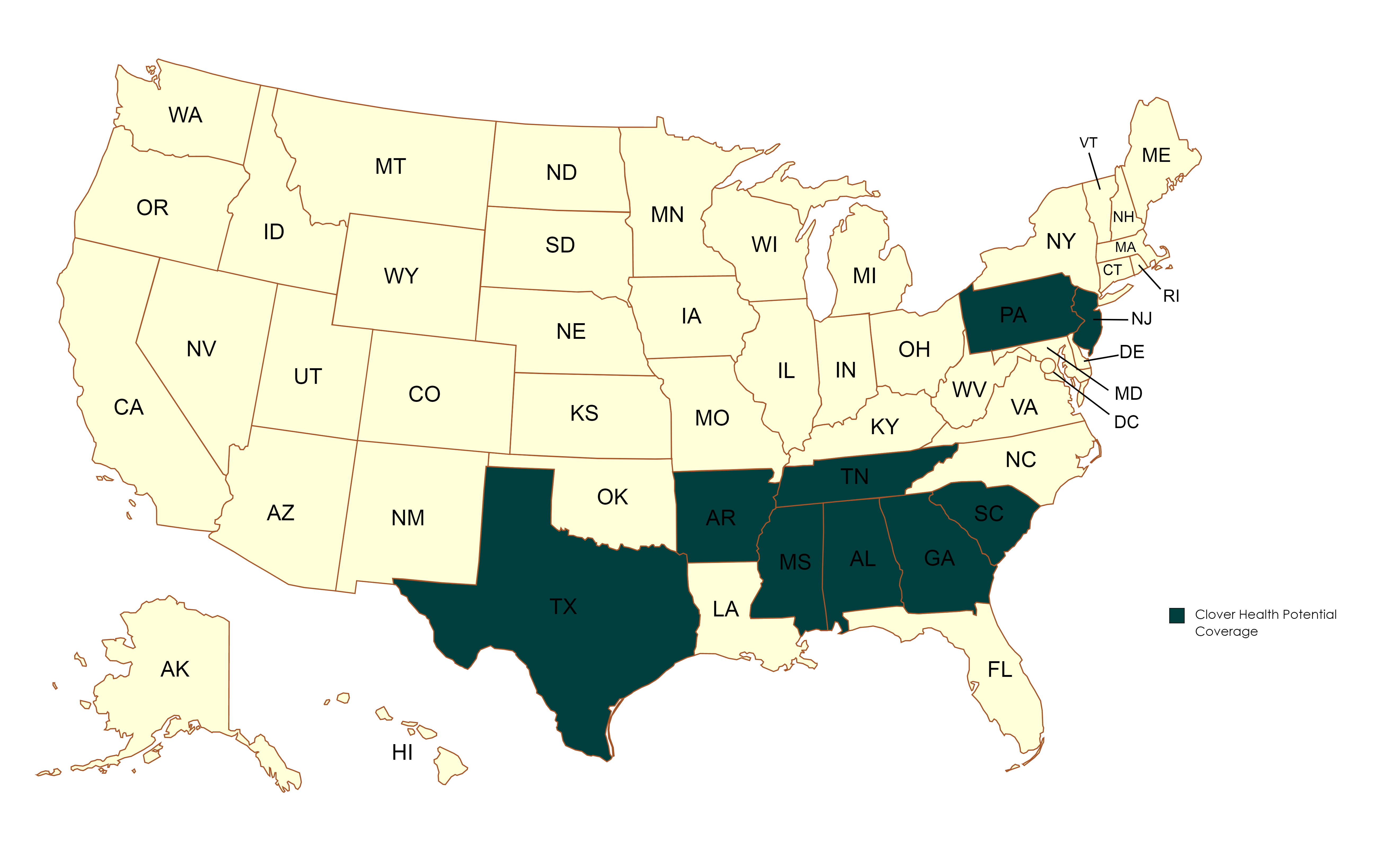

In a strategy update on the 24th June 2020. Clover announced an expansion into 101 new markets, which will make Clover’s Medicare Advantage (MA) plans available in 209 counties across 9 US states.

The map below shows which states are going to grant (partial) eligibility to Clover's plans.

NASDAQ:CLOV Map of partial plan availability from Clover Health Investments - Pending Approval

On the 22nd June 2021 it was also included in 2 indices, which will increase its exposure to the market. The indices are:

- S&P Health Care Services Select Industry Index

- S&P Global BMI Index

These news give perspective for potential growth, but it is smart to consider how analysts see the overall picture for the future of Clover.

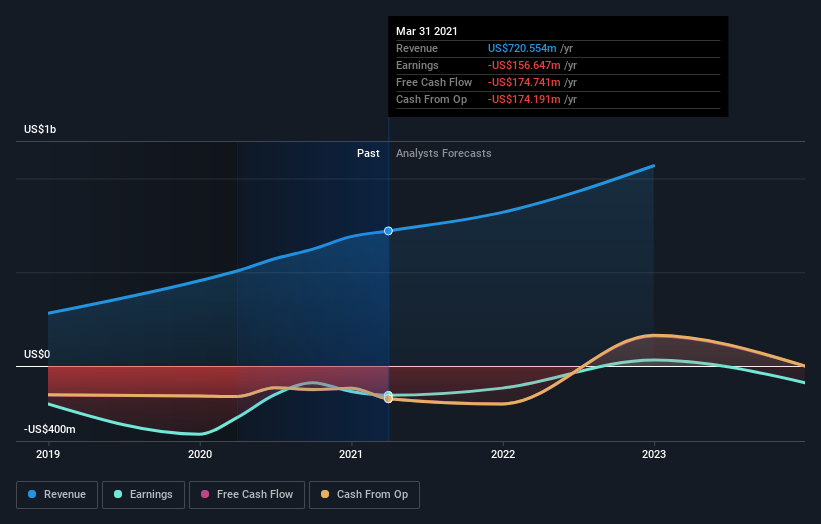

We've aggregated the latest statutory forecasts to see how analysts estimate future income of Clover Health Investments after the latest earnings results. Keep in mind that these may lag recent news and events, but should give investors a good baseline.

Check out our latest analysis for Clover Health Investments

Taking into account the latest results, the current consensus from Clover Health Investments' dual analysts is for revenues of US$819.2m in 2021 and almost completely in line with guidance. This implies a solid 14% sales growth.

We would highlight that Clover Health Investments' revenue growth is expected to slow, with the forecast 19% annualized growth rate until the end of 2021 being well below the historical 42% growth over the last year.

Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 7.6% per year. It is pretty assuring to know , that while Clover Health Investments' revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

We would also like to make a note of the financial health of Clover. The company has a manageable debt level standing around US$44m and plenty of current assets, such as a US$684m cash balance, to keep it going for some time. The financial health is quite contingent on management's approach, as they may overstretch on expenditures and seek further financing.

You can find our financial health analysis on Clover Here

The Bottom Line

Clover is a growing company, which is expected to have a fair share of turbulence. This is a period for both risk and opportunity for the company and investors.

The company has many upwards and downwards pressures alike, and may prove risky on the short term. T he business is estimated to grow faster than the wider industry and has a lot of room for expansion as the market for their main product is also expected to grow.

You should always think about risks. Case in point, we've spotted 1 warning sign for Clover Health Investments you should be aware of.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:CLOV

Clover Health Investments

Provides medicare advantage plans in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives