- United States

- /

- Healthcare Services

- /

- NasdaqGS:CLOV

Can New Leadership at Clover Health (CLOV) Clarify Its Path to AI-Driven Growth in Underserved Markets?

Reviewed by Sasha Jovanovic

- Earlier in October 2025, Counterpart Health, a subsidiary of Clover Health Investments, announced the appointments of Blaine Lindsey as Vice President of Enterprise Growth and Partnerships and Shannon Jacobs as President of Market Operations for the Gulf Region to accelerate adoption of its AI-powered Counterpart Assistant platform.

- This move reflects Clover Health's aim to strengthen its technology-driven care offerings and expand support for clinicians, particularly in underserved markets, through targeted leadership additions.

- We'll examine how these leadership appointments to advance Clover Health's AI platform could influence the company's long-term investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Clover Health Investments Investment Narrative Recap

To invest in Clover Health Investments, you need confidence that the company’s technology-driven model will help drive a sustainable turnaround, even as it faces recent declines in revenue and persistent cash burn. The new leadership appointments at Counterpart Health are unlikely to shift the most critical near-term catalyst, Clover’s ability to stabilize membership growth and margins ahead of its next earnings report, but do little to ease concerns over financial stability, which remains the principal risk for shareholders.

Among recent announcements, the upcoming Q3 2025 earnings release scheduled for November 4 is particularly significant, as the report will offer the latest insight into Clover Health’s progress toward reaching profitability, a vital short-term indicator given investor worries about growing losses and negative cash flow. How the company addresses its cash flow trends and responds to ongoing margin pressures could shape investor sentiment around both risks and potential recovery catalysts.

Yet, while technology rollouts continue, investors should also watch for signs that persistent losses may...

Read the full narrative on Clover Health Investments (it's free!)

Clover Health Investments' narrative projects $3.0 billion revenue and $10.7 million earnings by 2028. This requires 22.8% yearly revenue growth and a $52.8 million earnings increase from current earnings of -$42.1 million.

Uncover how Clover Health Investments' forecasts yield a $3.65 fair value, a 31% upside to its current price.

Exploring Other Perspectives

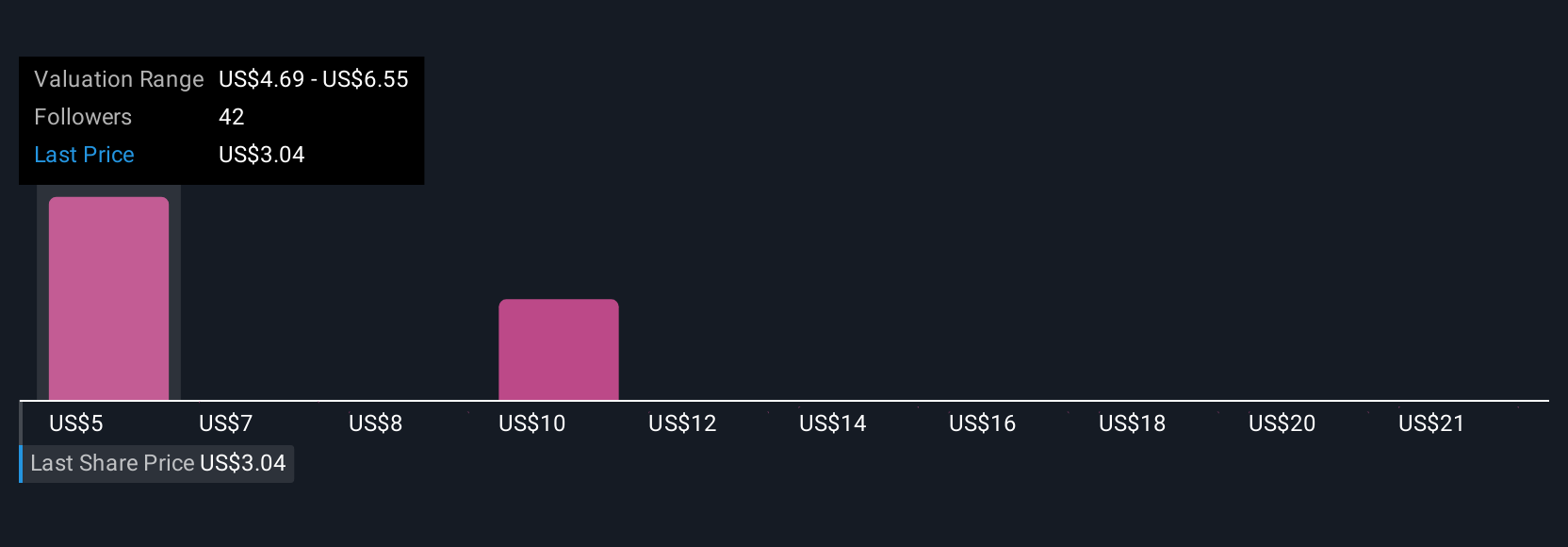

Simply Wall St Community members estimate Clover Health's fair value from US$3.65 to US$23.32, based on 13 independent perspectives. Given cash burn concerns, your view on Clover Health’s path to profitability may differ sharply from others, take a closer look and consider a range of views.

Explore 13 other fair value estimates on Clover Health Investments - why the stock might be worth just $3.65!

Build Your Own Clover Health Investments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clover Health Investments research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Clover Health Investments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clover Health Investments' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLOV

Clover Health Investments

Provides medicare advantage plans in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives