- United States

- /

- Healthtech

- /

- NasdaqGS:CERT

Certara (CERT) CEO Transition: Taking a Fresh Look at the Company’s Valuation After the 2026 Leadership Change

Reviewed by Simply Wall St

Certara (CERT) is stepping into 2026 with a leadership reset, as long time CEO Dr. William Feehery exits and former IQVIA executive Jon Resnick takes the helm, reshaping expectations for the stock.

See our latest analysis for Certara.

The leadership handover seems to have sparked a modest rebound, with a 1 month share price return of 9.41 percent after a tough stretch that left the year to date share price return at negative 14.92 percent and the 5 year total shareholder return at negative 76.02 percent. This suggests sentiment is stabilising rather than roaring back.

If this kind of transition has you reassessing your exposure to healthcare names, it could be a good time to explore other healthcare stocks that are capturing more positive momentum.

With revenue and earnings back in positive growth, while the share price remains heavily discounted versus targets and history, is Certara quietly undervalued or are investors already correctly pricing in Jon Resnick’s turnaround potential?

Most Popular Narrative: 27.7% Undervalued

With Certara last closing at $9.07 against a narrative fair value of $12.54, the spread frames a potentially mispriced recovery story in biosimulation.

The upcoming commercial launch of Certara's next-generation, AI-enabled MIDD platform and CertaraIQ QSP software leverages advanced analytics and machine learning, providing differentiated capabilities that democratize access and increase the potential customer base, which should translate to higher recurring revenue and margin expansion through cloud-based SaaS models.

Want to see the math behind that optimism? The narrative leans on accelerating software revenue, shifting margins, and a bold future earnings multiple. Curious which assumptions really move the fair value dial?

Result: Fair Value of $12.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower pharma adoption or weaker returns on Certara’s heavy AI and acquisition investments could derail the growth and re rating that are part of this narrative.

Find out about the key risks to this Certara narrative.

Another View on Valuation

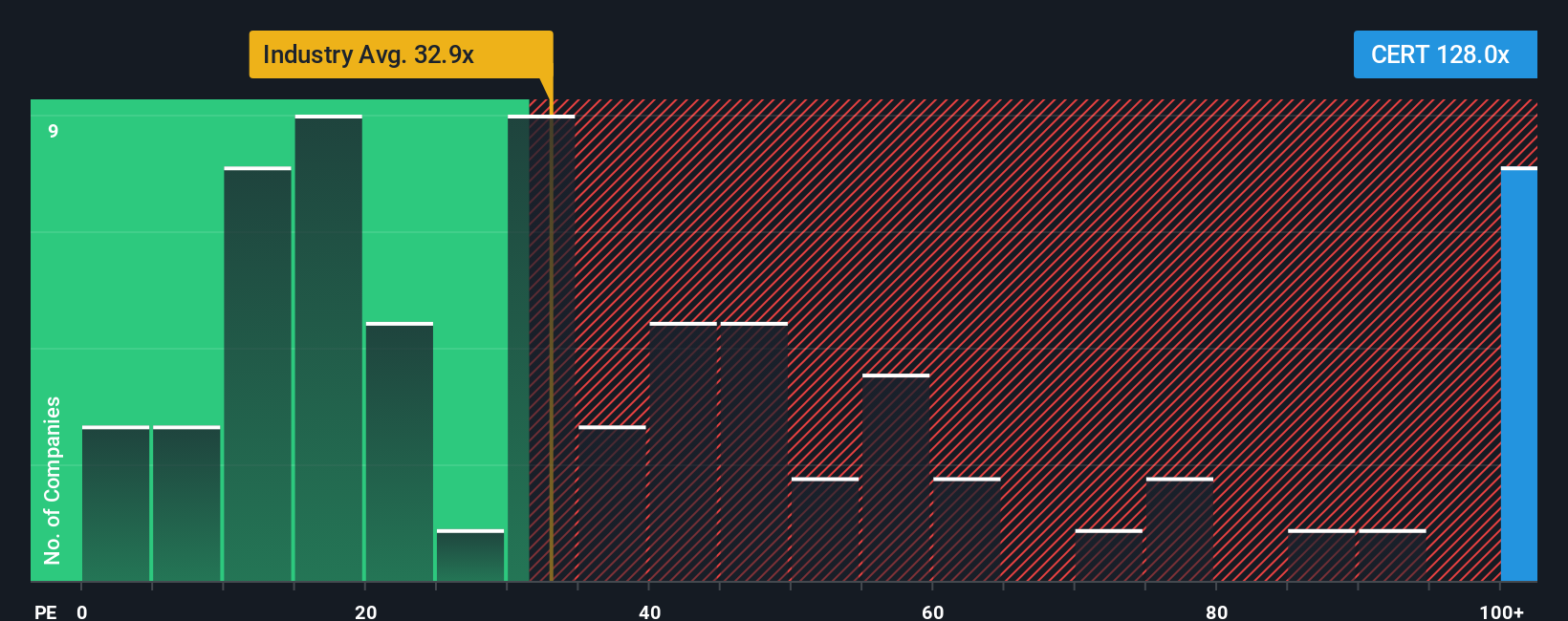

Analysts see Certara trading below their narrative fair value, but earnings based valuation tells a very different story. On a price to earnings basis around 130 times, the stock sits far above the healthcare services industry at 32.5 times, peers at 53.6 times, and even its 44.3 times fair ratio. That gap points to real de rating risk if growth or sentiment slips, even if the long term story plays out.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Certara Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a complete Certara storyline in minutes: Do it your way.

A great starting point for your Certara research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next smart move?

Do not stop at one opportunity. Use the Simply Wall Street Screener to uncover fresh stocks, compare ideas side by side, and act before the crowd catches on.

- Capitalize on potential mispricings by targeting companies that look cheap on cash flows, starting with these 916 undervalued stocks based on cash flows.

- Ride the structural shift toward automation and intelligent software by scanning these 25 AI penny stocks for names reshaping entire industries.

- Strengthen your income stream by reviewing dependable payers through these 13 dividend stocks with yields > 3% and lock in yields while they are still attractive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CERT

Certara

Provides technology-enabled services and software products for biosimulation in drug discovery, preclinical and clinical research, regulatory submissions, and market access.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion