- United States

- /

- Medical Equipment

- /

- NasdaqGM:CERS

Slammed 32% Cerus Corporation (NASDAQ:CERS) Screens Well Here But There Might Be A Catch

Cerus Corporation (NASDAQ:CERS) shareholders that were waiting for something to happen have been dealt a blow with a 32% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 60% share price decline.

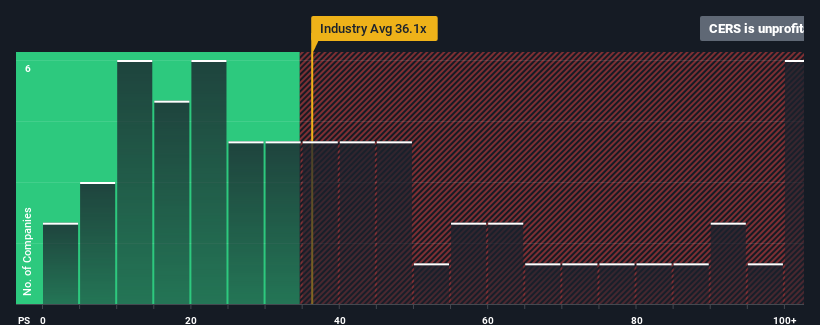

Since its price has dipped substantially, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 15x, you may consider Cerus as a highly attractive investment with its -7.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's superior to most other companies of late, Cerus has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Cerus

What Are Growth Metrics Telling Us About The Low P/E?

Cerus' P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings growth, the company posted a worthy increase of 8.8%. However, due to its less than impressive performance prior to this period, EPS growth is practically non-existent over the last three years overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 21% per annum over the next three years. That's shaping up to be materially higher than the 11% each year growth forecast for the broader market.

With this information, we find it odd that Cerus is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Having almost fallen off a cliff, Cerus' share price has pulled its P/E way down as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Cerus currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Cerus that you should be aware of.

If these risks are making you reconsider your opinion on Cerus, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Cerus, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CERS

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives