- United States

- /

- Healthtech

- /

- NasdaqGM:CCLD

Little Excitement Around CareCloud, Inc.'s (NASDAQ:CCLD) Revenues As Shares Take 25% Pounding

The CareCloud, Inc. (NASDAQ:CCLD) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 63% loss during that time.

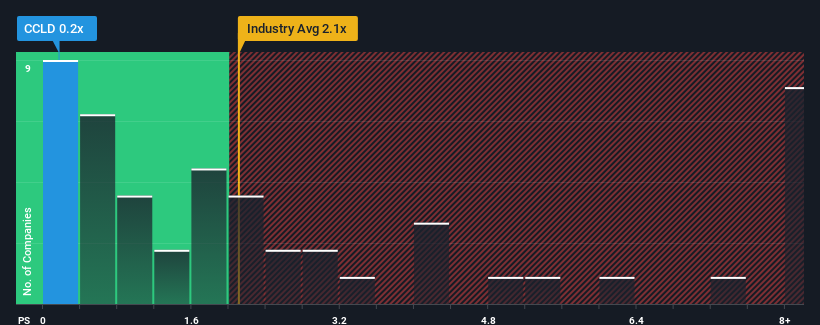

After such a large drop in price, CareCloud may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Healthcare Services industry in the United States have P/S ratios greater than 2.1x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for CareCloud

What Does CareCloud's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, CareCloud's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CareCloud.Do Revenue Forecasts Match The Low P/S Ratio?

CareCloud's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 16%. Still, the latest three year period has seen an excellent 36% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 1.9% as estimated by the four analysts watching the company. That's shaping up to be materially lower than the 12% growth forecast for the broader industry.

With this in consideration, its clear as to why CareCloud's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

CareCloud's recently weak share price has pulled its P/S back below other Healthcare Services companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of CareCloud's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Plus, you should also learn about these 4 warning signs we've spotted with CareCloud (including 1 which is a bit unpleasant).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CCLD

CareCloud

A healthcare information technology (IT) company, provides a suite of cloud-based solutions and related business services to healthcare providers and hospitals primarily in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives