- United States

- /

- Healthtech

- /

- NasdaqGM:CCLD

CareCloud, Inc.'s (NASDAQ:CCLD) 31% Dip In Price Shows Sentiment Is Matching Revenues

CareCloud, Inc. (NASDAQ:CCLD) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 76% share price decline.

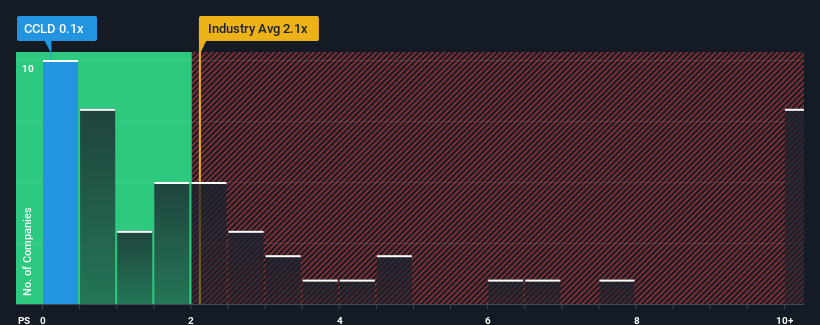

Since its price has dipped substantially, considering about half the companies operating in the United States' Healthcare Services industry have price-to-sales ratios (or "P/S") above 2.1x, you may consider CareCloud as an great investment opportunity with its 0.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for CareCloud

How Has CareCloud Performed Recently?

CareCloud hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on CareCloud will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

CareCloud's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. Still, the latest three year period has seen an excellent 36% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 3.3% over the next year. Meanwhile, the rest of the industry is forecast to expand by 12%, which is noticeably more attractive.

In light of this, it's understandable that CareCloud's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On CareCloud's P/S

Having almost fallen off a cliff, CareCloud's share price has pulled its P/S way down as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of CareCloud's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with CareCloud, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on CareCloud, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CCLD

CareCloud

A healthcare information technology (IT) company, provides technology-enabled business solutions, Software-as-a-Service offerings, and related business services to healthcare providers and hospitals primarily in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives