- United States

- /

- Healthcare Services

- /

- NasdaqGS:BTSG

BrightSpring Health Services (BTSG): Assessing Valuation After Analyst Upgrades and Renewed Growth Optimism

Reviewed by Kshitija Bhandaru

BrightSpring Health Services (BTSG) has attracted renewed investor interest following recent analyst updates. These updates highlight confidence in the company’s operational execution and expected EBITDA growth, supported by limited distribution drugs and generic conversions.

See our latest analysis for BrightSpring Health Services.

Following upbeat analyst sentiment and anticipation around its upcoming earnings release, BrightSpring’s recent momentum has been hard to miss. The shares have surged over 63% year-to-date on a share price return basis, while the total shareholder return for the past twelve months is an impressive 87%. This demonstrates that both momentum and conviction from investors remain strong as the company builds on operational execution and strategic growth drivers.

If the excitement around BrightSpring has you reconsidering your watchlist, it could be a great time to explore other healthcare leaders. See the full list for free with our See the full list for free..

With the stock trading just below its latest analyst price targets and momentum running high, investors may wonder if BrightSpring is still undervalued or if the market has already factored in its future growth potential.

Most Popular Narrative: 5.2% Undervalued

The widely followed narrative sets BrightSpring Health Services’ fair value above its recent closing price, highlighting optimism about future earnings growth. Here is a key driver propelling that viewpoint, straight from the narrative itself.

Ongoing investments in integrated service delivery, technology, procurement, and automation are enabling enhanced operating efficiencies and cross-selling, expected to deliver sustained improvements in net margins and EBITDA through 2026 and beyond.

Curious why analysts expect margins to keep rising, despite industry headwinds? There is a pivotal assumption in the forecast that could make or break this valuation. Dig into the full narrative to uncover the surprising growth targets and what is driving earnings potential.

Result: Fair Value of $29.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing labor challenges and high reliance on government reimbursement could threaten margins. These factors may act as potential catalysts for reversing the current bullish narrative.

Find out about the key risks to this BrightSpring Health Services narrative.

Another View: What the Multiples Say

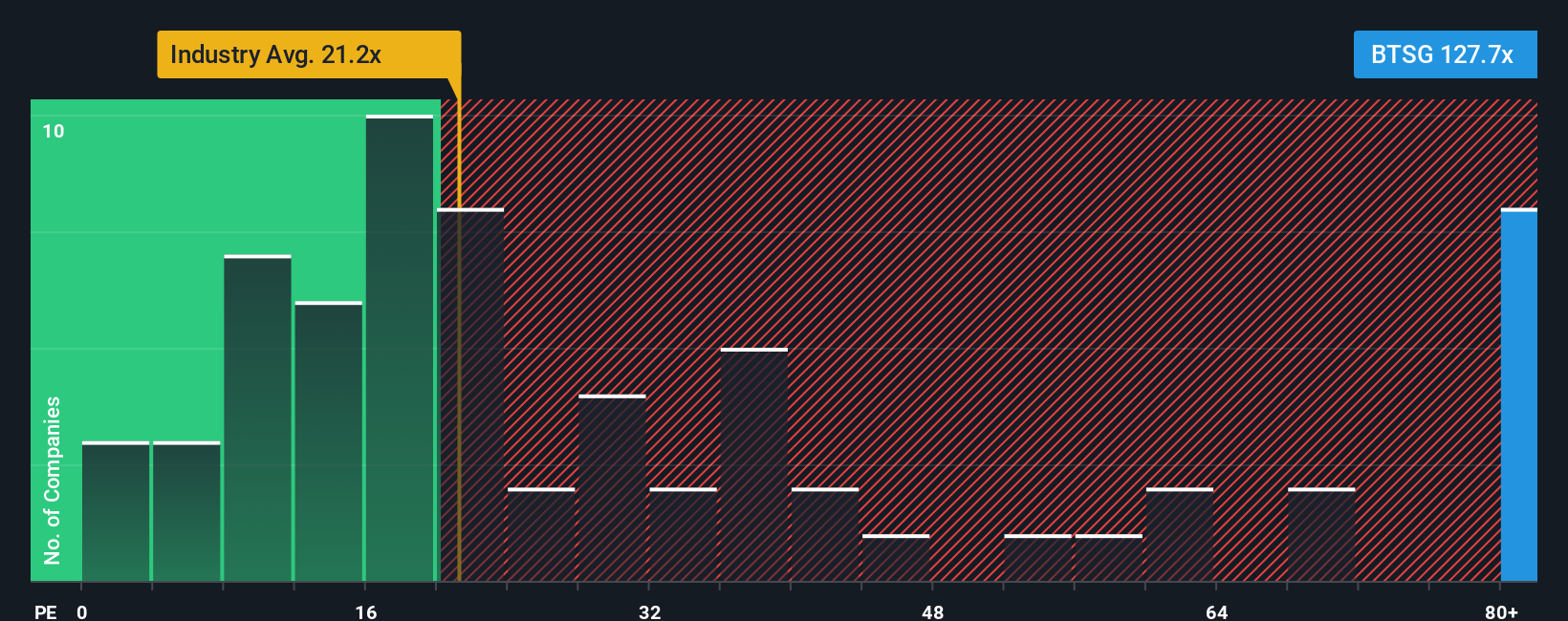

Looking at BrightSpring Health Services through its price-to-earnings ratio, the shares appear far more expensive than both industry and peer averages. They are trading at 121.9x, which is well above the US healthcare sector's 21.4x and the peer average of 22.4x. The fair ratio sits at 44.1x. This premium could signal optimism, or it might mean added risk if growth does not keep up. Might the market be overlooking valuation risk here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BrightSpring Health Services Narrative

If you see the story differently or want to dig deeper yourself, you can build your own view using the data in just a few minutes, and Do it your way.

A great starting point for your BrightSpring Health Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit their options. Power up your watchlist with stocks that could outperform and unlock new growth opportunities before the crowd catches on.

- Target income and stability by growing your portfolio with these 19 dividend stocks with yields > 3% featuring yields over 3% and solid payment histories.

- Chase breakthrough opportunities in technology by adding these 24 AI penny stocks positioned to benefit from the rise of artificial intelligence and automation.

- Get ahead of the market by searching for potential bargains among these 892 undervalued stocks based on cash flows based on fundamental cash flow insights.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BrightSpring Health Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BTSG

BrightSpring Health Services

Operates as a home and community-based healthcare services platform in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives