- United States

- /

- Medical Equipment

- /

- NasdaqCM:AXGN

Axogen (AXGN): Reassessing Valuation After FDA BLA Approval for AVANCE Nerve Allograft

Reviewed by Simply Wall St

Axogen (AXGN) just cleared a major regulatory hurdle, with the FDA approving its Biologics License Application for the AVANCE acellular nerve allograft, expanding indications and sharpening investor focus on the company’s potential growth opportunities.

See our latest analysis for Axogen.

That backdrop helps explain why, even after a modest 1 day share price pullback, Axogen’s 30 day share price return of 24.63 percent and 1 year total shareholder return of 99.12 percent signal strong, building momentum as investors reassess its long term growth prospects.

If this kind of regulatory driven rerating has your attention, it could be a good moment to explore other specialist names in healthcare via healthcare stocks and see what else the market may be revaluing.

With the shares nearly doubling over 12 months yet still trading at a sizable discount to analyst and intrinsic estimates, investors now face a key question: Is Axogen a mispriced growth story, or has the market already captured its upside?

Most Popular Narrative: 17.2% Undervalued

With Axogen closing at $29.35 against a narrative fair value of $35.44, the story leans toward upside, hinging on scaled adoption and regulatory tailwinds.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 62.4x on those 2028 earnings, up from -154.0x today. This future PE is greater than the current PE for the US Medical Equipment industry at 28.6x.

Curious why a loss making specialist is modeled with a premium profit multiple, rising margins, and accelerating top line expansion, all discounted at a modest rate? The narrative lays out an aggressive financial path, from revenue compounding to margin lift, that has to fall into place almost perfectly. Want to see the exact growth and profitability arc that underpins that punchy fair value? Read on to unpack how every assumption stacks up.

Result: Fair Value of $35.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if BLA related operational changes disrupt margins, or if payer pushback slows adoption of Axogen’s premium priced nerve portfolio.

Find out about the key risks to this Axogen narrative.

Another Angle on Valuation

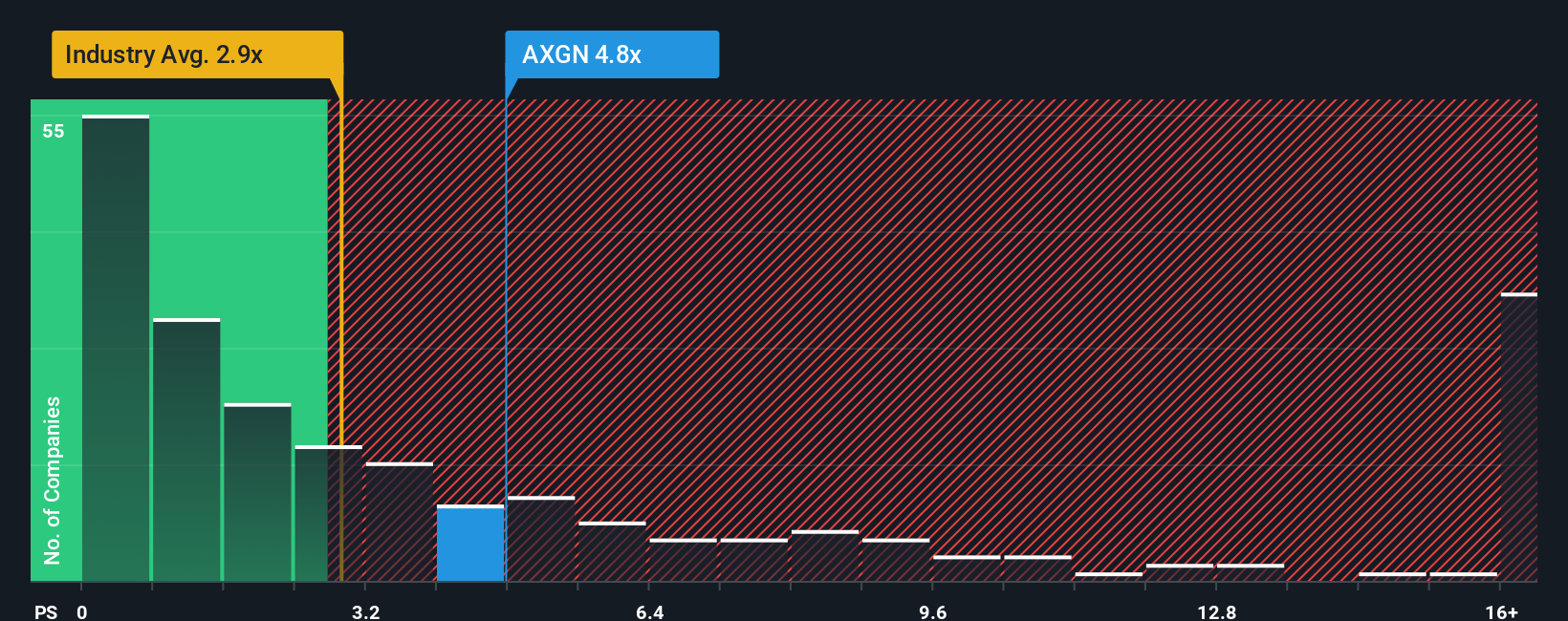

While the narrative fair value points to upside, the price to sales of 6.4 times paints a tougher picture. It sits well above the US Medical Equipment industry on 3.5 times and peers on 4.6 times, and even the 4.1 times fair ratio. This raises the risk of a sharp de rating if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Axogen Narrative

If you are skeptical of this view or prefer to stress test the numbers yourself, you can quickly build a custom Axogen story: Do it your way.

A great starting point for your Axogen research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high potential ideas?

If you stop at Axogen, you could miss other powerful setups, so put Simply Wall Street’s screener to work and upgrade your opportunity pipeline today.

- Capitalize on mispriced potential by targeting companies trading below their estimated cash flow value using these 912 undervalued stocks based on cash flows before the market catches up.

- Ride structural shifts in automation and machine learning by zeroing in on innovative names through these 25 AI penny stocks while they are still building momentum.

- Lock in income focused opportunities by scanning for resilient names with reliable payouts via these 13 dividend stocks with yields > 3% and avoid scrambling for yield later.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AXGN

Axogen

Develops and commercializes technologies for peripheral nerve regeneration and repair worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)