3 Stocks Estimated To Be Trading Below Their Fair Value In October 2025

Reviewed by Simply Wall St

As the United States stock market experiences solid weekly and monthly gains, driven by strong performances from tech giants like Amazon and Apple, investors remain attentive to identifying opportunities amidst fluctuating index movements. In this environment of mixed earnings results and economic indicators, discerning undervalued stocks can offer potential value plays for those looking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trade Desk (TTD) | $48.97 | $96.45 | 49.2% |

| TowneBank (TOWN) | $32.69 | $64.47 | 49.3% |

| SolarEdge Technologies (SEDG) | $34.34 | $68.31 | 49.7% |

| Northwest Bancshares (NWBI) | $11.78 | $23.50 | 49.9% |

| NeuroPace (NPCE) | $9.86 | $19.61 | 49.7% |

| Midland States Bancorp (MSBI) | $16.02 | $30.60 | 47.6% |

| Huntington Bancshares (HBAN) | $15.32 | $30.21 | 49.3% |

| Horizon Bancorp (HBNC) | $15.70 | $30.17 | 48% |

| Eagle Bancorp (EGBN) | $16.76 | $33.24 | 49.6% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $19.50 | $38.00 | 48.7% |

Let's explore several standout options from the results in the screener.

Axogen (AXGN)

Overview: Axogen, Inc., along with its subsidiaries, focuses on developing and commercializing technologies for peripheral nerve regeneration and repair globally, with a market cap of approximately $1.03 billion.

Operations: Axogen generates revenue through the development and commercialization of technologies aimed at peripheral nerve regeneration and repair on a global scale.

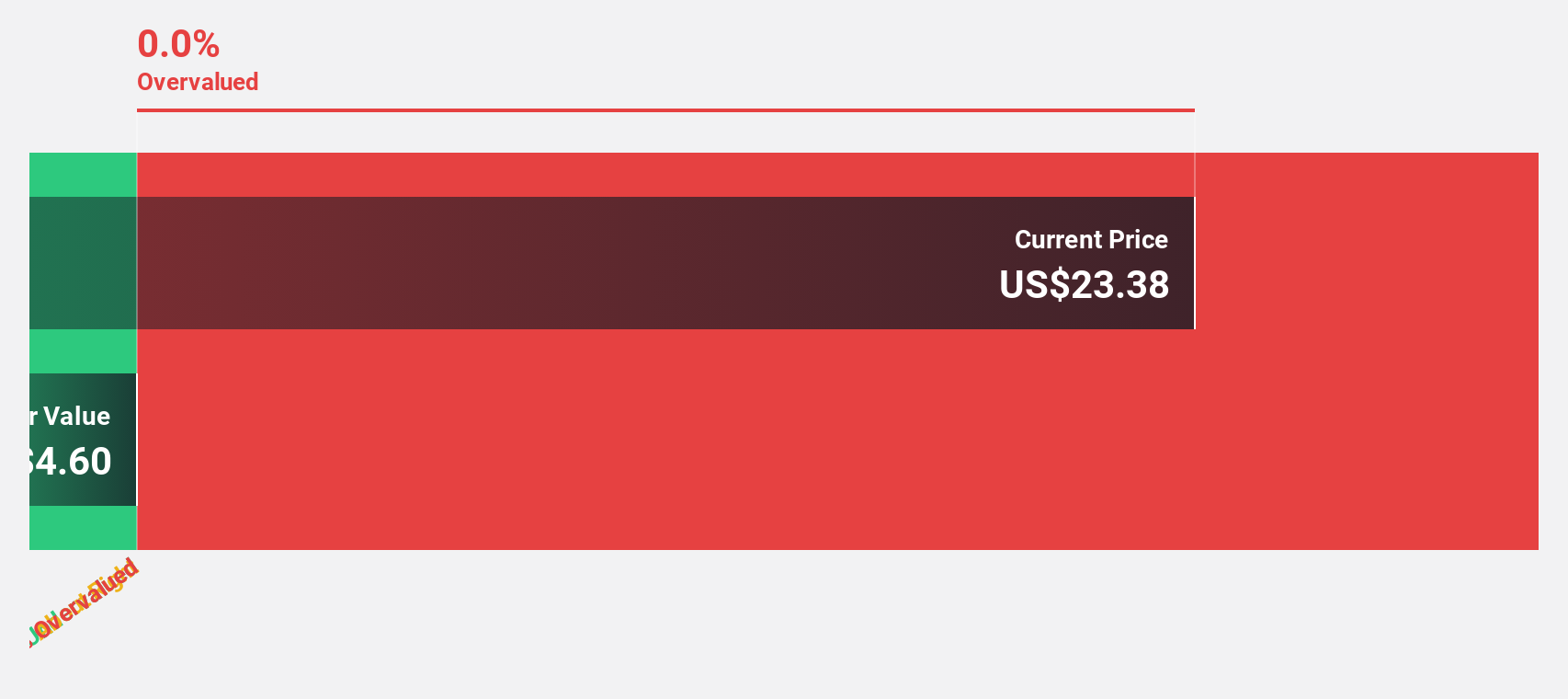

Estimated Discount To Fair Value: 23.9%

Axogen, trading at US$22.68, is valued below its estimated fair value of US$29.8, suggesting potential undervaluation based on cash flows. Recent earnings show a shift to profitability with Q3 net income at US$0.708 million from a previous loss, and revenue growth forecasted to outpace the market at 13.8% annually. The company raised its 2025 revenue guidance to a minimum of 19% growth or US$222.8 million, highlighting strong financial prospects amidst ongoing FDA review processes for Avance® Nerve Graft approval.

- Our comprehensive growth report raises the possibility that Axogen is poised for substantial financial growth.

- Click here to discover the nuances of Axogen with our detailed financial health report.

Huntington Bancshares (HBAN)

Overview: Huntington Bancshares Incorporated is a bank holding company for The Huntington National Bank, offering commercial, consumer, and mortgage banking services in the United States with a market cap of $23.76 billion.

Operations: The company generates revenue from its Commercial Banking segment, which accounts for $2.81 billion, and its Consumer & Regional Banking segment, contributing $5.10 billion.

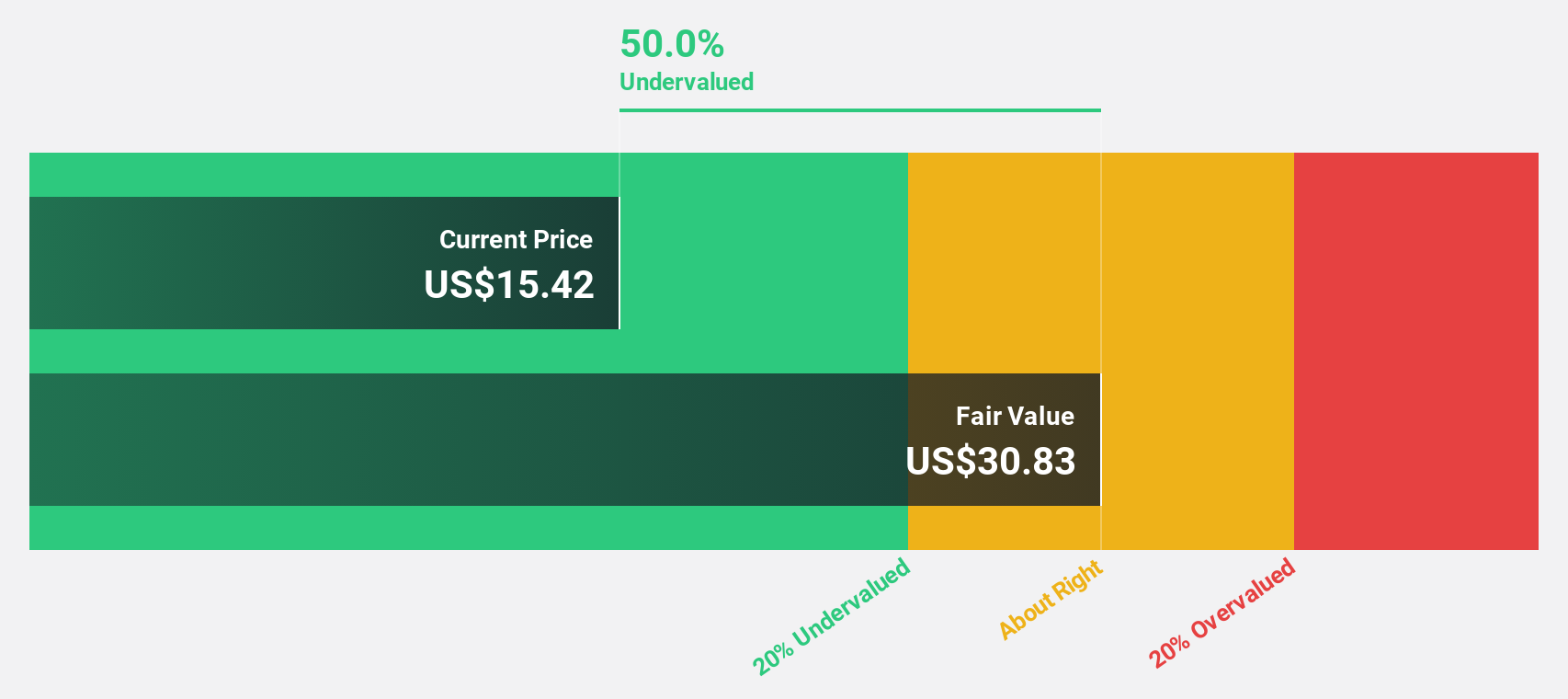

Estimated Discount To Fair Value: 49.3%

Huntington Bancshares, trading at US$15.32, is significantly undervalued with an estimated fair value of US$30.21. Recent earnings reveal strong performance with Q3 net income rising to US$629 million from US$517 million a year ago. The company's merger with Veritex Holdings enhances strategic positioning in Texas, and its revenue growth is projected to surpass the market at 22.6% annually, supported by increased earnings guidance and innovative banking solutions like Caregiver Banking.

- Our earnings growth report unveils the potential for significant increases in Huntington Bancshares' future results.

- Unlock comprehensive insights into our analysis of Huntington Bancshares stock in this financial health report.

Mirion Technologies (MIR)

Overview: Mirion Technologies, Inc. operates in North America, Europe, and the Asia Pacific, offering radiation detection, measurement, analysis, and monitoring products and services with a market cap of approximately $6.99 billion.

Operations: Mirion Technologies generates revenue from its operations across North America, Europe, and the Asia Pacific through the provision of products and services related to radiation detection, measurement, analysis, and monitoring.

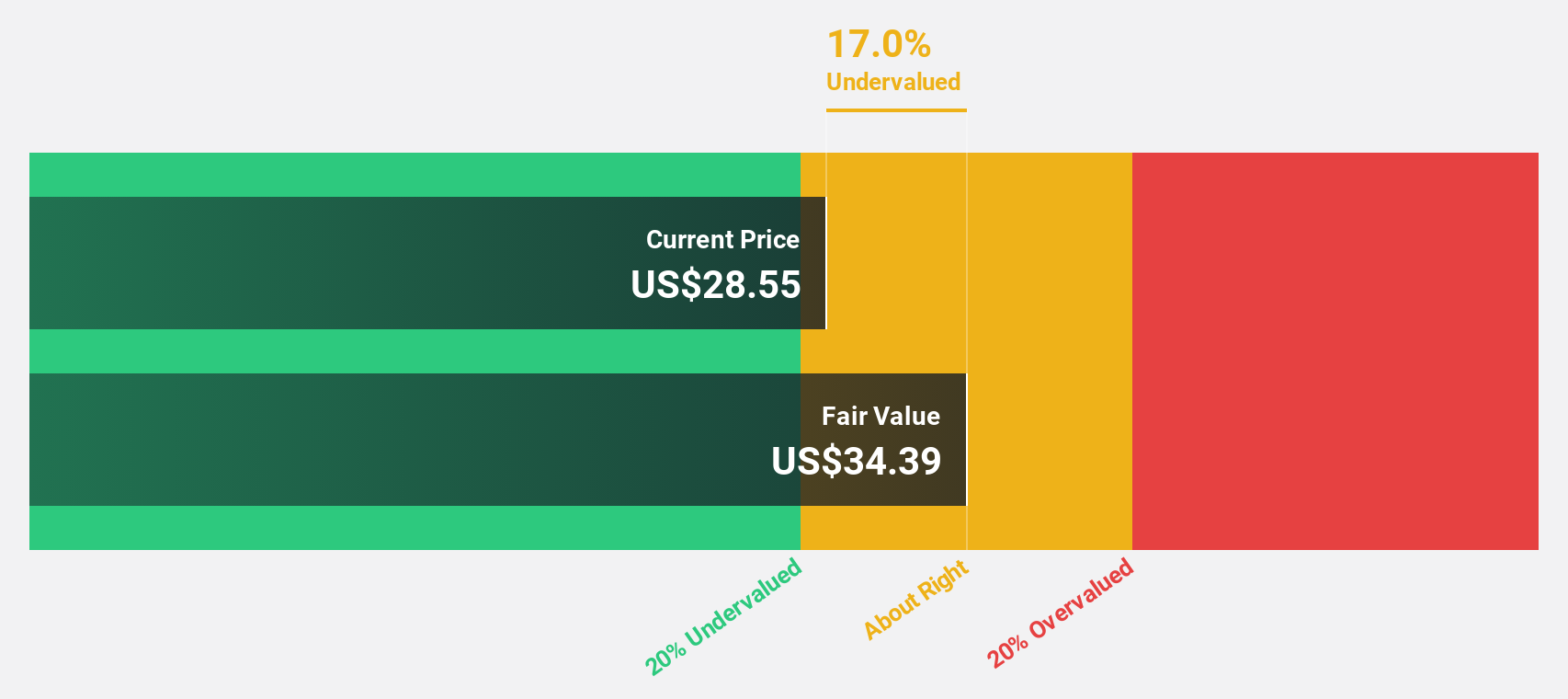

Estimated Discount To Fair Value: 15.4%

Mirion Technologies, trading at US$29.03, is undervalued relative to its estimated fair value of US$34.3 and expects significant earnings growth of 77% annually over the next three years. Recent results show a turnaround with Q3 net income at US$2.9 million from a prior loss, driven by revenue growth and strategic acquisitions like Certrec and Oncospace. However, insider selling raises caution despite strong revenue forecasts exceeding market averages.

- In light of our recent growth report, it seems possible that Mirion Technologies' financial performance will exceed current levels.

- Dive into the specifics of Mirion Technologies here with our thorough financial health report.

Taking Advantage

- Discover the full array of 174 Undervalued US Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MIR

Mirion Technologies

Provides radiation detection, measurement, analysis, and monitoring products and services in North America, Europe, and the Asia Pacific.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives