- United States

- /

- Real Estate

- /

- NasdaqCM:ALBT

A Look At Avalon GloboCare's (NASDAQ:AVCO) Share Price Returns

As an investor its worth striving to ensure your overall portfolio beats the market average. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term Avalon GloboCare Corp. (NASDAQ:AVCO) shareholders, since the share price is down 11% in the last three years, falling well short of the market return of around 62%. And the share price decline continued over the last week, dropping some 15%.

See our latest analysis for Avalon GloboCare

Avalon GloboCare wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, Avalon GloboCare grew revenue at 6.1% per year. That's not a very high growth rate considering it doesn't make profits. Indeed, the stock dropped 4% over the last three years. Shareholders will probably be hoping growth picks up soon. But ultimately the key will be whether the company can become profitability.

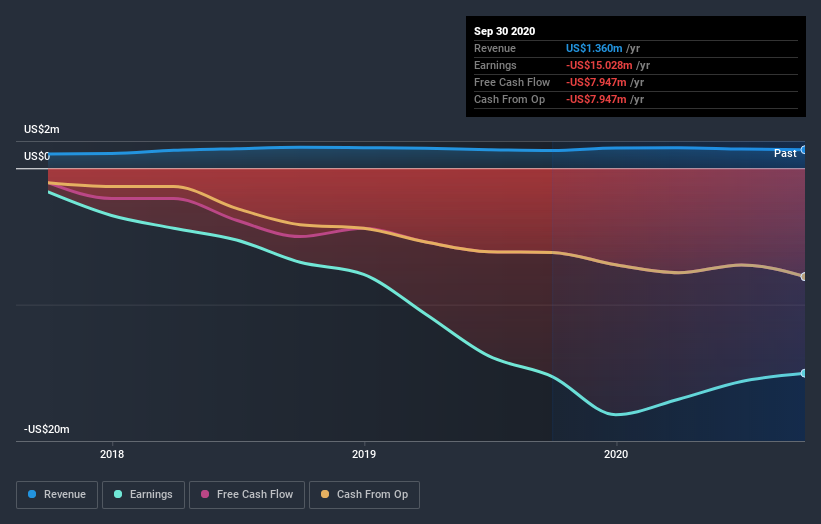

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Avalon GloboCare's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for Avalon GloboCare shares, which cost holders 10%, while the market was up about 40%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 4% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Avalon GloboCare better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Avalon GloboCare (of which 2 are potentially serious!) you should know about.

Avalon GloboCare is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Avalon GloboCare, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:ALBT

Avalon GloboCare

Owns and operates commercial real estate properties in the United States.

Medium-low risk and overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026