- United States

- /

- Medical Equipment

- /

- NasdaqGM:ATRC

Assessing AtriCure (ATRC) Valuation After Its Recent Share Price Surge

Reviewed by Simply Wall St

Recent performance puts AtriCure in focus

AtriCure (ATRC) has quietly put together a strong run, with the stock up around 28% over the past month and roughly 39% year to date, drawing fresh attention to its growth story.

See our latest analysis for AtriCure.

That momentum is not just a one week pop. AtriCure’s recent double digit 1 month share price return has helped turn a modest multi year total shareholder return into a far more convincing uptrend as investors warm to its growth profile.

Given that backdrop, it can be smart to see what else is working in the sector and compare AtriCure with other healthcare stocks that might fit your strategy.

With shares already surging and analysts still seeing upside from here, the key question now is whether AtriCure is trading below its long term potential or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 15.2% Undervalued

With AtriCure last closing at $42.38 against a most popular narrative fair value of $50, the valuation hinges on ambitious growth and margin improvements.

Positive volume trends from new product launches, combined with operational efficiencies (evidenced by SG&A and R&D growth below revenue growth), are driving operating leverage, which should improve net margins and profitability as the business continues to scale.

Curious how a loss making company earns a premium style valuation. The narrative leans on rapid scaling, margin lift, and a bold future earnings multiple. Want to see which forecasts make that math work.

Result: Fair Value of $50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained pressure from pulsed field ablation rivals and slower than expected international adoption could undermine growth assumptions and challenge the premium valuation.

Find out about the key risks to this AtriCure narrative.

Another View on AtriCure’s Valuation

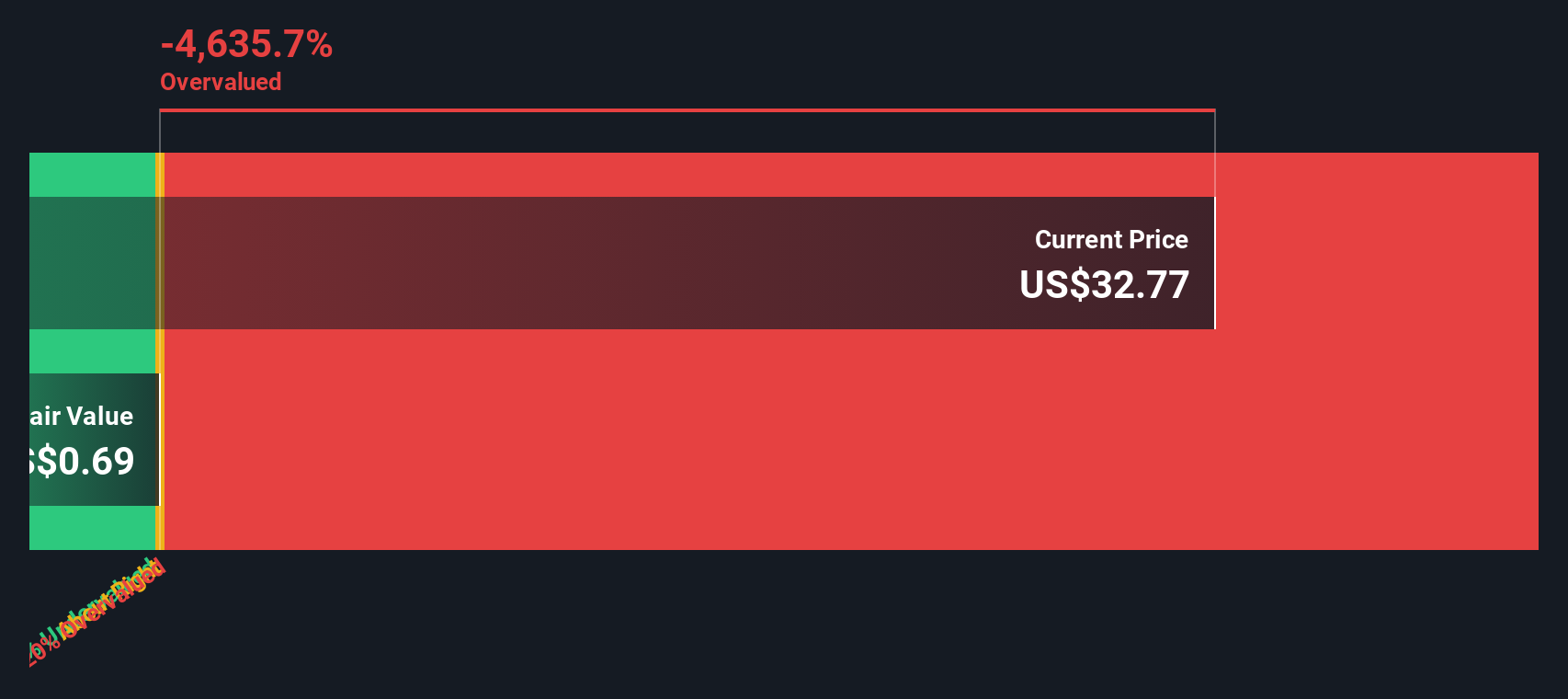

While the popular narrative points to upside, our DCF model tells a very different story, suggesting fair value nearer $0.78 versus today’s $42.38 share price. That implies AtriCure screens heavily overvalued on cash flow terms, so what would need to go right to close that gap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AtriCure for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AtriCure Narrative

If you want to challenge these assumptions or rely on your own research, you can build a personalized AtriCure view in minutes: Do it your way.

A great starting point for your AtriCure research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before the market moves on without you, use the Simply Wall Street Screener to uncover fresh opportunities that match your style, risk appetite, and return goals.

- Capture tomorrow’s breakout names early by scanning these 3606 penny stocks with strong financials with resilient balance sheets and genuine business momentum.

- Position yourself at the heart of the AI transformation by targeting these 26 AI penny stocks poised to benefit from accelerating demand and structural tailwinds.

- Lock in more dependable portfolio income by focusing on these 13 dividend stocks with yields > 3% that can support payouts through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ATRC

AtriCure

Develops, manufactures, and sells devices for surgical ablation of cardiac tissue, exclusion of the left atrial appendage, and temporarily blocking pain by ablating peripheral nerves to medical centers in the United States, the Asia-Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)