- United States

- /

- Medical Equipment

- /

- NasdaqGS:ANGO

There Is A Reason AngioDynamics, Inc.'s (NASDAQ:ANGO) Price Is Undemanding

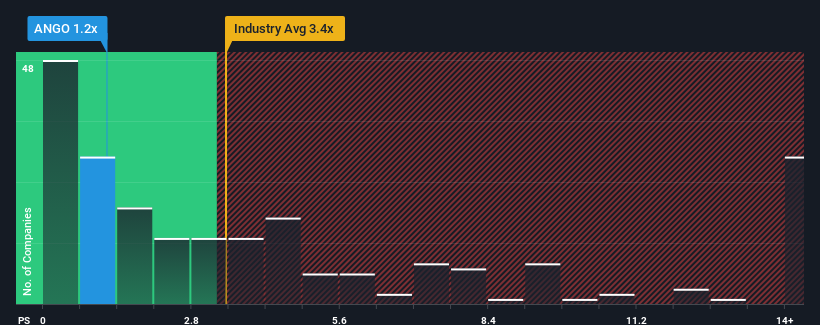

You may think that with a price-to-sales (or "P/S") ratio of 1.2x AngioDynamics, Inc. (NASDAQ:ANGO) is definitely a stock worth checking out, seeing as almost half of all the Medical Equipment companies in the United States have P/S ratios greater than 3.4x and even P/S above 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for AngioDynamics

What Does AngioDynamics' Recent Performance Look Like?

AngioDynamics hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on AngioDynamics will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For AngioDynamics?

AngioDynamics' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. As a result, revenue from three years ago have also fallen 1.7% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 6.5% per year during the coming three years according to the three analysts following the company. With the industry predicted to deliver 9.4% growth each year, the company is positioned for a weaker revenue result.

With this information, we can see why AngioDynamics is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On AngioDynamics' P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of AngioDynamics' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for AngioDynamics with six simple checks.

If you're unsure about the strength of AngioDynamics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ANGO

AngioDynamics

A medical technology company, designs, manufactures, and sells medical, surgical, and diagnostic devices for the use in treating peripheral vascular disease, and oncology and surgical settings in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives