- United States

- /

- Medical Equipment

- /

- NasdaqGS:ANGO

AngioDynamics, Inc.'s (NASDAQ:ANGO) Shares Bounce 26% But Its Business Still Trails The Industry

AngioDynamics, Inc. (NASDAQ:ANGO) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

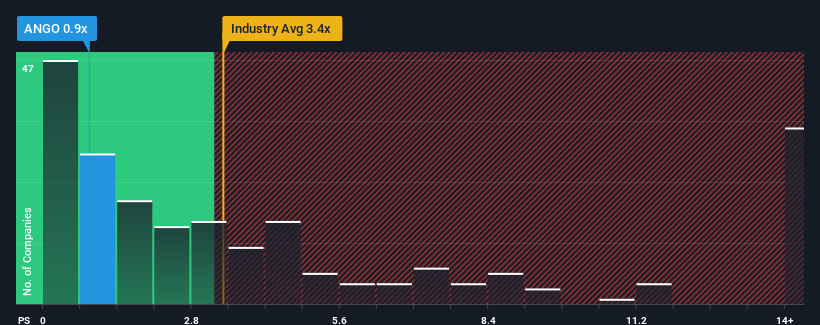

Although its price has surged higher, AngioDynamics may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.9x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.4x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for AngioDynamics

How AngioDynamics Has Been Performing

While the industry has experienced revenue growth lately, AngioDynamics' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AngioDynamics.How Is AngioDynamics' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as AngioDynamics' is when the company's growth is on track to lag the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.2%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 19% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 1.6% each year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 10% each year, which is noticeably more attractive.

With this in consideration, its clear as to why AngioDynamics' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Shares in AngioDynamics have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of AngioDynamics' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 1 warning sign for AngioDynamics that you need to take into consideration.

If you're unsure about the strength of AngioDynamics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ANGO

AngioDynamics

A medical technology company, designs, manufactures, and sells medical, surgical, and diagnostic devices for the use in treating peripheral vascular disease, and oncology and surgical settings in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives