- United States

- /

- Healthcare Services

- /

- NasdaqGS:ALHC

Could Alignment Healthcare’s (ALHC) Focus on Senior Debt Signal a Shift in Its Growth Strategy?

Reviewed by Sasha Jovanovic

- Earlier this week, Alignment Healthcare released its 2025 Social Threats to Aging Well in America survey, highlighting that U.S. seniors face significant barriers to health, including aging in place, access limitations to medical care, and growing economic insecurity.

- An important insight from the survey is that over a quarter of seniors with medical debt now owe amounts equal to at least four months of living expenses, indicating a rising financial strain within this population.

- We'll examine how Alignment's focus on addressing seniors' rising medical debt may reshape its long-term growth story and product offerings.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Alignment Healthcare Investment Narrative Recap

To be a shareholder in Alignment Healthcare, you need to believe that its technology-driven Medicare Advantage model and proactive approach to senior health can drive sustainable membership and revenue growth, despite regulatory challenges. The release of Alignment’s 2025 survey reinforces the urgency of addressing economic insecurity and medical debt among seniors, but does not materially impact the immediate driver for shares, continued margin improvement and membership expansion, or the most pressing risk, potential reimbursement changes from CMS.

Among recent announcements, the March 2025 expansion of Alignment’s partnership with Sutter Health, broadening access for members in Northern California, directly addresses the core issues highlighted in the new survey: access barriers and the need for high-touch, community-based care. This initiative aligns closely with expected catalysts, particularly as the company seeks to widen its presence in existing and new markets to capture more of the growing Medicare-eligible population.

On the other hand, investors should be aware that federal policy changes tied to Medicare Advantage reimbursement…

Read the full narrative on Alignment Healthcare (it's free!)

Alignment Healthcare's outlook points to $6.8 billion in revenue and $118.7 million in earnings by 2028. This implies a 26.7% annual revenue growth and a $169.7 million increase in earnings from the current $-51.0 million.

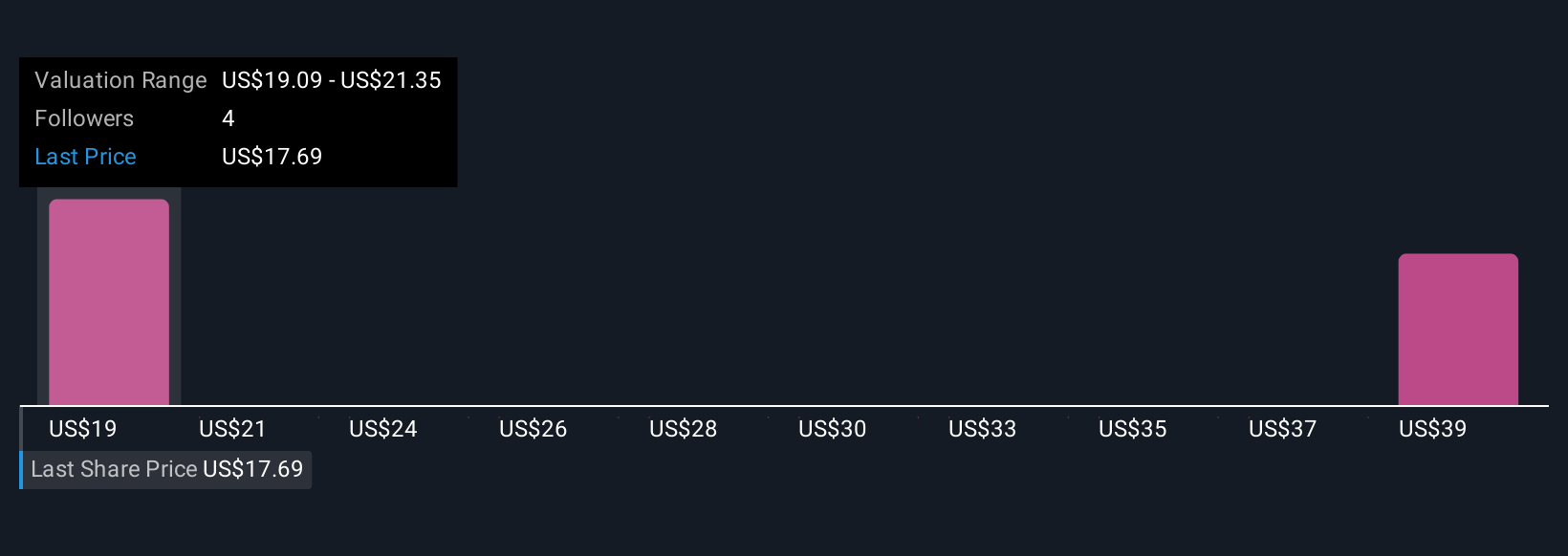

Uncover how Alignment Healthcare's forecasts yield a $19.09 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have shared two fair value estimates for Alignment, ranging from US$19.09 up to US$41.69 per share. Despite this spread, ongoing discussion about the cost-effectiveness of Medicare Advantage has broad implications for future revenue and profitability projections, explore these varied views to get the full picture.

Explore 2 other fair value estimates on Alignment Healthcare - why the stock might be worth just $19.09!

Build Your Own Alignment Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alignment Healthcare research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alignment Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alignment Healthcare's overall financial health at a glance.

No Opportunity In Alignment Healthcare?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALHC

Alignment Healthcare

Operates a consumer-centric healthcare platform for seniors in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives