- United States

- /

- Healthcare Services

- /

- NasdaqGM:AIRS

Why Investors Shouldn't Be Surprised By AirSculpt Technologies, Inc.'s (NASDAQ:AIRS) 30% Share Price Surge

Despite an already strong run, AirSculpt Technologies, Inc. (NASDAQ:AIRS) shares have been powering on, with a gain of 30% in the last thirty days. The last 30 days bring the annual gain to a very sharp 44%.

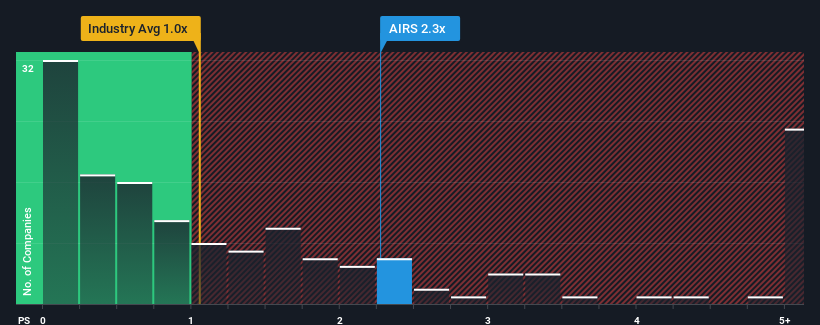

After such a large jump in price, when almost half of the companies in the United States' Healthcare industry have price-to-sales ratios (or "P/S") below 1x, you may consider AirSculpt Technologies as a stock probably not worth researching with its 2.3x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for AirSculpt Technologies

How Has AirSculpt Technologies Performed Recently?

While the industry has experienced revenue growth lately, AirSculpt Technologies' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AirSculpt Technologies.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like AirSculpt Technologies' to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 59% overall rise in revenue, in spite of its uninspiring short-term performance. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Looking ahead now, revenue is anticipated to climb by 9.5% each year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 7.3% per annum, which is noticeably less attractive.

With this in mind, it's not hard to understand why AirSculpt Technologies' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From AirSculpt Technologies' P/S?

The large bounce in AirSculpt Technologies' shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that AirSculpt Technologies maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Healthcare industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with AirSculpt Technologies.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AIRS

AirSculpt Technologies

Focuses on operating as a holding company for EBS Intermediate Parent LLC that provides body contouring procedure services in the United States, Canada, and the United Kingdom.

Very low risk and overvalued.

Market Insights

Community Narratives