- United States

- /

- Healthcare Services

- /

- NasdaqGS:ACHC

Will Leadership and Activist Pressure Reshape Acadia Healthcare’s Capital Strategy and Outlook? (ACHC)

Reviewed by Sasha Jovanovic

- Earlier this month, Acadia Healthcare announced that Todd Young will become its Chief Financial Officer on October 27, 2025, following calls from Khrom Capital Management for a formal review of strategic alternatives and substantial governance reform due to concerns over performance and capital allocation.

- The combination of executive changes and persistent activist investor pressure highlights increased scrutiny on Acadia’s management and corporate strategy amid operational and financial challenges.

- We'll explore how activist investor demands for a review of strategic alternatives could alter Acadia Healthcare’s investment narrative and outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Acadia Healthcare Company Investment Narrative Recap

To own shares of Acadia Healthcare, investors need to be confident in the company’s ability to address ongoing operational and financial challenges while capitalizing on long-term growth in behavioral health demand. The recent CFO appointment and activist investor pressure highlight management scrutiny, but do not materially shift the short-term catalyst, which remains the successful turnaround of underperforming facilities. The primary near-term risk continues to be operational execution, particularly the risk of further EBITDA drag from select locations.

Among recent announcements, Acadia’s second quarter results are especially relevant. While revenue increased to US$869.23 million, net income declined sharply and earnings per share fell, reinforcing the importance of improving execution and managing costs as key to restoring market confidence, especially given heightened investor and boardroom scrutiny from ongoing activist engagement.

In contrast, investors should also be aware of the unresolved risks tied to underperforming facilities and the potential for further closures, as...

Read the full narrative on Acadia Healthcare Company (it's free!)

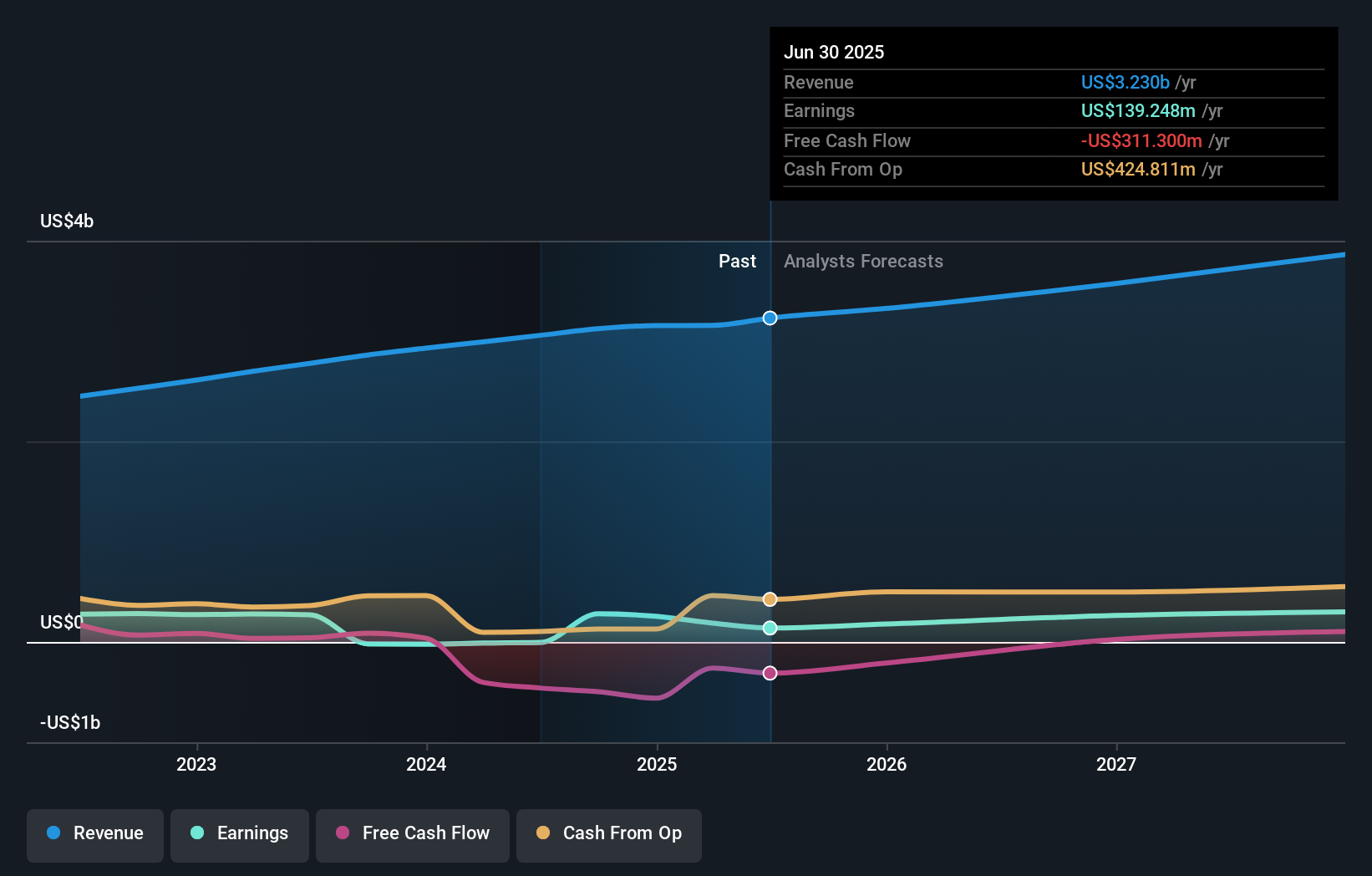

Acadia Healthcare Company is forecast to achieve $4.1 billion in revenue and $322.9 million in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 8.3% and reflects a $183.7 million increase in earnings from the current level of $139.2 million.

Uncover how Acadia Healthcare Company's forecasts yield a $29.71 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community contributors provided a single fair value estimate of US$29.71 for Acadia Healthcare, offering one direct perspective. Opinions on operational turnaround and execution may differ widely, so consider the full range of investor viewpoints before forming your own outlook.

Explore another fair value estimate on Acadia Healthcare Company - why the stock might be worth just $29.71!

Build Your Own Acadia Healthcare Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Acadia Healthcare Company research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Acadia Healthcare Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Acadia Healthcare Company's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACHC

Acadia Healthcare Company

Provides behavioral healthcare services in the United States and Puerto Rico.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives