- United States

- /

- Healthcare Services

- /

- NasdaqGS:ACHC

Acadia Healthcare (ACHC) Valuation Following Federal Probe, Lawsuit, and Reduced 2024 Outlook

Reviewed by Kshitija Bhandaru

If you are holding Acadia Healthcare Company (ACHC) stock, or thinking about getting in, this week’s news probably caught your eye. The company is now under investigation by the U.S. Attorney’s Office after being served a grand jury subpoena, specifically targeting its admissions, length of stay, and billing practices. In addition, Acadia faces a securities class action lawsuit that claims it withheld key information, and management just cut their full-year outlook for both revenue and adjusted EBITDA. Slower patient day growth was blamed, but there is no doubt these events have heightened uncertainty, especially for investors weighing Acadia’s future performance.

After a turbulent year, the stock has dropped about 71% over the past twelve months, outpacing declines seen in both the past five years and three-year periods. Even a modest 5% gain during the past three months has not been enough to offset the slide. Recent events add new risk into the mix, and momentum has clearly faded versus prior years as legal scrutiny combines with a lower growth outlook.

With these pressures already reflected in the share price, the key question is whether the market has overreacted, leaving hidden value on the table, or if these risks mean the stock still has further to fall.

Most Popular Narrative: 27.6% Undervalued

The prevailing narrative sees Acadia Healthcare as significantly undervalued, with the stock trading well below what analysts believe it should be worth based on future growth and profitability projections.

Accelerated facility development, opening beds ahead of schedule, joint ventures with large healthcare systems, and ongoing expansion in high-demand lines (comprehensive treatment centers, specialty care) should fuel multiyear top-line growth and operational leverage, positively impacting revenue and earnings as new facilities ramp up.

Want to see what is powering this double-digit undervaluation? This narrative leans on bold assumptions such as outpacing revenue growth and margins that could rerate how the whole market sees Acadia. Could these financial projections really hold the secret to a game-changing rebound?

Result: Fair Value of $30.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent Medicaid reimbursement challenges and costly legal and operational setbacks could undermine the rebound story and stall future growth for Acadia Healthcare.

Find out about the key risks to this Acadia Healthcare Company narrative.Another View: SWS DCF Model's Perspective

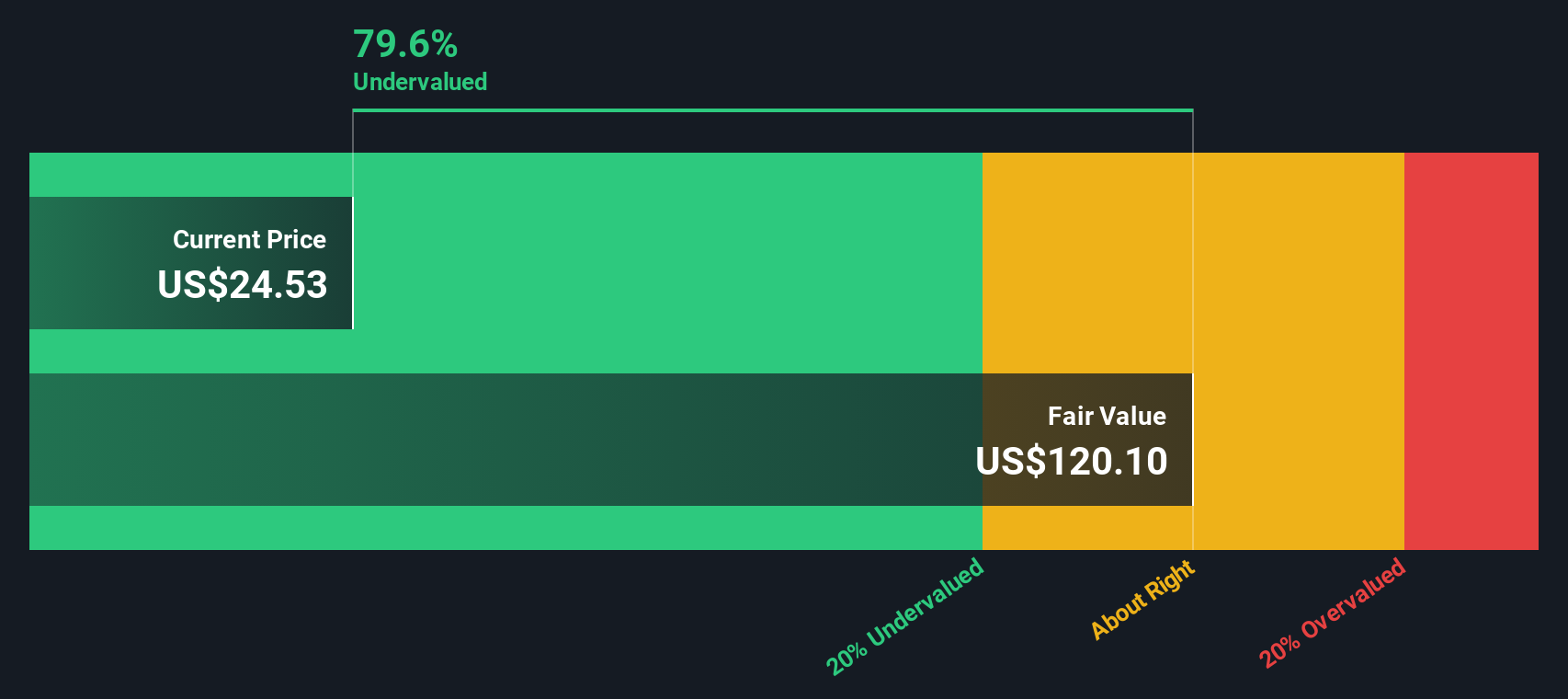

Looking at Acadia Healthcare through our discounted cash flow (DCF) model offers a very different story. This approach also points to the stock being undervalued; however, a wider gap opens up between price and fair value. Which side do you trust with your next move?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Acadia Healthcare Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Acadia Healthcare Company Narrative

If you have a different take or want to analyze the latest numbers for yourself, you can craft your own Acadia Healthcare story in just a few minutes. Do it your way.

A great starting point for your Acadia Healthcare Company research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities slip by while you wait on the sidelines. Act now to find stocks that match your strategy and could ignite your portfolio.

- Uncover companies with huge potential before the crowd by checking out penny stocks with strong financials that are already showing strong financials.

- Target tomorrow’s winners in cutting-edge healthcare technology through our carefully curated list of healthcare AI stocks.

- Boost your passive income with high-yielding opportunities featured in dividend stocks with yields > 3%, chosen for stability and consistent dividend performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACHC

Acadia Healthcare Company

Provides behavioral healthcare services in the United States and Puerto Rico.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives