- United States

- /

- Beverage

- /

- NYSE:ZVIA

Zevia PBC (NYSE:ZVIA) Stock's 31% Dive Might Signal An Opportunity But It Requires Some Scrutiny

To the annoyance of some shareholders, Zevia PBC (NYSE:ZVIA) shares are down a considerable 31% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 77% share price decline.

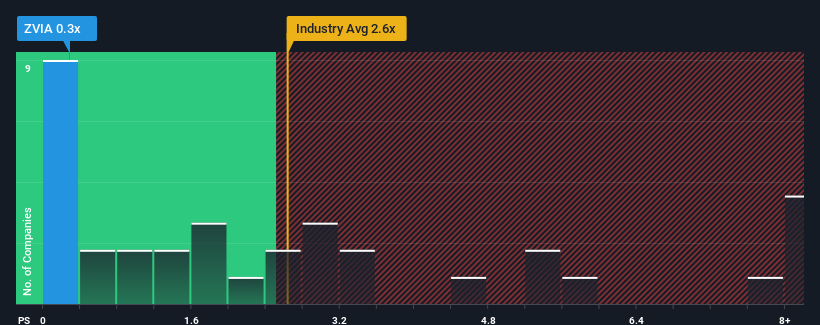

Following the heavy fall in price, Zevia PBC's price-to-sales (or "P/S") ratio of 0.3x might make it look like a strong buy right now compared to the wider Beverage industry in the United States, where around half of the companies have P/S ratios above 2.6x and even P/S above 6x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Zevia PBC

How Zevia PBC Has Been Performing

With revenue growth that's inferior to most other companies of late, Zevia PBC has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Zevia PBC's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Zevia PBC's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 51% overall rise in revenue, in spite of its uninspiring short-term performance. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 8.3% per year over the next three years. With the industry only predicted to deliver 5.6% each year, the company is positioned for a stronger revenue result.

With this information, we find it odd that Zevia PBC is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Having almost fallen off a cliff, Zevia PBC's share price has pulled its P/S way down as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Zevia PBC's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Plus, you should also learn about these 4 warning signs we've spotted with Zevia PBC.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zevia PBC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ZVIA

Zevia PBC

Develops, markets, sells, and distributes zero sugar beverages in the United States and Canada.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives