Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given this risk, we thought we'd take a look at whether Zevia PBC (NYSE:ZVIA) shareholders should be worried about its cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Zevia PBC

Does Zevia PBC Have A Long Cash Runway?

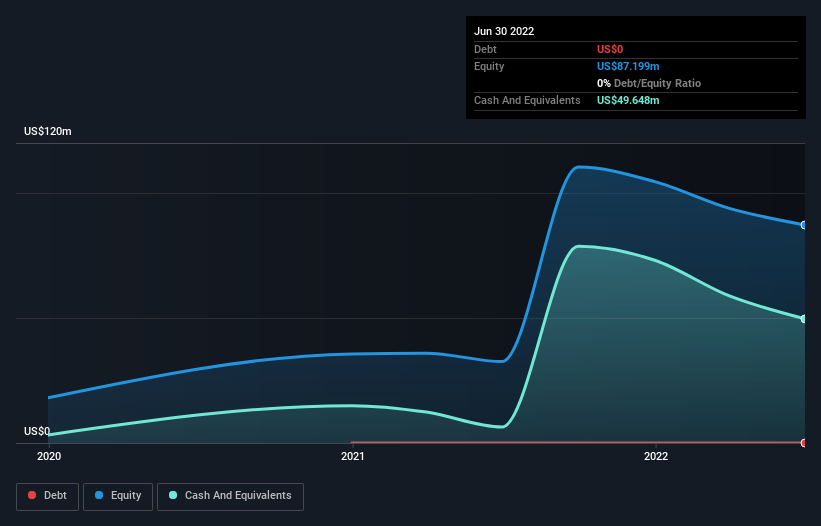

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at June 2022, Zevia PBC had cash of US$50m and no debt. Importantly, its cash burn was US$40m over the trailing twelve months. That means it had a cash runway of around 15 months as of June 2022. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. Importantly, if we extrapolate recent cash burn trends, the cash runway would be noticeably longer. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Zevia PBC Growing?

It was quite stunning to see that Zevia PBC increased its cash burn by 1,261% over the last year. But the silver lining is that operating revenue increased by 25% in that time. Taken together, we think these growth metrics are a little worrying. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Zevia PBC Raise More Cash Easily?

Given the trajectory of Zevia PBC's cash burn, many investors will already be thinking about how it might raise more cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Zevia PBC has a market capitalisation of US$309m and burnt through US$40m last year, which is 13% of the company's market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

How Risky Is Zevia PBC's Cash Burn Situation?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Zevia PBC's revenue growth was relatively promising. Even though we don't think it has a problem with its cash burn, the analysis we've done in this article does suggest that shareholders should give some careful thought to the potential cost of raising more money in the future. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 4 warning signs for Zevia PBC that potential shareholders should take into account before putting money into a stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you're looking to trade Zevia PBC, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zevia PBC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ZVIA

Zevia PBC

Develops, markets, sells, and distributes zero sugar beverages in the United States and Canada.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives