- United States

- /

- Beverage

- /

- NYSE:ZVIA

May 2025's Promising Penny Stocks To Consider

Reviewed by Simply Wall St

The U.S. stock market has experienced a significant surge, with major indices like the Dow Jones Industrial Average climbing nearly 1,000 points following a temporary easing of U.S.-China trade tensions. As investors navigate these evolving market conditions, penny stocks present an intriguing area for exploration. Though often associated with smaller or newer companies, these stocks can offer surprising value and potential growth when backed by solid financial foundations.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.42 | $358.57M | ✅ 4 ⚠️ 3 View Analysis > |

| IDenta (OTCPK:IDTA) | $0.698616 | $2.83M | ✅ 2 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.32 | $1.39B | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.12 | $188.36M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.45 | $56.28M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.74 | $94.3M | ✅ 3 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.83935 | $6.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dingdong (Cayman) (NYSE:DDL) | $2.42 | $518.62M | ✅ 4 ⚠️ 0 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.23 | $72.4M | ✅ 3 ⚠️ 2 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8999 | $80.94M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 757 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Gevo (NasdaqCM:GEVO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gevo, Inc. operates as a carbon abatement company with a market cap of $269.15 million.

Operations: The company generates revenue primarily from two segments: Gevo, contributing $1.12 million, and GevoRNG, which accounts for $15.80 million.

Market Cap: $269.15M

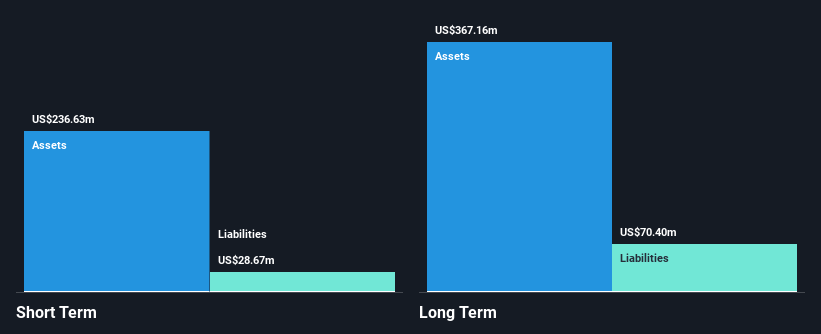

Gevo, Inc., with a market cap of US$269.15 million, is navigating the volatile landscape of penny stocks by focusing on carbon abatement technologies. Despite being unprofitable and reporting a net loss of US$78.64 million for 2024, Gevo maintains more cash than its total debt and covers both short and long-term liabilities with its assets. The company is actively pursuing growth through strategic alliances, such as the partnership with Axens to commercialize sustainable aviation fuel technology. While revenue growth is forecasted at 21.08% annually, profitability remains elusive in the near future.

- Take a closer look at Gevo's potential here in our financial health report.

- Assess Gevo's future earnings estimates with our detailed growth reports.

Information Services Group (NasdaqGM:III)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Information Services Group, Inc. operates as an AI-centered technology research and advisory company across the Americas, Europe, and the Asia Pacific with a market cap of $223.90 million.

Operations: The company's Fact-Based Sourcing Advisory Services generated $242.90 million in revenue.

Market Cap: $223.9M

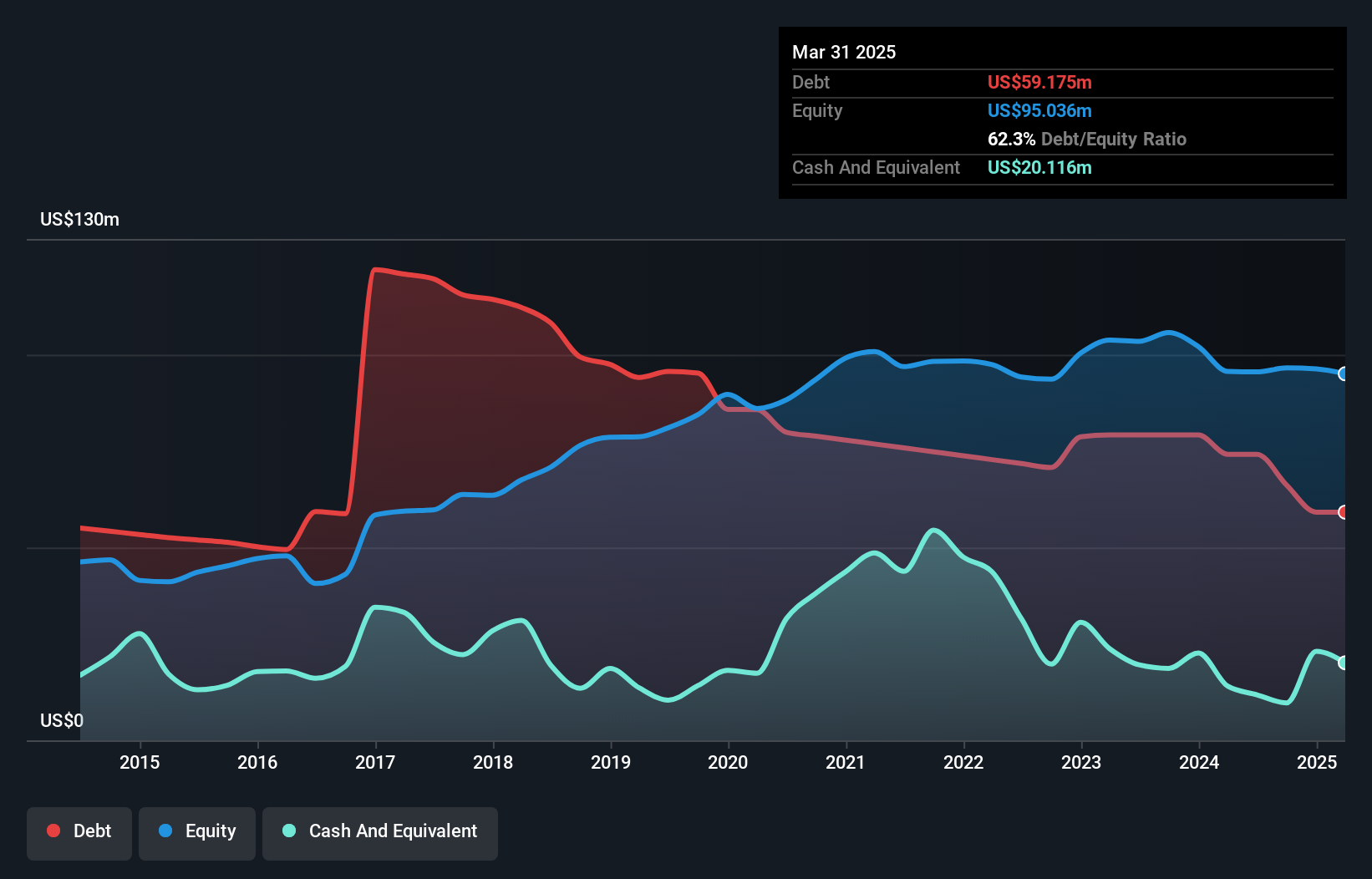

Information Services Group, Inc., with a market cap of US$223.90 million, is navigating the penny stock terrain by leveraging its AI-centered technology services. The company reported first-quarter 2025 revenues of US$59.58 million and net income of US$1.49 million, marking a shift from previous losses. Despite this profitability, earnings are impacted by significant one-off gains and high debt levels relative to equity at 41.1%. Recent developments include a shelf registration for US$22.4 million in common stock and confirmed guidance targeting second-quarter revenues between US$59.5 million to US$60.5 million, reflecting stable operational momentum.

- Jump into the full analysis health report here for a deeper understanding of Information Services Group.

- Examine Information Services Group's earnings growth report to understand how analysts expect it to perform.

Zevia PBC (NYSE:ZVIA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zevia PBC develops, markets, sells, and distributes zero sugar beverages in the United States and Canada with a market cap of approximately $196.27 million.

Operations: Zevia PBC does not report specific revenue segments.

Market Cap: $196.27M

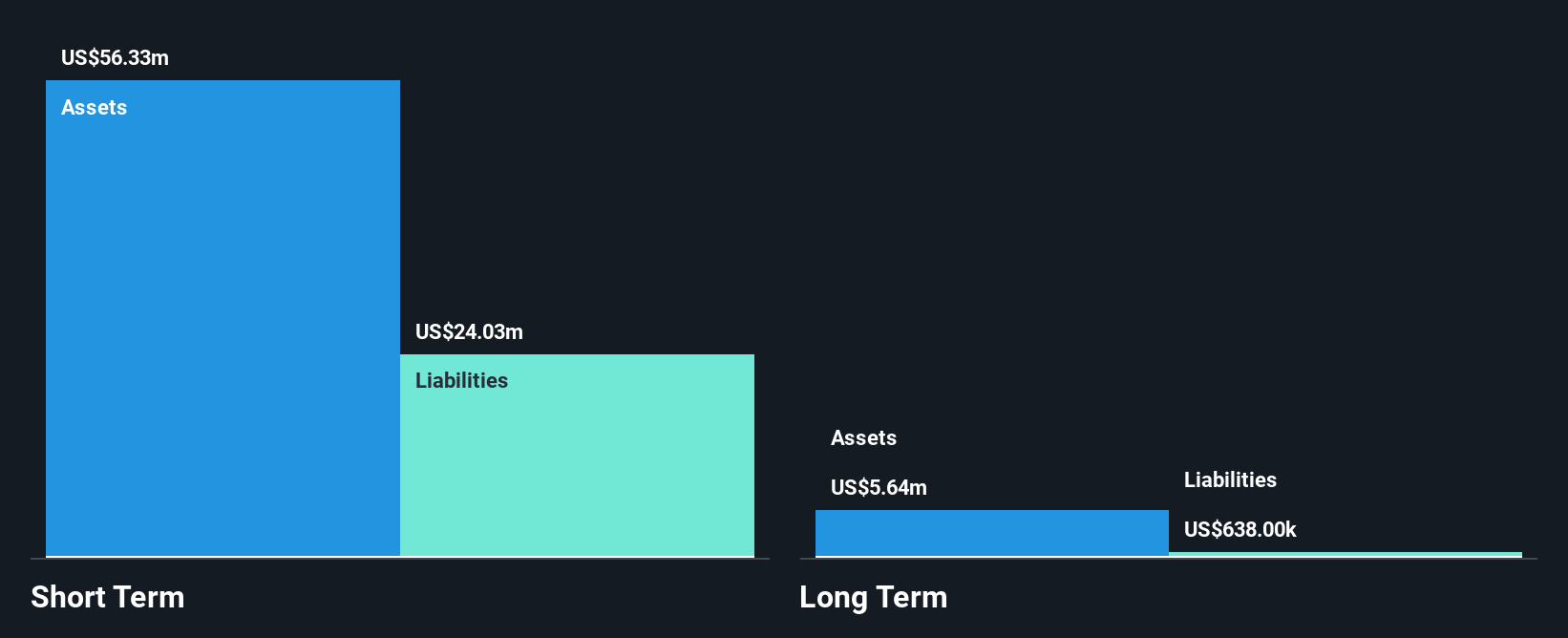

Zevia PBC, with a market cap of US$196.27 million, is navigating the penny stock landscape with its focus on zero-sugar beverages. Despite recent net losses of US$5.23 million in Q1 2025 and a negative return on equity, Zevia maintains a solid cash runway exceeding three years based on current free cash flow. The company reported Q1 sales of US$38.02 million and expects second-quarter sales between US$40.5 million to US$42.5 million, indicating potential growth despite volatility in share price and insider selling activities over the past quarter. The company remains debt-free with sufficient short-term assets covering liabilities.

- Get an in-depth perspective on Zevia PBC's performance by reading our balance sheet health report here.

- Understand Zevia PBC's earnings outlook by examining our growth report.

Seize The Opportunity

- Unlock more gems! Our US Penny Stocks screener has unearthed 754 more companies for you to explore.Click here to unveil our expertly curated list of 757 US Penny Stocks.

- Want To Explore Some Alternatives? These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Zevia PBC, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zevia PBC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZVIA

Zevia PBC

Develops, markets, sells, and distributes zero sugar beverages in the United States and Canada.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives