- United States

- /

- Beverage

- /

- NYSE:ZVIA

3 Promising Penny Stocks With Market Caps Under $200M

Reviewed by Simply Wall St

As major U.S. stock indexes reach new records, driven by anticipation of Federal Reserve decisions and tech earnings, the market continues to capture investor attention with its dynamic shifts. Amidst these developments, penny stocks remain an intriguing segment for investors seeking opportunities outside the realm of large-cap giants. Although the term "penny stock" may seem outdated, it still represents smaller or newer companies that can offer significant potential when backed by strong financials and a clear growth path.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.91 | $409.32M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.77 | $650.99M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.09 | $191.54M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.97 | $869.92M | ✅ 4 ⚠️ 1 View Analysis > |

| Global Self Storage (SELF) | $5.00 | $56.92M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $2.00 | $24.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.99 | $7.21M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.62 | $84.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.78 | $11.73M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 359 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Vera Bradley (VRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vera Bradley, Inc. designs and manufactures women's handbags, luggage, travel items, fashion and home accessories, and gifts in the United States with a market cap of $60.89 million.

Operations: The company's revenue is primarily derived from its Direct segment, which accounts for $232.51 million, and its Indirect segment, contributing $46.79 million.

Market Cap: $60.89M

Vera Bradley faces challenges as it navigates a period of financial difficulty, marked by a net loss of US$38.13 million for the first half of 2025, compared to a smaller loss the previous year. Despite these setbacks, its seasoned management team is bolstered by the recent appointment of Melinda Paraie as Chief Brand Officer, bringing valuable experience from her tenure at Coach and Cath Kidston. The company has also amended its credit agreements to allow more flexibility in asset sales and security interests. Additionally, Vera Bradley's collaboration with Anthropologie aims to enhance its brand appeal during the holiday season.

- Click to explore a detailed breakdown of our findings in Vera Bradley's financial health report.

- Understand Vera Bradley's earnings outlook by examining our growth report.

Zevia PBC (ZVIA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zevia PBC develops, markets, sells, and distributes zero sugar beverages in the United States and Canada, with a market cap of $184.38 million.

Operations: The company's revenue is generated entirely from its non-alcoholic beverages segment, totaling $158.37 million.

Market Cap: $184.38M

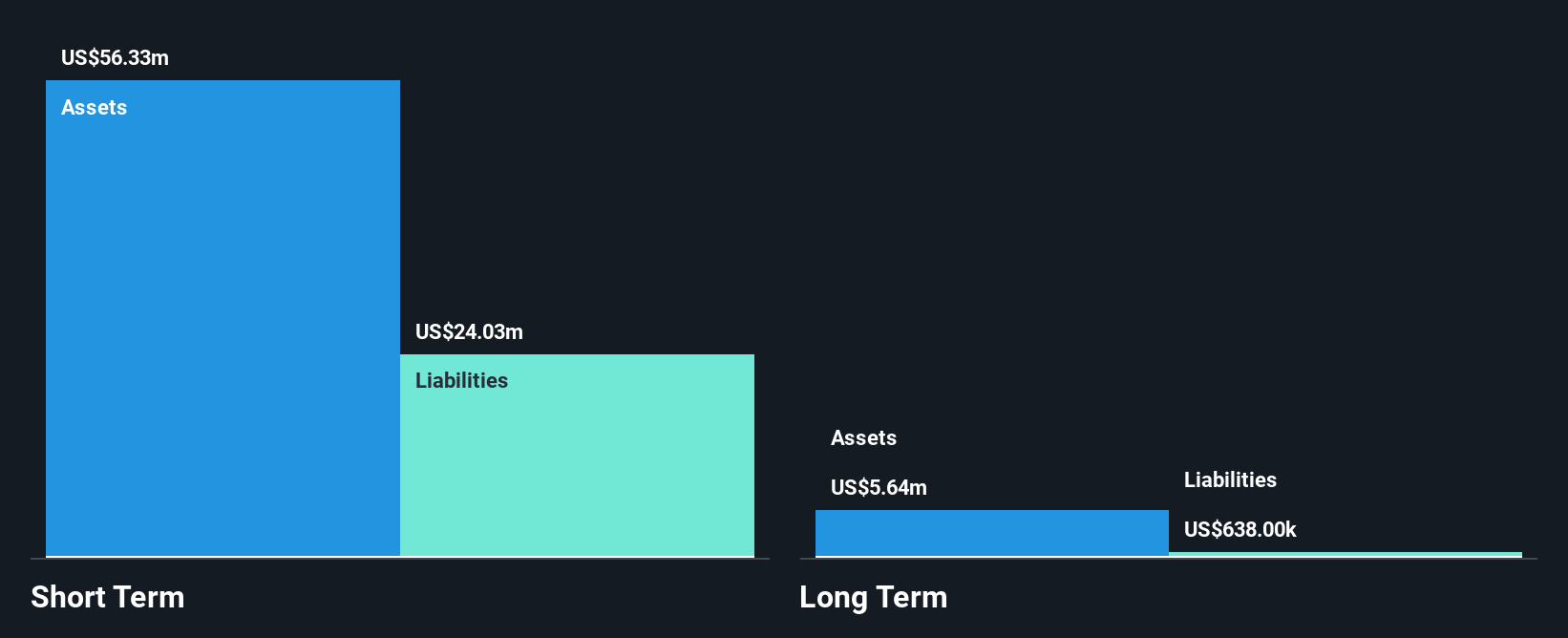

Zevia PBC, with a market cap of US$184.38 million, remains unprofitable but has made strides in reducing its losses over the past five years. The company reported second-quarter sales of US$44.52 million, an increase from the previous year, and significantly narrowed its net loss to US$0.697 million from US$5.89 million a year ago. Despite this progress, Zevia's management team is relatively new with an average tenure of 1.7 years, which may impact strategic continuity. Recently added to the S&P Global BMI Index and planning a follow-on equity offering of US$20 million, Zevia shows potential for growth amidst volatility reduction and strong asset coverage over liabilities.

- Dive into the specifics of Zevia PBC here with our thorough balance sheet health report.

- Learn about Zevia PBC's future growth trajectory here.

Where To Now?

- Navigate through the entire inventory of 359 US Penny Stocks here.

- Curious About Other Options? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zevia PBC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZVIA

Zevia PBC

Develops, markets, sells, and distributes zero sugar beverages in the United States and Canada.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives