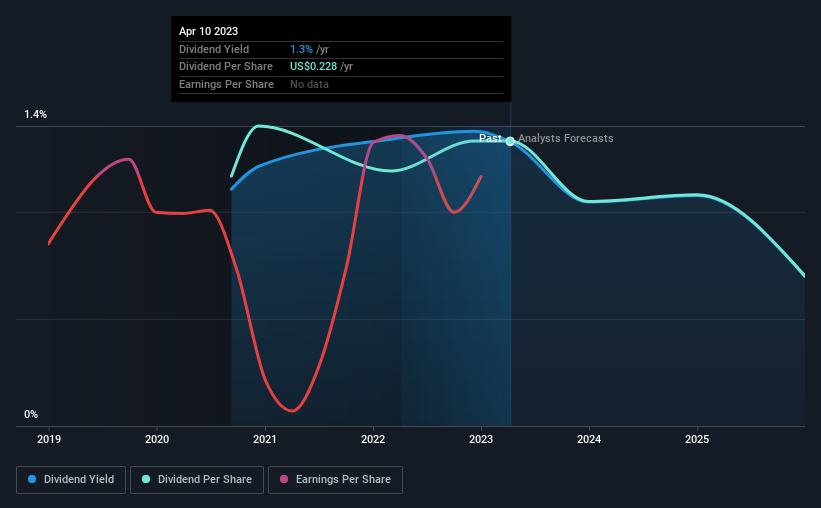

The board of Utz Brands, Inc. (NYSE:UTZ) has announced that it will be paying its dividend of $0.057 on the 4th of May, an increased payment from last year's comparable dividend. Even though the dividend went up, the yield is still quite low at only 1.3%.

Check out our latest analysis for Utz Brands

Utz Brands Might Find It Hard To Continue The Dividend

If it is predictable over a long period, even low dividend yields can be attractive. Even in the absence of profits, Utz Brands is paying a dividend. It is also not generating any free cash flow, we definitely have concerns when it comes to the sustainability of the dividend.

Over the next year, EPS is forecast to expand by 79.4%. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. Unless this happens fairly soon, the dividend could start to come under pressure.

Utz Brands Doesn't Have A Long Payment History

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. Since 2020, the dividend has gone from $0.20 total annually to $0.228. This works out to be a compound annual growth rate (CAGR) of approximately 4.5% a year over that time. Utz Brands hasn't been paying a dividend for very long, so we wouldn't get to excited about its record of growth just yet.

The Company Could Face Some Challenges Growing The Dividend

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. We are encouraged to see that Utz Brands has grown earnings per share at 16% per year over the past five years. It's not great that the company is not turning a profit, but the decent growth in recent years is certainly a positive sign. As long as the company becomes profitable soon, it is on a trajectory that could see it being a solid dividend payer.

Utz Brands' Dividend Doesn't Look Sustainable

Overall, we always like to see the dividend being raised, but we don't think Utz Brands will make a great income stock. Strong earnings growth means Utz Brands has the potential to be a good dividend stock in the future, despite the current payments being at elevated levels. We don't think Utz Brands is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 1 warning sign for Utz Brands that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:UTZ

Utz Brands

Engages in manufacture, marketing, and distribution of snack foods in the United States.

Slight and fair value.