- United States

- /

- Food

- /

- NYSE:TSN

Tyson Foods (TSN) Valuation Check as U.S. Beef Policy Shifts and Import Plans Take Shape

Reviewed by Simply Wall St

The U.S. administration’s push to tame soaring beef prices by pressuring ranchers and meatpackers, and considering more imports from Mexico and South America, immediately puts Tyson Foods (TSN) in focus for investors tracking margins and supply risk.

See our latest analysis for Tyson Foods.

That policy backdrop lands at a moment when Tyson’s 1 month share price return of 6.99 percent and 1 day gain of 3.15 percent suggest momentum is tentatively rebuilding, even as its 1 year total shareholder return of negative 3.55 percent shows the longer term reset investors have been working through.

If shifting meat policy has you rethinking where growth and resilience might show up next, it could be a good time to explore fast growing stocks with high insider ownership.

With Tyson trading below analyst targets yet showing a sharp rebound in earnings, the question now is whether investors are overlooking a genuine value reset or if the stock already reflects a full recovery in future growth.

Most Popular Narrative: 8% Undervalued

With Tyson Foods closing at $57.67 against a widely followed fair value near $62.67, the narrative frames today’s price as a modestly discounted entry.

The analysts have a consensus price target of $63.091 for Tyson Foods based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $55.0.

Curious what kind of profit rebound and margin reset could justify that gap, and why the projected earnings multiple drops so sharply from today’s levels? Dive in to see which specific revenue, margin, and valuation assumptions are doing the heavy lifting in this fair value story, and how long the market is expected to wait for them to play out.

Result: Fair Value of $62.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cattle supply constraints and rising input costs could squeeze margins and delay the earnings recovery that underpins today’s modest undervaluation story.

Find out about the key risks to this Tyson Foods narrative.

Another Angle on Valuation

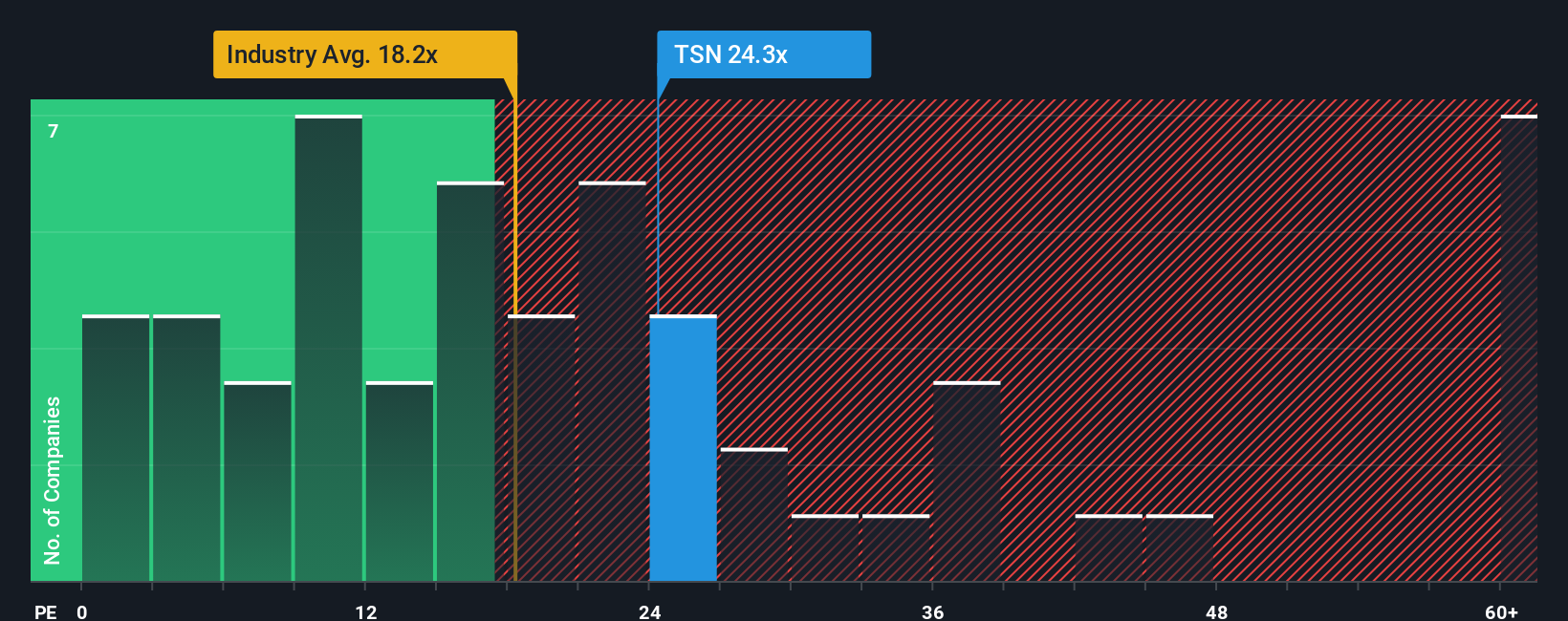

Our SWS fair ratio work paints a tougher picture. Tyson trades on a 43x price to earnings ratio versus a 28.7x fair ratio, well above the US Food industry at 21.5x and peers at 15.2x. This hints at limited margin for error if the recovery stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tyson Foods Narrative

If you see the setup differently or want to test your own assumptions against the data, you can build a personalized view in just minutes, Do it your way.

A great starting point for your Tyson Foods research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with Tyson alone, you could miss sharper opportunities. Let’s widen your watchlist with focused ideas tailored to different strategies and risk levels.

- Capture early-stage growth potential by targeting these 3597 penny stocks with strong financials that already back their stories with solid financial foundations.

- Ride structural shifts in automation and data by zeroing in on these 26 AI penny stocks positioned at the heart of AI driven transformation.

- Lock in stronger income streams by focusing on these 12 dividend stocks with yields > 3% that can support reliable, attractive payouts over the long term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyson Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSN

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026