- United States

- /

- Tobacco

- /

- NYSE:TPB

How Prospect Capital’s Bigger Bet And Modern Oral Growth At Turning Point Brands (TPB) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- During the third quarter, Prospect Capital Advisors nearly tripled its position in Turning Point Brands, adding 59,250 shares for a total stake valued at about US$9.25 million, as the company reported a very large increase in sales and an 18% rise in adjusted net income in its latest quarter.

- This combination of heavier institutional ownership and growth in both legacy tobacco and newer modern oral products highlights how Turning Point Brands is trying to reposition its portfolio toward faster-growing, higher-margin categories.

- We’ll now examine how Prospect Capital Advisors’ increased stake and Turning Point Brands’ expanding modern oral portfolio could shape the company’s investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Turning Point Brands Investment Narrative Recap

To own Turning Point Brands, you need to believe its push into modern oral nicotine can offset pressure on legacy tobacco and justify today’s premium earnings multiple. Prospect Capital Advisors’ larger stake and the latest quarter’s double digit sales and profit growth reinforce that modern oral momentum is the key near term catalyst, while regulatory and competitive risks in this segment remain the most important near term overhang and are not eased by this news.

The company’s raised 2025 guidance for Modern Oral sales to US$125.0 million to US$130.0 million is especially relevant here, because it directly ties to the growth that appears to underpin Prospect Capital Advisors’ conviction and frames how much execution headroom TPB has before higher sales and marketing spend begins to pressure margins.

Yet investors should also be clear-eyed about how quickly a change in nicotine pouch regulations could affect that growth engine and...

Read the full narrative on Turning Point Brands (it's free!)

Turning Point Brands' narrative projects $745.7 million in revenue and $100.8 million in earnings by 2028.

Uncover how Turning Point Brands' forecasts yield a $118.75 fair value, a 21% upside to its current price.

Exploring Other Perspectives

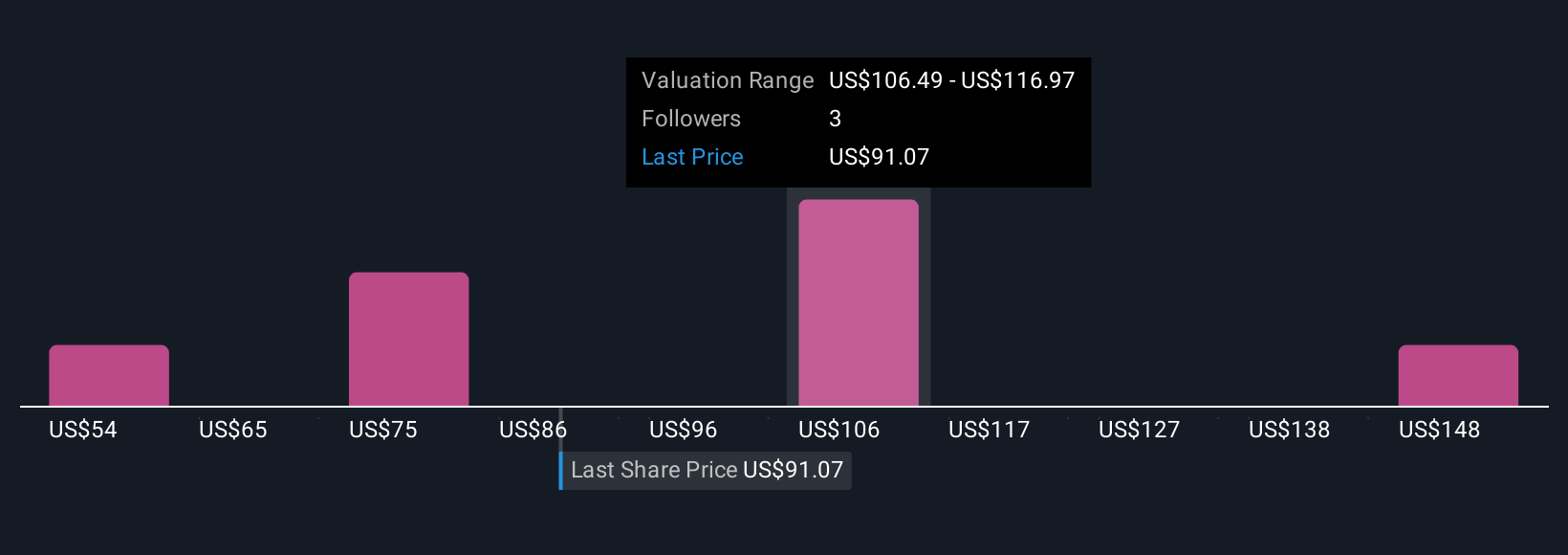

Four members of the Simply Wall St Community currently estimate TPB’s fair value between US$54.06 and US$158.91, highlighting widely different views on upside and downside. Against that backdrop, the company’s rapid Modern Oral expansion as a central growth catalyst could influence how you weigh long term opportunity against concentrated regulatory risk and invites you to compare several alternative viewpoints before deciding how to treat the stock.

Explore 4 other fair value estimates on Turning Point Brands - why the stock might be worth 45% less than the current price!

Build Your Own Turning Point Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Turning Point Brands research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Turning Point Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Turning Point Brands' overall financial health at a glance.

No Opportunity In Turning Point Brands?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Turning Point Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPB

Turning Point Brands

Manufactures, markets, and distributes branded consumer products in the United States and Canada.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026