- United States

- /

- Beverage

- /

- NYSE:TAP

With EPS Growth And More, Molson Coors Beverage (NYSE:TAP) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Molson Coors Beverage (NYSE:TAP). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Molson Coors Beverage with the means to add long-term value to shareholders.

View our latest analysis for Molson Coors Beverage

How Quickly Is Molson Coors Beverage Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. To the delight of shareholders, Molson Coors Beverage has achieved impressive annual EPS growth of 46%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Molson Coors Beverage shareholders can take confidence from the fact that EBIT margins are up from 12% to 16%, and revenue is growing. Both of which are great metrics to check off for potential growth.

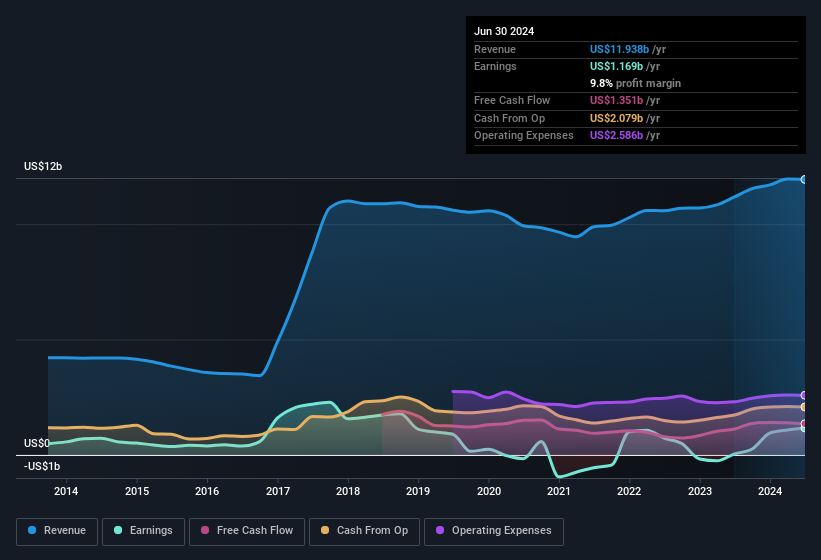

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Molson Coors Beverage's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Molson Coors Beverage Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Molson Coors Beverage shares, in the last year. Add in the fact that James Winnefeld, the Independent Director of the company, paid US$5.9k for shares at around US$59.02 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Along with the insider buying, another encouraging sign for Molson Coors Beverage is that insiders, as a group, have a considerable shareholding. Holding US$60m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. This should keep them focused on creating long term value for shareholders.

Should You Add Molson Coors Beverage To Your Watchlist?

Molson Coors Beverage's earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bunch of shares, and one has been buying more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Molson Coors Beverage belongs near the top of your watchlist. It is worth noting though that we have found 3 warning signs for Molson Coors Beverage (1 makes us a bit uncomfortable!) that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Molson Coors Beverage, you'll probably love this curated collection of companies in the US that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TAP

Molson Coors Beverage

Manufactures, markets, and sells beer and other malt beverage products under various brands in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record and pays a dividend.