- United States

- /

- Beverage

- /

- NYSE:TAP

Molson Coors (TAP): Evaluating Valuation as CEO Leadership Shift Signals Strategic Change

Reviewed by Kshitija Bhandaru

If you have been tracking Molson Coors Beverage (NYSE:TAP) lately, you likely noticed the leadership shakeup making waves this week. The company just announced that Rahul Goyal, who has spent more than two decades holding key roles across strategy, technology, and finance, will take over as CEO on October 1, 2025. Gavin Hattersley, who steered Molson Coors through a rapidly evolving beverage landscape, will step aside but remain as an advisor through year end to smooth the transition. Any time a large company brings in fresh leadership at the top, it sparks speculation about the direction ahead and what kind of changes might be in store.

While the CEO news grabs the spotlight, it lands at a complicated moment for Molson Coors. Over the past year, shares have slipped 15%, reflecting softness in revenues and profits as beer consumption trends move against big brands and input costs, such as aluminum, trend higher. Recent months have brought some other disruptions including a removal from the FTSE All-World Index. Despite a strong five-year total return, momentum has clearly faded in the past year as the company works to adapt its portfolio and navigate tougher industry headwinds.

So, with a new leader stepping in, investors are left asking, is this the reset Molson Coors needs to unlock hidden value, or are the market’s concerns already reflected in today’s price?

Most Popular Narrative: 17.2% Undervalued

The current narrative views Molson Coors Beverage as significantly undervalued and highlights the potential for upside if company projections hold true.

Molson Coors' expansion into above-premium and non-beer beverage categories (such as Fever-Tree mixers, seltzers, and flavored malt beverages) positions it to capitalize on shifting consumer preferences for higher-quality, better-for-you, and non-alcoholic options. This may drive higher-margin revenue growth in future periods.

Growth and premiumization in international segments, especially the ongoing success of Madri and Peroni in EMEA/APAC and the distribution runway for Banquet in the US, indicate strong potential for margin expansion and top-line growth as global urbanization and rising disposable incomes support higher long-term beverage consumption.

Curious what is fueling this bullish view? There is more behind this discount than meets the eye, including bold assumptions about Molson’s future margins, revenue mix, and industry shifts. Want to see which numbers turn these brand expansions into a higher valuation? The details might surprise you.

Result: Fair Value of $55.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent declines in beer demand or unpredictable spikes in costs could quickly challenge even the most bullish outlook for Molson Coors.

Find out about the key risks to this Molson Coors Beverage narrative.Another View: What If Our Model Is Wrong?

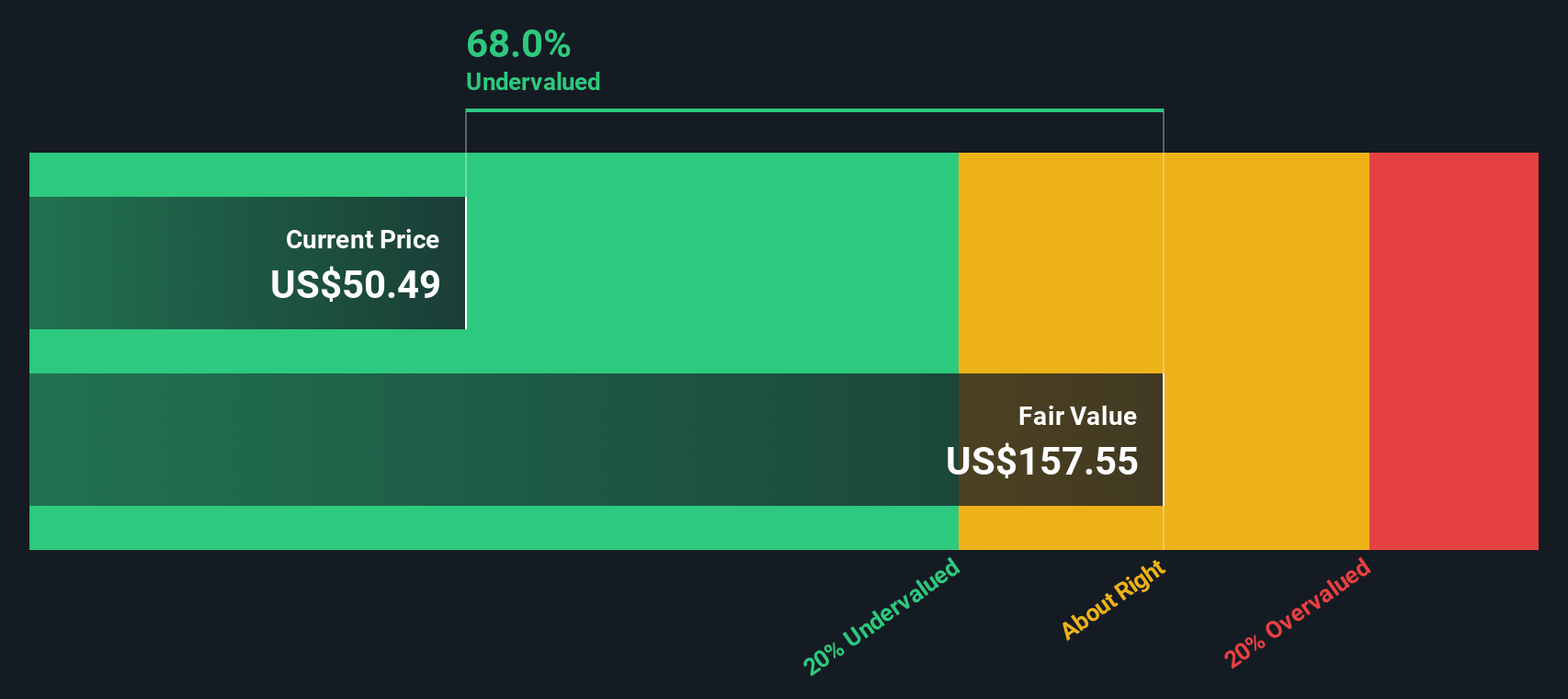

While analysts see upside, the SWS DCF model also points to the shares being undervalued. This offers a different framework for considering Molson Coors’ potential. But are both approaches right, or is something missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Molson Coors Beverage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Molson Coors Beverage Narrative

If you look at the numbers and feel unconvinced, or want to dig deeper on your own, you can quickly shape your own take on Molson Coors' story in just a few minutes. Do it your way

A great starting point for your Molson Coors Beverage research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let strong opportunities slip by. Take your next step to smarter investing with these hand-picked strategies from the Simply Wall Street Screener, each tailored for a specific edge in the market.

- Fuel your growth portfolio with breakthrough companies shaping tomorrow’s tech landscape by checking out the latest in AI penny stocks.

- Capture steady income and market resilience when you scan for market leaders offering high yields and robust dividend histories with dividend stocks with yields > 3%.

- Unlock value and uncover hidden gems trading below fair worth with targeted picks sourced using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TAP

Molson Coors Beverage

Manufactures, markets, and sells beer and other malt beverage products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives