- United States

- /

- Food

- /

- NYSE:SJM

Assessing J. M. Smucker's (SJM) Valuation Following Recent Share Price Fluctuations

Reviewed by Kshitija Bhandaru

See our latest analysis for J. M. Smucker.

J. M. Smucker’s share price has drifted lower so far this year, with a 5.9% year-to-date decline and a total shareholder return of -7.8% over the last 12 months. While short-term momentum has faded, these shifts reflect broad market caution and changing sentiment across the food and beverage sector.

If you’re keeping an eye on shifts like these, it may be a smart moment to expand your search and see what’s possible with fast growing stocks with high insider ownership

With shares trading below analyst price targets and long-term returns lagging, could J. M. Smucker be presenting a value opportunity, or is the market fully factoring in its prospects for earnings recovery and growth?

Most Popular Narrative: 9.8% Undervalued

With the most followed narrative placing fair value at $116.19, J. M. Smucker’s last close price of $104.75 is notably below the consensus estimate. This gap sharpens attention around the narrative’s key drivers and promises a compelling story for interested investors.

Focus on pricing strategies, SKU rationalization, and brand investments aims to drive profitability, expand margins, and strengthen competitive positioning. Enhanced e-commerce, direct-to-customer channels, and strong cash flow enable reinvestment, marketing innovation, and increased financial flexibility for future growth.

Ever wonder what ambitious growth metrics and strategic shifts justify this above-market fair value? The narrative hinges on dramatic margin expansion and profit leaps, yet the underlying projections and rationale might surprise you. Discover the details that fuel these bold expectations behind the valuation.

Result: Fair Value of $116.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff headwinds and slower organic sales growth could quickly undermine analyst optimism around J. M. Smucker’s recovery narrative.

Find out about the key risks to this J. M. Smucker narrative.

Another View: What Do The Multiples Say?

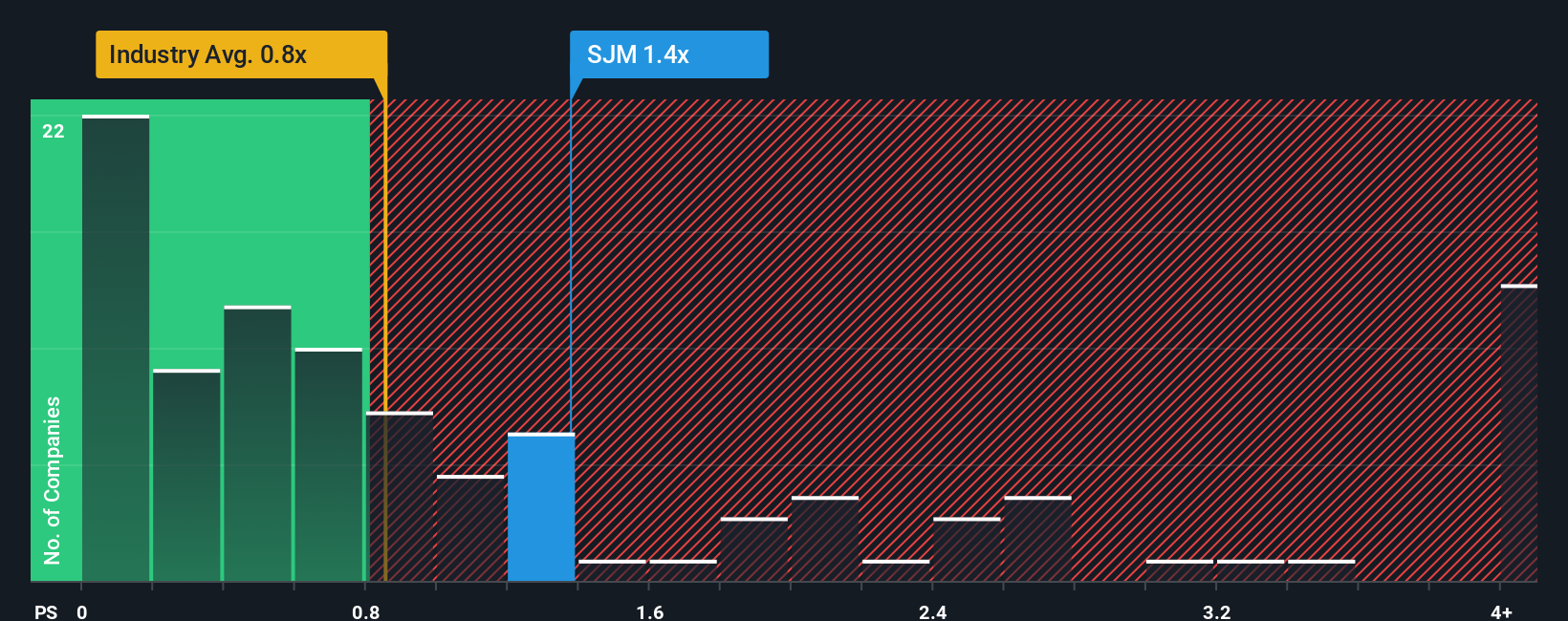

Taking a look at the price-to-sales ratio, J. M. Smucker is trading at 1.3x, which is higher than both its peer average of 0.7x and the US Food industry’s 0.9x. While this might suggest the stock is overvalued on this basis, our fair ratio points to 1.3x, implying it may be closer to fairly priced than industry comparisons assume. Does this signal hidden stability or undiscounted risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own J. M. Smucker Narrative

If the consensus view doesn’t quite match your take or you’d rather dig into the numbers personally, creating your own perspective can be done in under three minutes with Do it your way.

A great starting point for your J. M. Smucker research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the crowd by expanding your watchlist today. Don't miss your shot at up-and-coming winners found through these powerful stock screens:

- Capture high yields and consistent returns as you assess these 19 dividend stocks with yields > 3% with payouts exceeding 3%. This approach is designed for building income in any market.

- Unlock game-changing advancements by targeting these 26 quantum computing stocks, where innovation is reshaping sectors from computing to cybersecurity.

- Spot companies priced below their true worth and maximize your upside by checking out these 897 undervalued stocks based on cash flows based on robust cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SJM

J. M. Smucker

Manufactures and markets branded food and beverage products worldwide.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives